Texas Manufacturing Outlook Survey

Growth resumes in Texas manufacturing activity

For this month’s survey, Texas business executives were asked supplemental questions on wages, prices, outlook concerns and government spending. Results for these questions from the Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey have been released together. Read the special questions results.

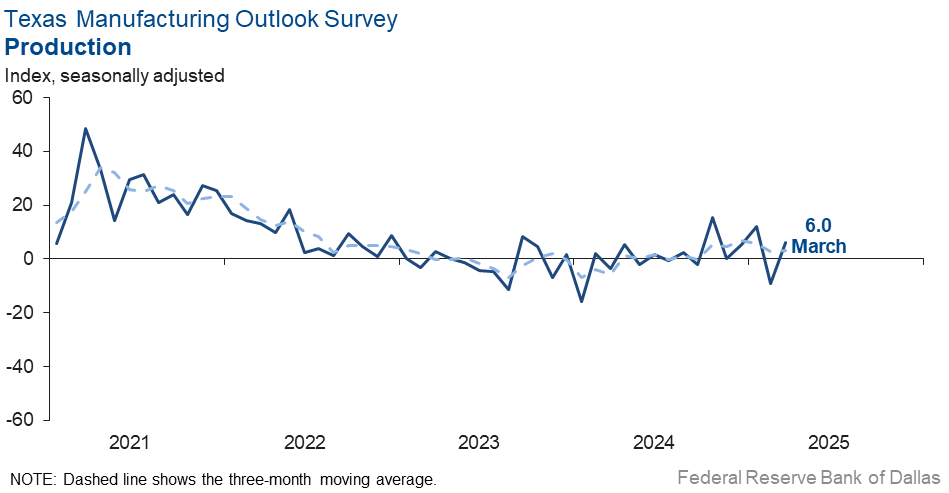

Texas factory activity rose in March after declining in February, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose 15 points to 6.0.

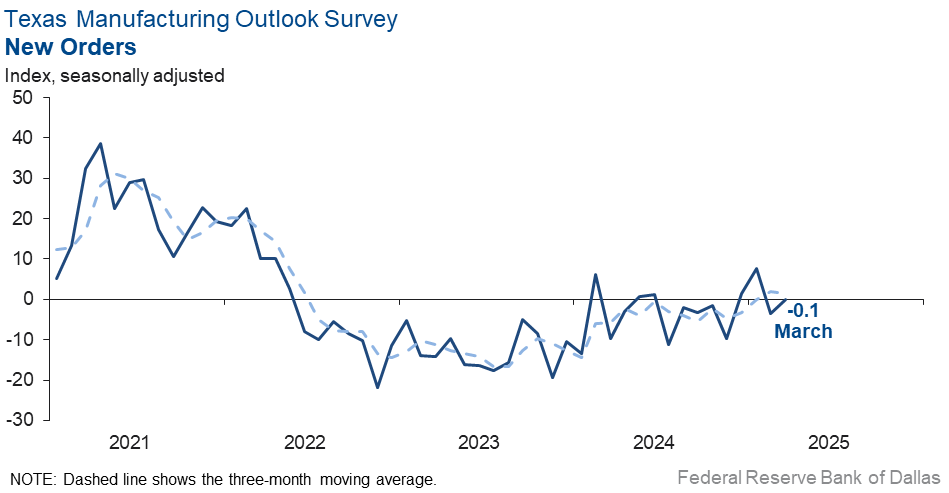

Other measures of manufacturing activity were mixed. The new orders index moved up three points to zero, a reading that suggests demand in March was similar to February. The capacity utilization index remained negative but pushed up six points to -2.3. The shipments index was positive and little changed at 6.1.

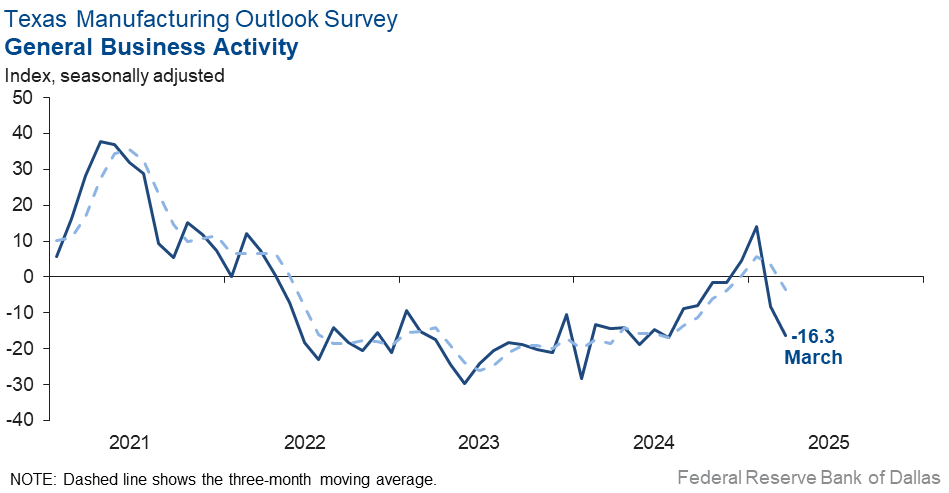

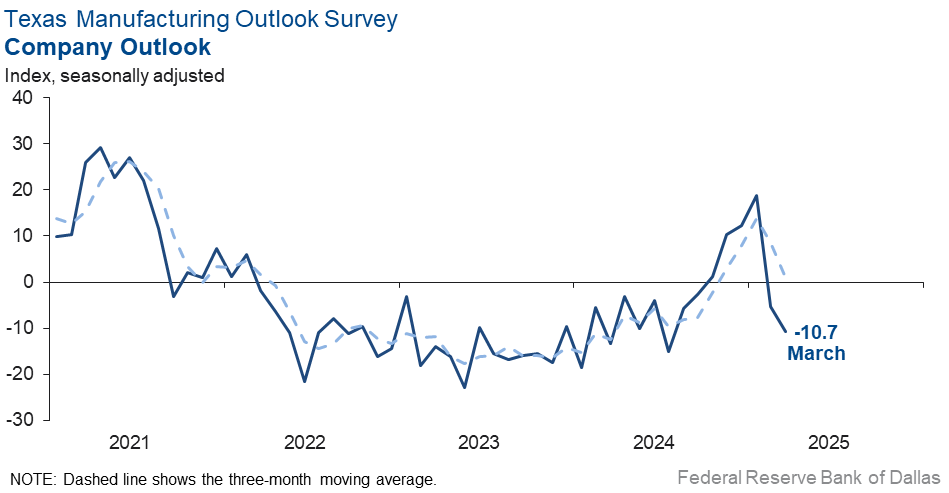

Perceptions of broader business conditions continued to worsen in March. The general business activity index fell eight points to -16.3, its lowest reading since last July. The company outlook index also retreated to an eight-month low of -10.7. The outlook uncertainty index pushed up seven points to 36.2, its highest reading since fall 2022.

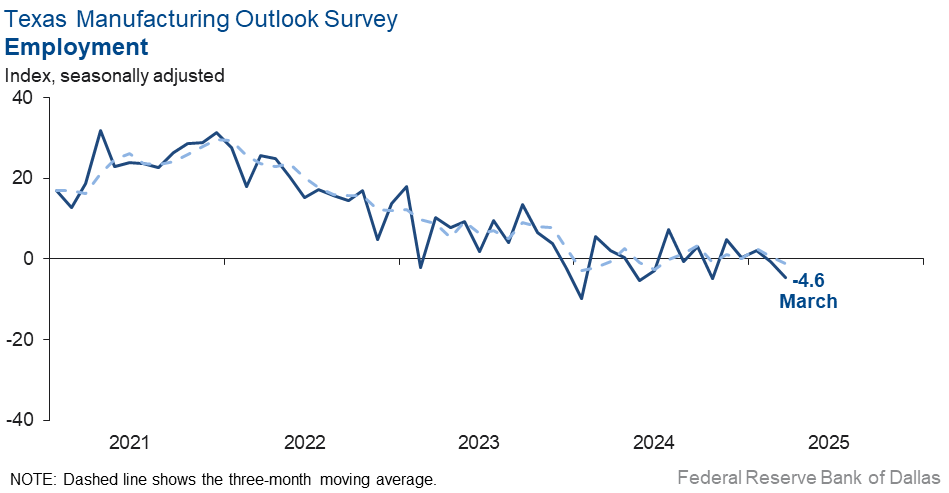

Labor market measures suggested a decrease in head counts and slightly shorter workweeks this month. The employment index slipped further into negative territory, falling four points to -4.6, with 12 percent of firms noting net hiring and 16 percent noting net layoffs. The hours worked index shot up 11 points but remained slightly negative at -2.9.

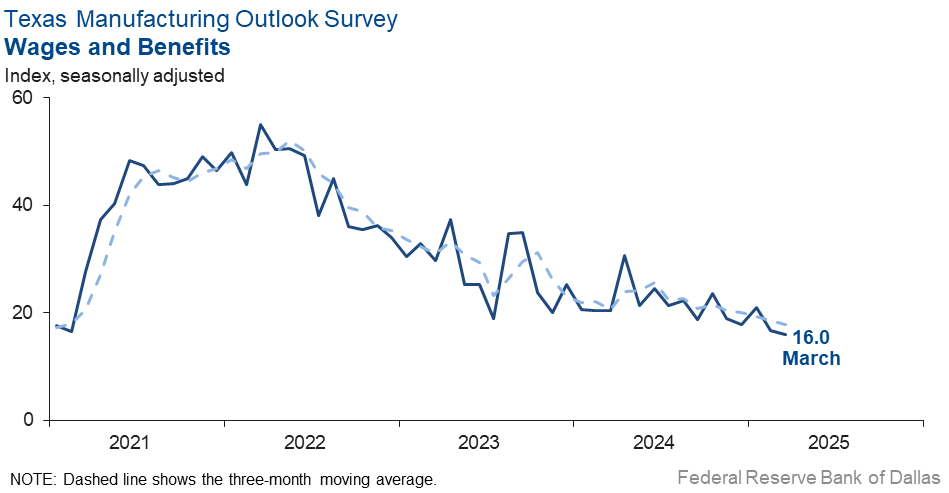

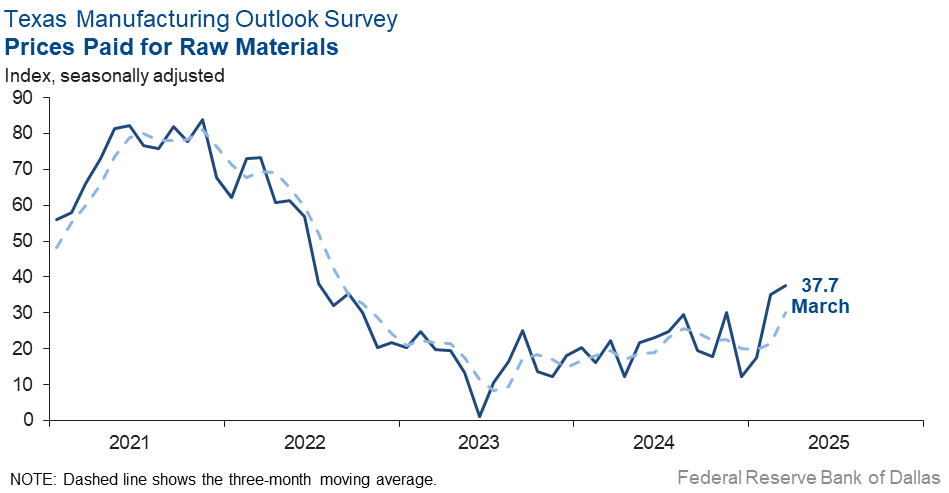

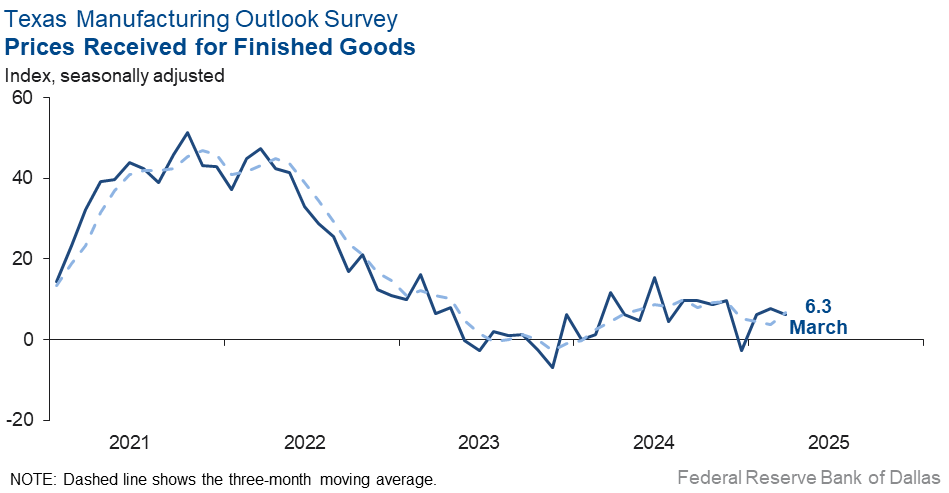

Input cost pressures edged higher in March, while wages and selling price pressures remained stable. The raw materials prices index ticked up three points to 37.7, a multiyear high. The finished goods prices index was largely unchanged at 6.3, and the wages and benefits index held steady at 16.0, below its average reading.

Expectations for manufacturing activity six months from now were mixed. The future production index was steady at 27.6, while the future general business activity plummeted 14 points to -6.6, its first negative reading since May 2024. Most other indexes of future manufacturing activity remained positive but slipped further below average.

Next release: Monday, April 28

Data were collected March 18–26, and 84 of the 118 Texas manufacturers surveyed submitted a response. The Dallas Fed conducts the Texas Manufacturing Outlook Survey monthly to obtain a timely assessment of the state’s factory activity. Firms are asked whether output, employment, orders, prices and other indicators increased, decreased or remained unchanged over the previous month.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior month. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior month. An index will be zero when the number of firms reporting an increase is equal to the number of firms reporting a decrease. Data have been seasonally adjusted as necessary.

Results summary

Historical data are available from June 2004 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Current (versus previous month) | ||||||||

| Indicator | Mar Index | Feb Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Production | 6.0 | –9.1 | +15.1 | 9.6 | 1(+) | 28.8 | 48.4 | 22.8 |

Capacity Utilization | –2.3 | –8.7 | +6.4 | 7.5 | 2(–) | 22.6 | 52.5 | 24.9 |

New Orders | –0.1 | –3.5 | +3.4 | 4.9 | 2(–) | 26.7 | 46.4 | 26.8 |

Growth Rate of Orders | –8.1 | –7.5 | –0.6 | –0.9 | 2(–) | 15.3 | 61.3 | 23.4 |

Unfilled Orders | –8.3 | –9.9 | +1.6 | –2.4 | 7(–) | 9.1 | 73.5 | 17.4 |

Shipments | 6.1 | 5.6 | +0.5 | 8.0 | 4(+) | 26.7 | 52.7 | 20.6 |

Delivery Time | 3.4 | –6.3 | +9.7 | 0.7 | 1(+) | 10.7 | 82.0 | 7.3 |

Finished Goods Inventories | 7.2 | –9.1 | +16.3 | –3.2 | 1(+) | 24.1 | 59.0 | 16.9 |

Prices Paid for Raw Materials | 37.7 | 35.0 | +2.7 | 27.1 | 59(+) | 42.0 | 53.7 | 4.3 |

Prices Received for Finished Goods | 6.3 | 7.8 | –1.5 | 8.6 | 3(+) | 13.4 | 79.5 | 7.1 |

Wages and Benefits | 16.0 | 16.7 | –0.7 | 21.2 | 59(+) | 19.3 | 77.4 | 3.3 |

Employment | –4.6 | –0.7 | –3.9 | 7.3 | 2(–) | 11.8 | 71.8 | 16.4 |

Hours Worked | –2.9 | –14.2 | +11.3 | 3.1 | 2(–) | 8.6 | 79.9 | 11.5 |

Capital Expenditures | –0.6 | 8.6 | –9.2 | 6.6 | 1(–) | 20.4 | 58.6 | 21.0 |

| General Business Conditions Current (versus previous month) | ||||||||

| Indicator | Mar Index | Feb Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –10.7 | –5.2 | –5.5 | 4.5 | 2(–) | 13.1 | 63.1 | 23.8 |

General Business Activity | –16.3 | –8.3 | –8.0 | 0.6 | 2(–) | 12.7 | 58.3 | 29.0 |

| Indicator | Mar Index | Feb Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty | 36.2 | 29.2 | +7.0 | 17.0 | 47(+) | 45.8 | 44.6 | 9.6 |

| Business Indicators Relating to Facilities and Products in Texas Future (six months ahead) | ||||||||

| Indicator | Mar Index | Feb Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Production | 27.6 | 28.3 | –0.7 | 36.3 | 59(+) | 43.3 | 40.9 | 15.7 |

Capacity Utilization | 16.3 | 28.4 | –12.1 | 33.2 | 59(+) | 32.5 | 51.3 | 16.2 |

New Orders | 28.6 | 25.8 | +2.8 | 33.8 | 29(+) | 44.6 | 39.5 | 16.0 |

Growth Rate of Orders | 18.1 | 19.6 | –1.5 | 24.9 | 22(+) | 32.8 | 52.5 | 14.7 |

Unfilled Orders | –1.9 | –1.4 | –0.5 | 2.8 | 2(–) | 11.4 | 75.3 | 13.3 |

Shipments | 21.7 | 32.1 | –10.4 | 34.7 | 59(+) | 36.4 | 48.9 | 14.7 |

Delivery Time | –7.9 | 0.5 | –8.4 | –1.3 | 1(–) | 4.2 | 83.7 | 12.1 |

Finished Goods Inventories | –1.3 | 4.8 | –6.1 | –0.1 | 1(–) | 14.5 | 69.7 | 15.8 |

Prices Paid for Raw Materials | 53.2 | 59.0 | –5.8 | 33.5 | 60(+) | 56.5 | 40.2 | 3.3 |

Prices Received for Finished Goods | 27.6 | 42.0 | –14.4 | 21.0 | 59(+) | 35.5 | 56.6 | 7.9 |

Wages and Benefits | 27.2 | 39.5 | –12.3 | 39.2 | 59(+) | 32.0 | 63.2 | 4.8 |

Employment | 17.6 | 16.5 | +1.1 | 22.9 | 58(+) | 30.4 | 56.8 | 12.8 |

Hours Worked | 1.2 | 8.8 | –7.6 | 8.8 | 12(+) | 12.9 | 75.4 | 11.7 |

Capital Expenditures | 10.1 | 21.1 | –11.0 | 19.4 | 58(+) | 27.4 | 55.3 | 17.3 |

| General Business Conditions Future (six months ahead) | ||||||||

| Indicator | Mar Index | Feb Index | Change | Series Average | Trend** | % Reporting Increase | % Reporting No Change | % Reporting Worsened |

Company Outlook | 4.2 | 13.9 | –9.7 | 18.4 | 16(+) | 26.8 | 50.6 | 22.6 |

General Business Activity | –6.6 | 7.7 | –14.3 | 12.4 | 1(–) | 21.4 | 50.6 | 28.0 |

*Shown is the number of consecutive months of expansion or contraction in the underlying indicator. Expansion is indicated by a positive index reading and denoted by a (+) in the table. Contraction is indicated by a negative index reading and denoted by a (–) in the table.

**Shown is the number of consecutive months of improvement or worsening in the underlying indicator. Improvement is indicated by a positive index reading and denoted by a (+) in the table. Worsening is indicated by a negative index reading and denoted by a (–) in the table.

Data have been seasonally adjusted as necessary.

Comments from survey respondents

These comments are from respondents’ completed surveys and have been edited for publication.

- The tariff discussion is driving significant uncertainty and a negative outlook. Project costs are increasing immediately, with significant rises in equipment and piping costs.

- Tariffs and the economy may be a drag on business.

- Tariffs are a constant and increasing source of uncertainty. We do not know what prices we will have to pay for components, and we do not know how customers will respond to increases strictly related to tariffs. Also, it is unknown how the market will change in response to the tariffs and higher costs. We know we will lose opportunities to build products used for other countries because we already have, but will tariffs bring new opportunities from foreign companies wanting to build in the U.S.? That remains to be seen, but the known risk currently seems to outweigh the unknown opportunity.

- Despite all of the doomsaying in the press, we are not seeing any drop in orders. We have invested heavily in equipment and production capacity in the last 12 months and are seeing the benefits from that now. While a short recession is a possibility due to the reductions in government spending, we view this as a net positive for the economy and our business in the medium term.

- Trump, tariffs, massive uncertainty—how can you do business planning with all of this uncertainty and the daily changes in direction made by the Trump administration?

- We have seen a decrease in sales and a lot of external demands. I am thinking of closing the company.

- The cyclical recovery looks like it is continuing. There is lots of noise and uncertainty with tariffs and rumors of trade restrictions.

- We still have some orders that have been on hold, including one major job on hold for a year and a half from a large public company through a good repeating customer contractor. This one job represents almost half of our backlog, but we continue to be assured the project will go on.

- DOGE [Department of Government Efficiency] and government-induced disruption in the supply chain [are issues affecting our business].

- Our biggest concern is import taxes and the increase in price that it causes.

- [There is] mostly "no change" but that just reflects it's already a bad market. We had to cut wages due to cash flow, and it takes us much longer to ship finished goods due to a lack of labor, which in turn means receipts are delayed. Overall, we are just fortunate to keep the shop open.

- We seem to be in a holding pattern. There's much uncertainty in our customer base. Tariffs will drive/have driven pricing up for raw materials at a rate far exceeding the true tariff implementation rate. There's optimism, but there's also an abundance of trepidation. Ultimately, we sense the underlying economy is stronger than the general public sentiment, so that should bode well for the last half of the year.

- Finally, we can focus on business rather than policy. It is great to get back to work.

- Business activity during 2025 has been steady and at a higher level than we experienced in 2024. We believe this positive trend will continue.

- We are currently working to expand production efforts in Texas. It is very costly and only getting more expensive. We have a long road ahead before we see it having a positive ROI [return on investment].

- Raw materials metals prices are surging. Continued uncertainty due to Trump tariffs and chaotic economic and immigration policy is putting downward expectations for sales beyond March 2025. Forty-six percent of our sales are in automotive OEM [original equipment manufacturer], and of that, most parts are shipped to Mexico for further assembly. If tariffs remain in place for a prolonged period of time, the automotive part of our business may dwindle further.

- Tariffs [are an issue affecting our business].

- Tariffs! We need to make decisions, but the ball is constantly moving. This is truly ridiculous. I have been in business for 50 years as of next year, and never have I seen such uncertainty in the market. It is very difficult to plan and make decisions.

- It has been very slow since Jan. 2, and there is continuing slowness that is starting to look longer term. We are starting to plan accordingly.

- My company is the beneficiary of steel tariffs, which should, but has not yet, create a tailwind for a short time until our customers adjust to tariff-induced higher prices.

- The craziness over tariffs is very painful as I'm confident this is a reason for a general malaise we are sensing in our customers. If not for some specific work we do this time of year, we would be stupid slow and in stark contrast to where we were 12 months ago. I'm very worried about what the next six to 12 months will look like, especially if these goofy tariffs become a reality.

- Uncertainty due to tariffs is the wild card. Imports from Mexico and Canada are vital to the business and the industry. U.S. suppliers cannot supply quantities required. The tariffs are definitely inflationary.

- The tariffs will loom large on our market demand. The commercial vehicle industry is still in a freight recession, which drives our overall demand.

- We don’t expect a pickup in business conditions until the fourth quarter and interest rates come down 150 basis points.

Historical Data

Historical data can be downloaded dating back to June 2004.

Indexes

Download indexes for all indicators. For the definitions of all variables, see Data Definitions.

| Unadjusted |

| Seasonally adjusted |

All Data

Download indexes and components of the indexes (percentage of respondents reporting increase, decrease, or no change). For the definitions of all variables, see Data Definitions.

| Unadjusted |

| Seasonally adjusted |

Questions regarding the Texas Business Outlook Surveys can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Texas Manufacturing Outlook Survey is released on the web.