Eleventh District Banking Trends

Second Quarter 2025

This report tracks the financial performance of Eleventh District banks in comparison with national averages, looking at profitability, loans, deposits and other key metrics. It is updated quarterly.

Highlights

- Banking conditions remained satisfactory through second quarter 2025.

- Profitability in the district, comprised of southern New Mexico, northern Louisiana and Texas, increased as higher revenue offset slight increases in provision and noninterest expense.

- Asset quality metrics remained relatively benign, with Eleventh District banks reporting a flat net loan charge-off rate and a slight increase in the noncurrent loan rate.

- Loan growth picked up both overall and for most major loan categories except consumer loans.

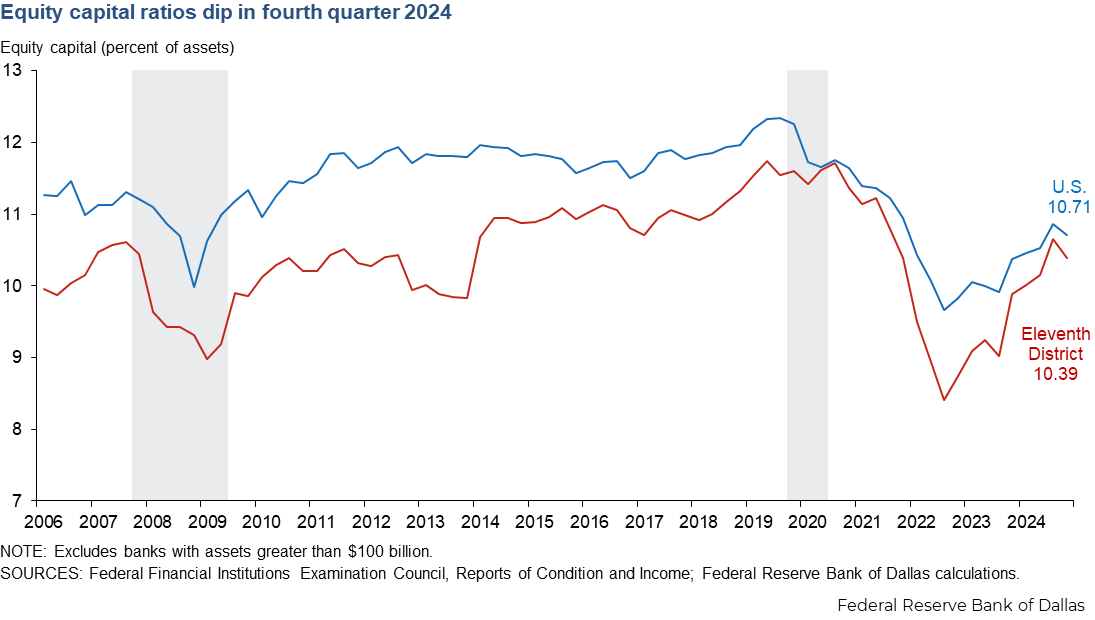

- Equity capital ratios rose on both higher retained earnings and lower unrealized losses on available-for-sale securities.

Charts

Select a metric to go directly to the related chart below.

Return on average assets

- Eleventh District banks earned return on average assets of 1.35 percent in the second quarter, 12 basis points higher than the first quarter and 14 basis points higher than the second quarter of 2024.

- U.S. banks earned ROAA of 1.18 percent in the second quarter, 10 basis points higher than the first quarter and 16 basis points higher than a year ago.

Net income breakdown

- Higher revenue more than offset a slight increase in expenses, leading to improved profitability in the second quarter.

- Higher profitability for Eleventh District banks relative to U.S. peers can be traced to lower provision expense.

Net interest margins

- Bank net interest margin was up in the second quarter as higher interest income more than offset flat interest expense.

- Eleventh District banks' net interest margin was 3.58 percent in the second quarter, 13 basis points higher than the first quarter.

- U.S. bank net interest margin was 3.62 percent, 14 basis points higher than the first quarter.

Provision expense

- Eleventh District bank provision expense has trended below U.S. peers since late 2021.

- For the second quarter, Eleventh District bank provision expense relative to average assets was 14 basis points lower than the U.S peer value.

Net loan losses

- Eleventh District bank net charge-off rate also continues to trend below U.S. peers.

- The rate for Eleventh District banks was unchanged at 0.17 percent in the second quarter, compared with a slight increase for U.S. banks to 0.31 percent.

Net charge-offs by loan type

Noncurrent loans

- Eleventh District bank noncurrent loan rate has consistently trended below U.S. peers.

- Eleventh District bank noncurrent loan rate was 0.77 percent for the second quarter (up 3 basis points quarter-over-quarter and 7 basis points year-over-year), compared with 0.92 percent for U.S. peers (down 2 basis points quarter over quarter but up 18 basis points year over year).

Noncurrent loans by type

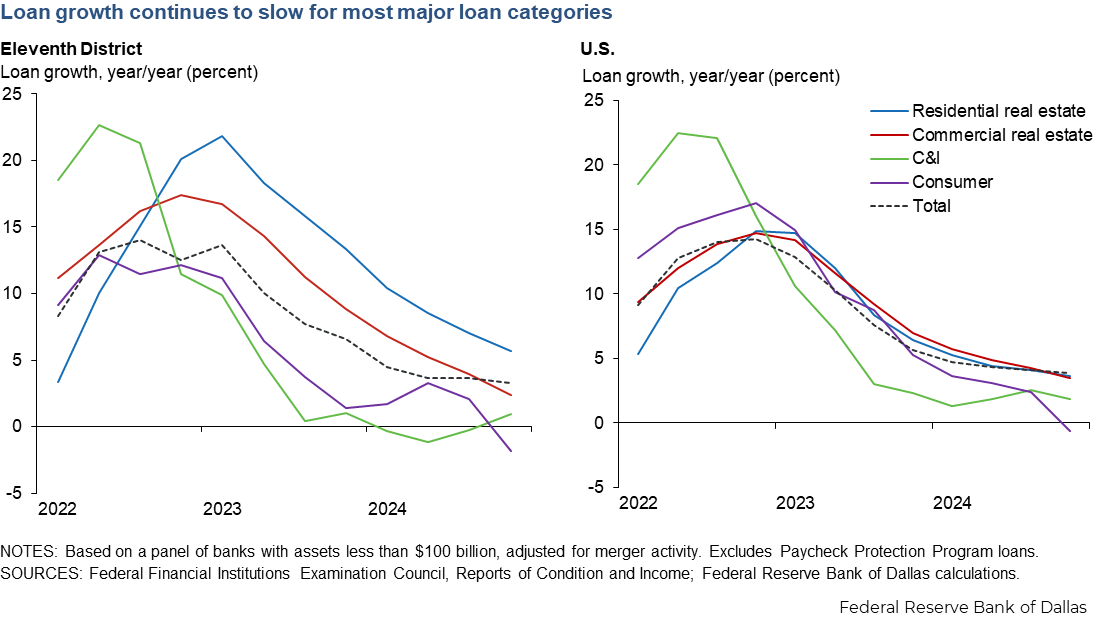

Loan growth

- Loan growth picked up slightly in the second quarter for both Eleventh District banks and their U.S. peers.

- For Eleventh District banks, growth accelerated for all major loan categories except consumer loans.

Loan growth by type

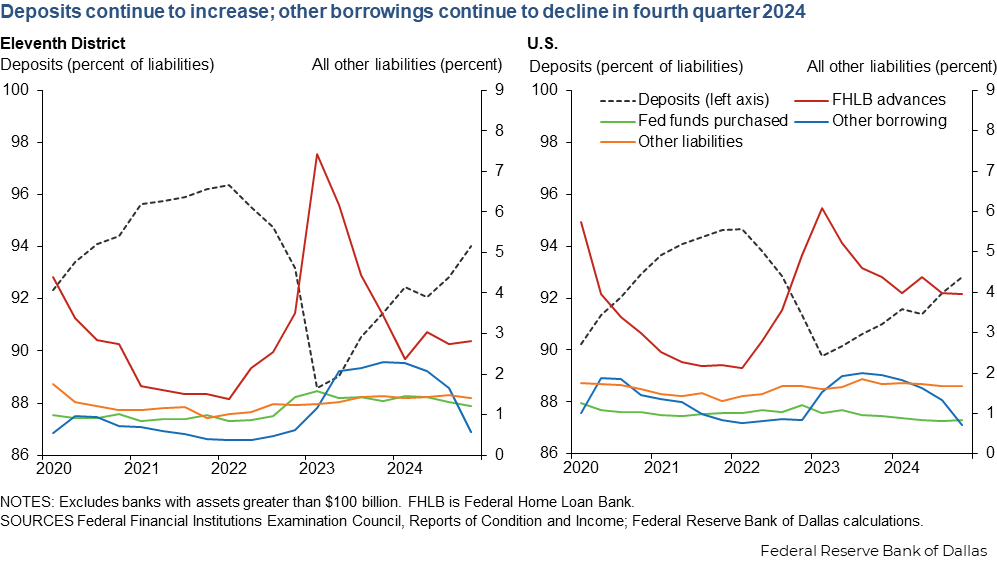

Funding mix

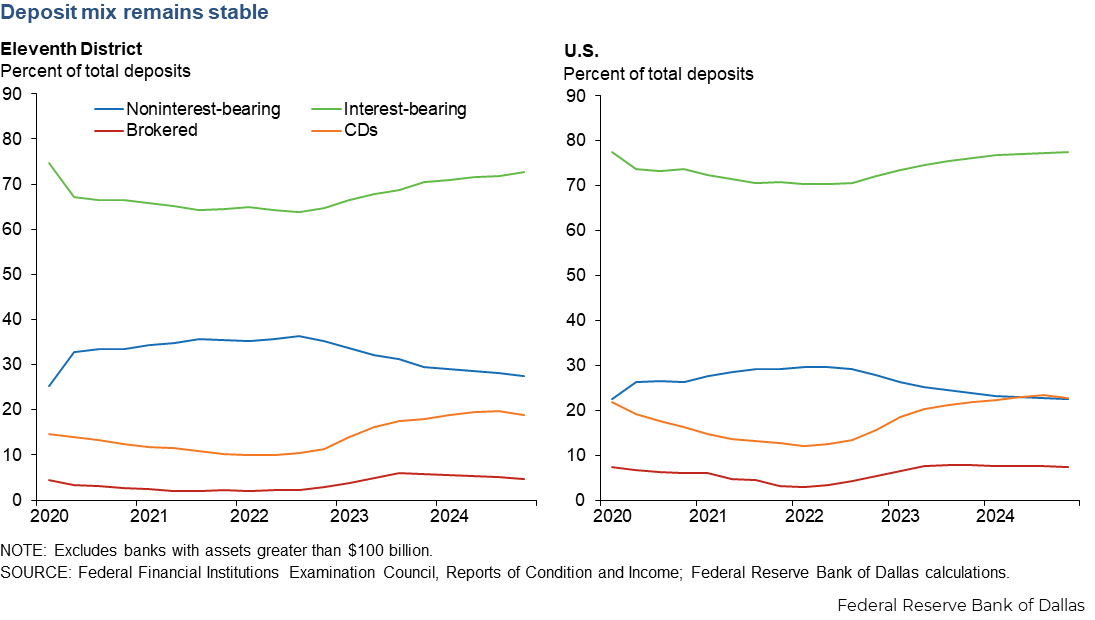

Deposit mix

Equity capital ratios

- Equity capital ratios have been trending up since mid-2022 as retained earnings increased and unrealized losses on available-for-sale securities abated.

- Eleventh District bank equity capital ratio increased 20 basis points in the second quarter to 10.8 percent, and U.S. bank equity capital ratio increased 12 basis points to 11.0 percent.

NOTES: Analysis excludes banks with assets greater than $100 billion (one bank in the Eleventh District and 33 banks nationwide).

The Eleventh Federal Reserve District includes Texas, northern Louisiana and southern New Mexico. Banks headquartered in the Eleventh District may also operate elsewhere.

About Eleventh District Banking Trends

For more information about this report, contact Emily Greenwald.