Industrial building boom is bigger in Texas, signaling growth wave

Industrial construction is surging to new highs in Texas, where energy, manufacturing and exports have historically helped drive robust levels of new building.

A trio of federal programs—the Inflation Reduction Act, the Infrastructure Investment and Jobs Act and the Creating Helpful Incentives to Produce Semiconductors and Science Act (popularly known as the CHIPS and Science Act)—have supercharged construction of technology and energy-transition-related projects. They follow the pandemic-era warehouse and logistics building boom, boosting Texas’ reputation as a go-to central location for distribution of goods nationally.

Additionally, advances in data processing central to emerging artificial intelligence and cloud-based data services are behind a wave of data center construction. The building activity, in turn, depends on the availability and distribution of electricity, increasingly produced by wind and solar generation for the Texas electric grid.

A healthy energy sector provides backing for all of this and still more industrial construction—big-dollar projects needed to meet the demands of burgeoning petrochemical operations, manufacturing powered by natural gas, energy exports and electricity. This activity kicked into high gear a decade ago, building on Texas’ unique positioning as a leader in both low- and high-carbon energy development.

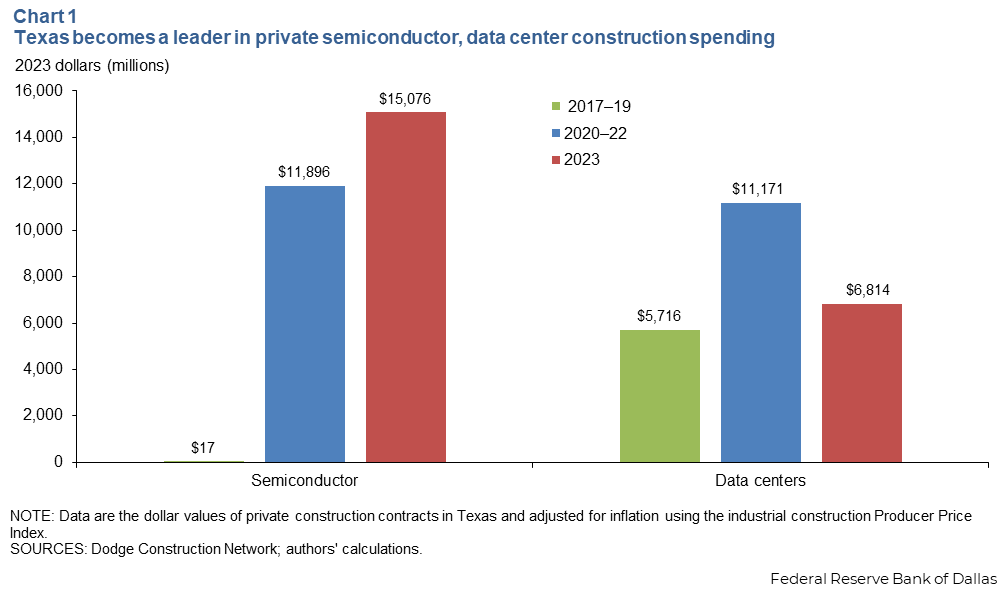

From 2017 through 2019, before the 2020 onset of the pandemic, the state accounted for just $17 million of the nearly $5.1 billion in construction contracts for semiconductor plants (in 2023 dollars), according to data from the Dodge Construction Network. With massive public subsidies and in the wake of pandemic-related supply-chain disruptions, construction contracts rose to $11.9 billion from 2020 to 2022, more than 17 percent of the U.S. total. In 2023 alone, semiconductor manufacturing facilities in Texas accounted for more than $15 billion—23.9 percent of the U.S. total (Chart 1). Thus, the state entered 2025 with considerable ongoing activity before the Trump administration announced executive actions in January to pause or halt various spending programs.

Altogether, contract values for nonresidential and nonbuilding (such as highways and communications structures) are rising. Texas’ share of total U.S. spending in the two broad categories has tracked higher since the shale oil and gas boom years, 2011–14 (Chart 2).

In the postpandemic period, Texas’ share of spending has again increased, averaging 15.5 percent of the national total in 2023, a much higher share than the state’s contribution to the U.S. GDP, at 9 percent. Two categories driving the surge are “manufacturing plants, warehouses and labs” and “power plants, gas and communications,” Dodge data show. Mega projects in high-tech manufacturing, liquefied natural gas (LNG) facilities, chemical plants and data centers drove the outsized increases.

But that doesn’t tell the whole story.

The construction activity supports growing production across sectors. In 2023, the state produced 9.6 percent of U.S. manufacturing GDP, including 13.2 percent of chemicals and 8.2 percent of computer and electronic product manufacturing. In the associated construction sectors, Texas has obtained an outsized amount in new building contracts.

Since mid-2022, after many of the recent federal industrial policy programs were enacted, Texas is responsible for more than $289 billion, amounting to 16.5 percent of the value of total U.S. nonresidential and nonbuilding construction contracts. Of that, $44.8 billion was for manufacturing and $51.2 billion for power, gas and communications.

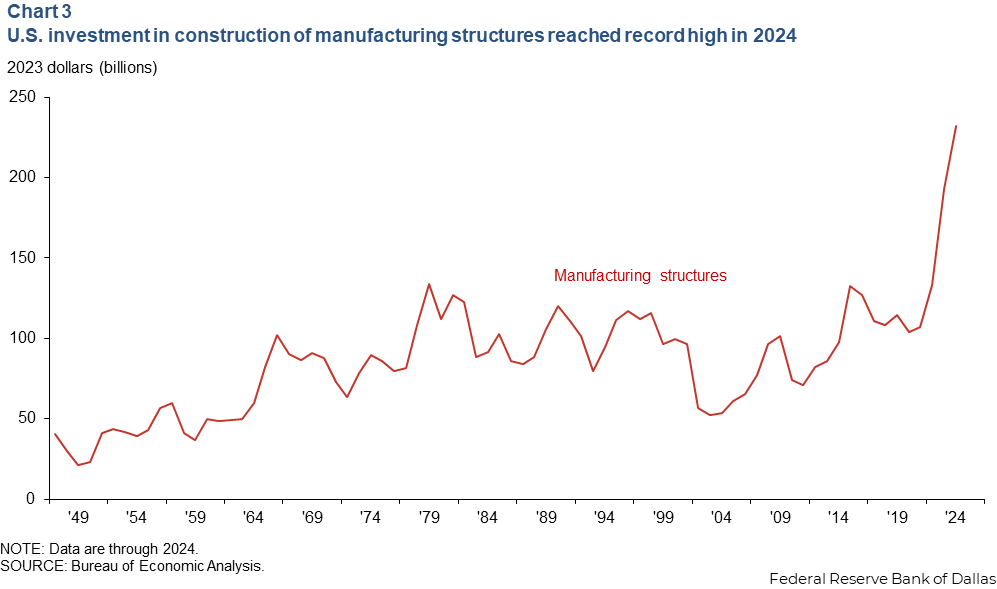

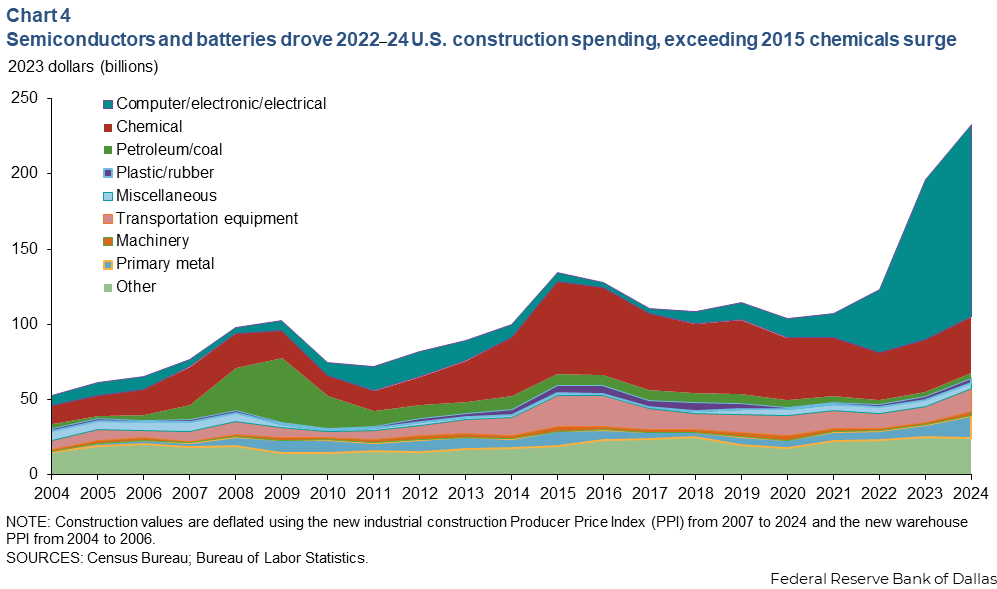

Nationally, total real (inflation-adjusted) investment in manufacturing structures reached a record high of $231.9 billion in 2024. During 2023 and 2024, construction in this sector logged its biggest contributions to annual real GDP growth since 1979 (Chart 3). Investment in manufacturing structures, typically industrial facilities, dramatically outpaced real fixed capital spending by oil and gas companies on wells and shafts—historically concentrated in Texas—by $135.2 billion, a record gap.

Old advantages spawn new investments

Texas’ outsized share of a national investment boom in manufacturing builds on earlier industrial growth, including the high-tech boom of the 1970s and 1980s that eventually stretched from Dallas–Fort Worth to Austin and beyond. The shale oil and gas boom that began 15 years ago—itself an iteration of more than a century of oil and gas discovery in the state—helped produce the latest wave of construction in refining, petrochemical, pipeline and export facilities.

Supporting this development, Texas has consistently prompted new investment with its growing, diverse and skilled workforce operating in an accommodative tax and regulatory environment. Admittedly, much of the growth in the workforce has come about through migration to the state, as growing labor demand has long outstripped the state’s ability to produce enough qualified workers.

Dallas-based Texas Instruments, which began in 1930 as a provider of seismographic data to the oil industry and became a global semiconductor leader, plans this year to open the first of four new manufacturing plants in Sherman, 70 miles north of Dallas. The company, which says its investment could reach $30 billion and create 3,000 jobs, is to receive $1.6 billion in CHIPS and Science Act funding.

Also in Sherman, Hsinchu, Taiwan-based GlobalWafers is building a 3.2 million-square-foot semiconductor manufacturing facility, with operations also to begin in 2025. The parent company is to receive $400 million in CHIPS and Science Act funding.

South Korea-based Samsung Electronics, which began its technology manufacturing in the Austin area in 1996, started construction on what was proposed as a $17 billion semiconductor manufacturing facility in 2022 in Taylor, 30 miles northeast of Austin, with plans to begin operation this year. The project includes $6.4 billion in CHIPS and Science Act funds. Still more semiconductor facilities in Taylor are in various stages of planning, totaling at least $40 billion, and aided by state and federal incentives.

Digital activity proliferates in Texas

Even before the new semiconductor facilities come online, computing activity and services have contributed to outsized growth in data centers, cloud-based storage and digital services. The volume of annual data center builds tracked by Dodge boomed from less than 1.6 million square feet, worth $870 million in 2017, to 10.3 million square feet worth $6.8 billion in 2023.

Texas accounts for a little more than 9 percent of the U.S. population. The state was home to 10.1 percent of the value of all construction contracts for data centers in 2023 after achieving an 8 percent share during the pandemic years and an 8.7 percent share in the three years before the pandemic.

There are lots of reasons for the rapid growth. There is ample land available for development near major population centers, and the state and local regulations make it relatively easy to build new infrastructure to meet the immense power demands of large data centers. Additionally, the state has generally low-priced electricity relative to other regions—though the price and the cost of ensuring reliability in Texas is rising. Critically, the state also has a large, mature, high-tech labor force and services base to build upon.

Playing to Texas’ energy strengths

While Texas has yet to receive a significant piece of solar or battery manufacturing dollars outside of Tesla’s lithium plant in Corpus Christi, Houston was named a “hydrogen hub” by the Department of Energy in 2022, with the metropolitan area to receive Inflation Reduction Act funds to expand hydrogen production. The massive network of Gulf Coast refining and petrochemical complexes centered in Houston already consumes large volumes of hydrogen for myriad processes such as removing sulfur from crude oil for refining.

The hydrogen initiative, which is under Trump administration review, is mainly aimed at lowering the emissions of hard-to-abate industries that rely on energy-intensive industrial processes. It also seeks to create supplies for newer hydrogen uses, such as fuel cells, or in the longstanding manufacture of ammonia. Texas received $1.1 billion (42.2 percent) of all the construction contracts for hydrogen in 2023 after drawing another $1.1 billion (29 percent) of investment during the pandemic years.

Notably, the same geology that made oil and gas a prominent resource along the Gulf Coast is rich with sites suitable for carbon sequestration—the process of warehousing CO2 emissions underground. Subsidies aimed at promoting the utilization of these resources could at least partly offset emissions from industrial processes such as hydrogen production, crude oil refining, petrochemicals production and power generation.

Meanwhile, abundant natural gas and natural gas liquids from shale continue to encourage new chemical plant expansions, such as a $1.1 billion addition to an OxyChem plant in La Porte, Texas. The investment underscores the nation’s enduring transformation from a high-cost to a low-cost global producer of commodity plastics, resins and other organic and inorganic chemical products. Real construction spending in the U.S. chemicals sector totaled $37.6 billion in 2024, off its peak of $61.7 billion in 2015 but still well above the $13.2 billion spent in 2011 before the shale boom drove rapid expansion (Chart 4).

LNG export facilities, such as ExxonMobil and Qatar Energy’s $11.6 billion Port Arthur LNG facility and related energy export infrastructure projects, have boosted Texas construction spending as growing supplies of shale gas drive efforts to improve facilities needed to sell additional product.

Related construction wages accelerate

Such big projects require thousands of workers, many of them highly specialized. The average weekly wage in 2023 for industrial construction jobs in Texas was $1,927, or $48.18 per hour (based on a 40-hour workweek). The pay was 38.5 percent higher than the all-industry average weekly wage.

Nationwide, workers in the sector earned an average hourly wage of $41 per hour that year, more than 21 percent above the national average wage rate. Commercial and industrial construction earned $41 per hour in Texas, while oil and gas pipeline building earned $36 per hour in 2023. Hourly wages in all three categories continued rising in 2024.

These types of building involve specific kinds of structures. Industrial building construction includes inorganic chemical and industrial gas plants (hydrogen or battery components), factories, including for semiconductors, and vehicle assembly plants. Commercial and industrial construction includes office buildings, restaurants, warehouses (including prefabricated building component assembly) and data centers. Firms in the oil and gas pipeline and related structures construction sector build pipelines, gas plants, chemical plants and LNG terminals.

Even more projects likely on the way

A long road lies between project announcement, groundbreaking and completion. Challenges across shared supply chains and the availability of high-skilled construction workers may emerge amid competing labor demands from federal programs plus the ongoing investment in oil and gas infrastructure and data centers.

There have been nearly $1 trillion in private investment projects announced nationally since the pandemic—much of the planned expenditure the product of U.S. industrial development policies—according to the Biden White House.

Of the total, $165 billion (or 16 percent) are for projects intended for Texas in addition to federal government aid that amounts to nearly $44 billion for clean energy, infrastructure and manufacturing. The bulk of the spending surge is directed at semiconductors and electronics sectors, of which, $78 billion of private spending is for Texas, comprising 20 percent of the U.S. semiconductor total. Only California has attracted a larger target for current and promised projects.

Some of these announced projects have already broken ground—such as the semiconductor plants—while many others remain on the drawing board. In the case of CHIPS and Science Act money, about $34 billion in grant awards and another $9 billion in loans have been allocated. One-third to one-half of announced projects across all spending programs that have not started may ultimately fall by the wayside, according to industry analysts.

Uncertain outlook for future activity

Many of these projects wouldn't proceed—even with substantial government backing—without massive corporate and other private funding sources seeing opportunity in U.S. industrial and commercial expansion.

However, both the appropriateness and efficacy of government investment programs are a matter of ongoing national debate, and it remains unclear what will happen to many of the provisions in the Inflation Reduction Act, the Infrastructure Investment and Jobs Act and the CHIPS Act under the Trump administration. It has sought to pause disbursements for several programs and has been challenged in the courts. Additionally, the specter of trade wars and potential reductions in labor availability could increase costs and affect project viability.

Regardless, the scale of development already underway—spurred both organically by market forces and via subsidies—is unprecedented in the postwar era. With a significant share of expenditures destined for Texas, future growth across diversified trade and manufacturing sectors seems assured.

About the authors