Texas Service Sector Outlook Survey

Growth resumes in Texas service sector, but company outlooks deteriorated further

For this month’s survey, Texas business executives were asked supplemental questions on the impact of tariffs. Results for these questions from the Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey have been released together. Read the special questions results.

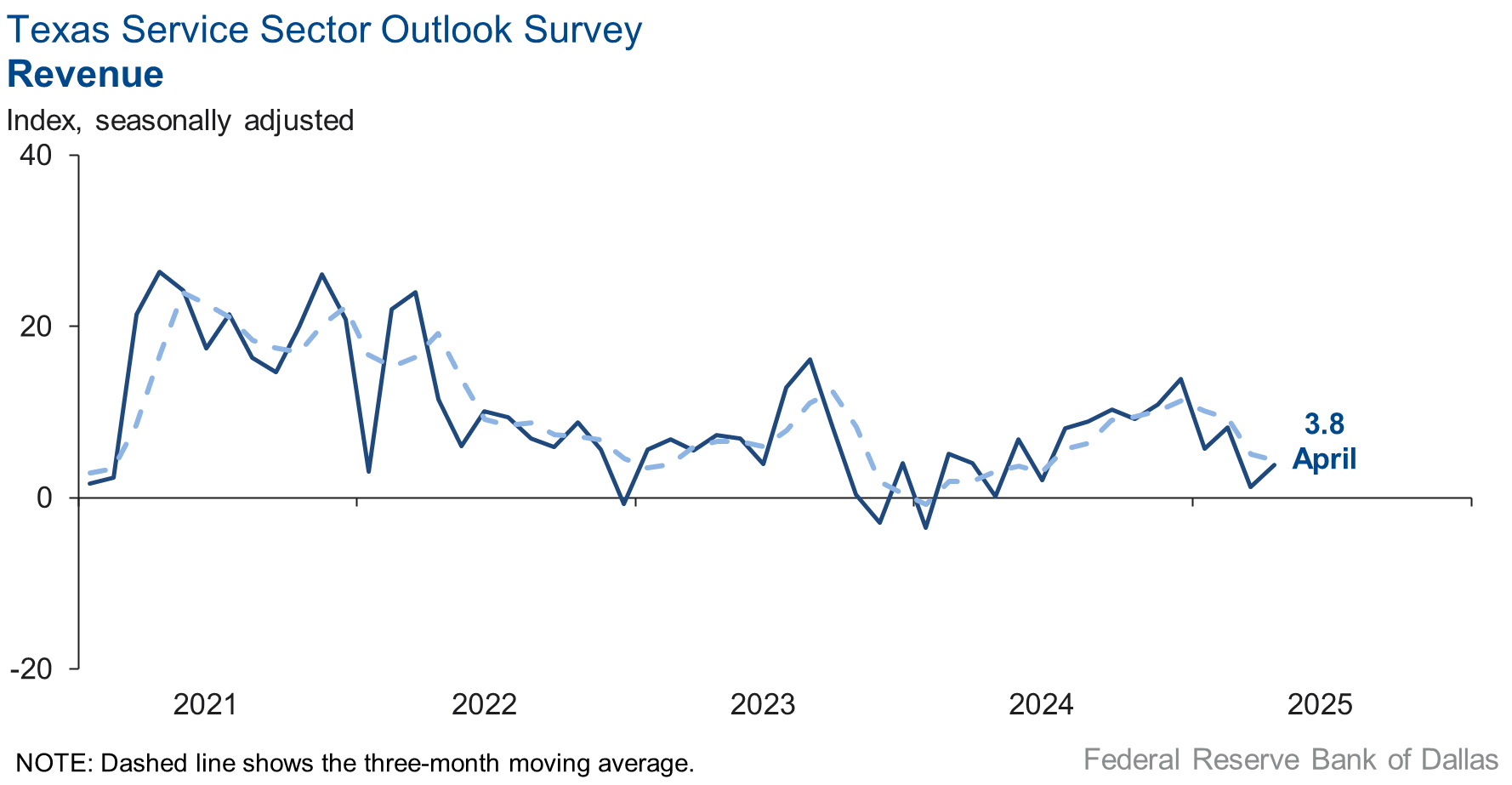

Texas service sector activity grew slightly in April, according to business executives responding to the Texas Service Sector Outlook Survey. The revenue index, a key measure of state service sector conditions, rose three points to 3.8, indicating a small increase in revenue.

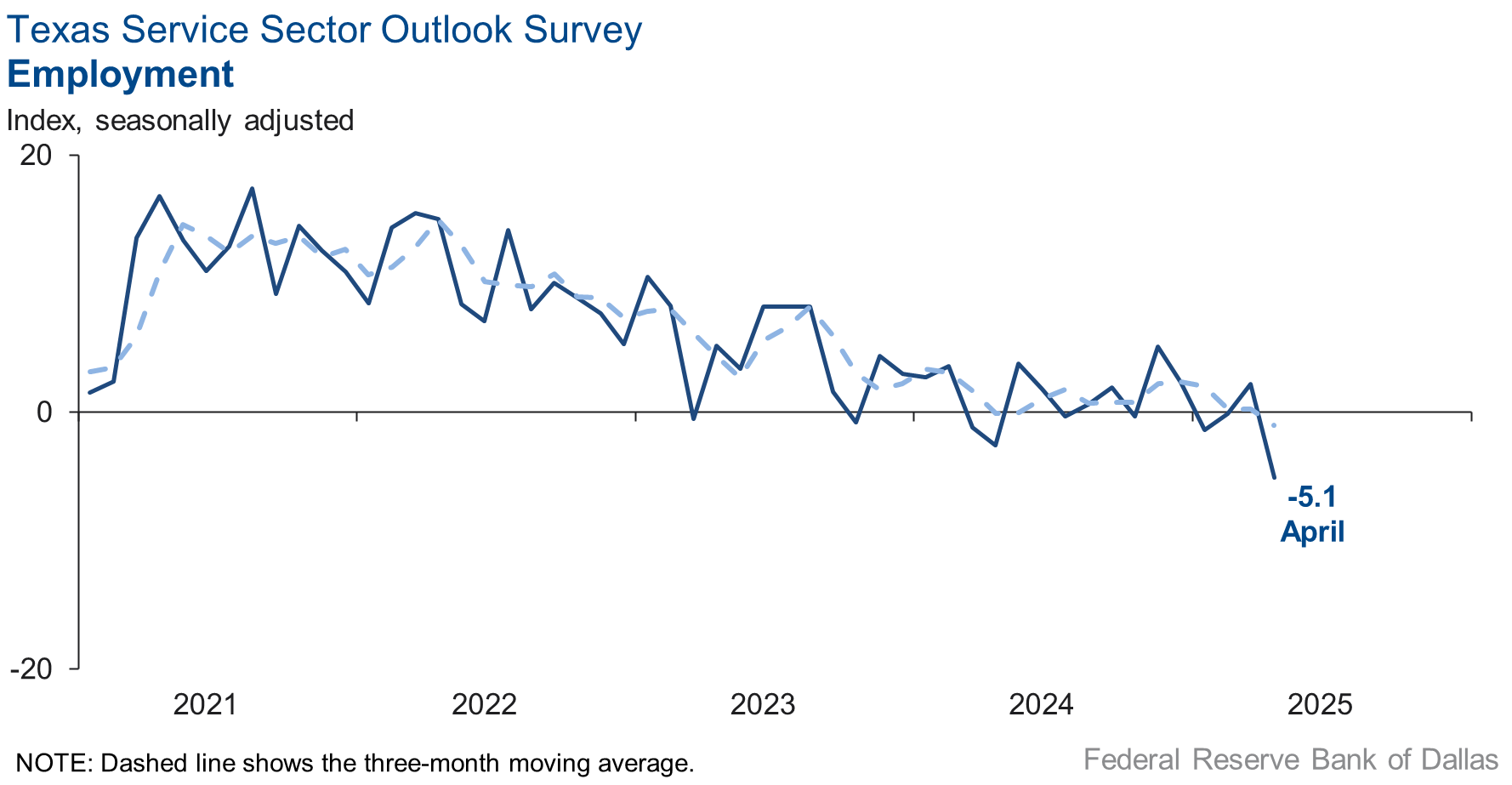

Labor market measures suggested a decline in employment in April and little change in workweeks. The employment index fell to -5.1 from 2.2. The part-time employment index edged down to -3.4 from -1.7, while the hours-worked index ticked up one point to 1.6.

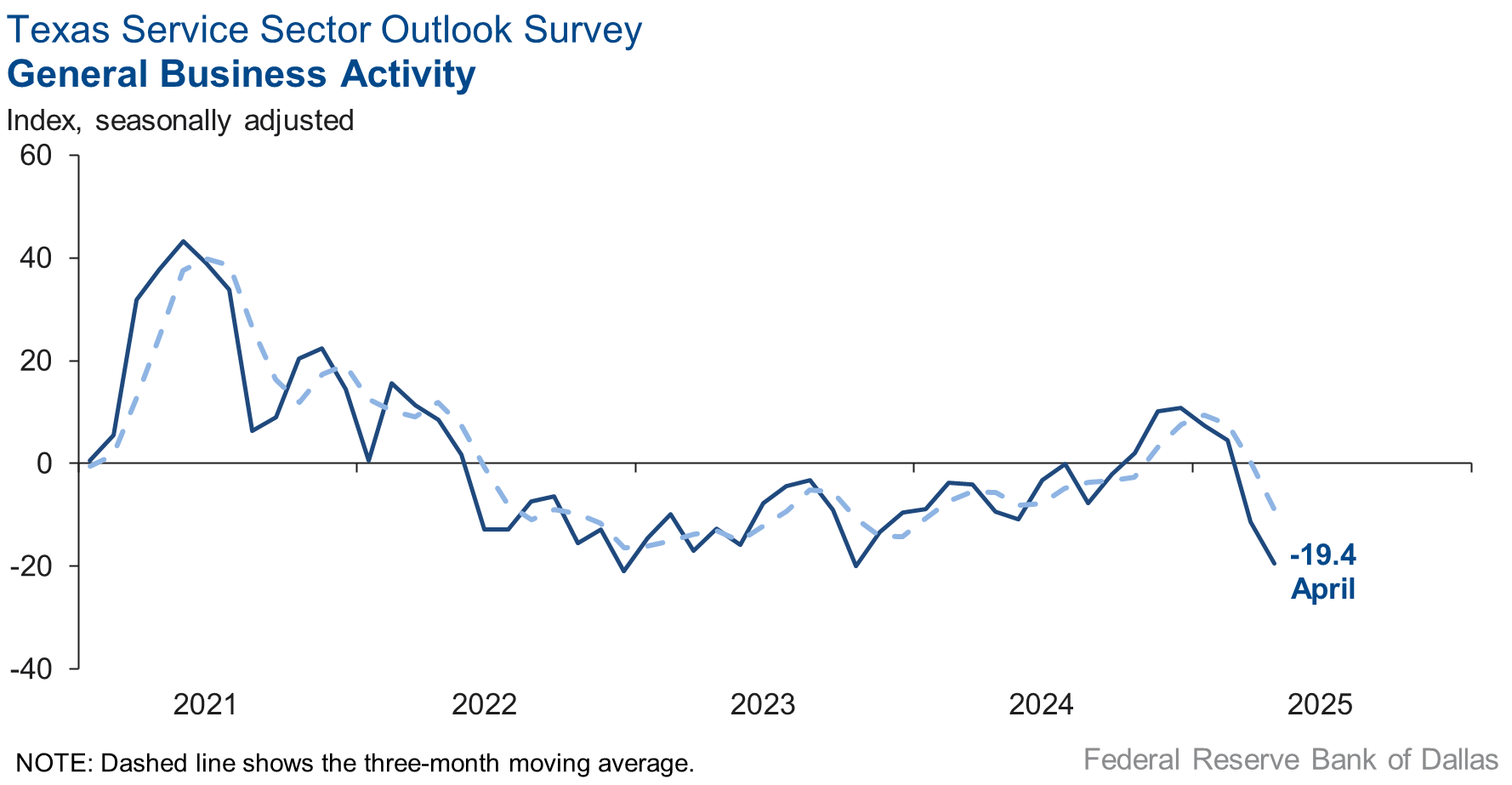

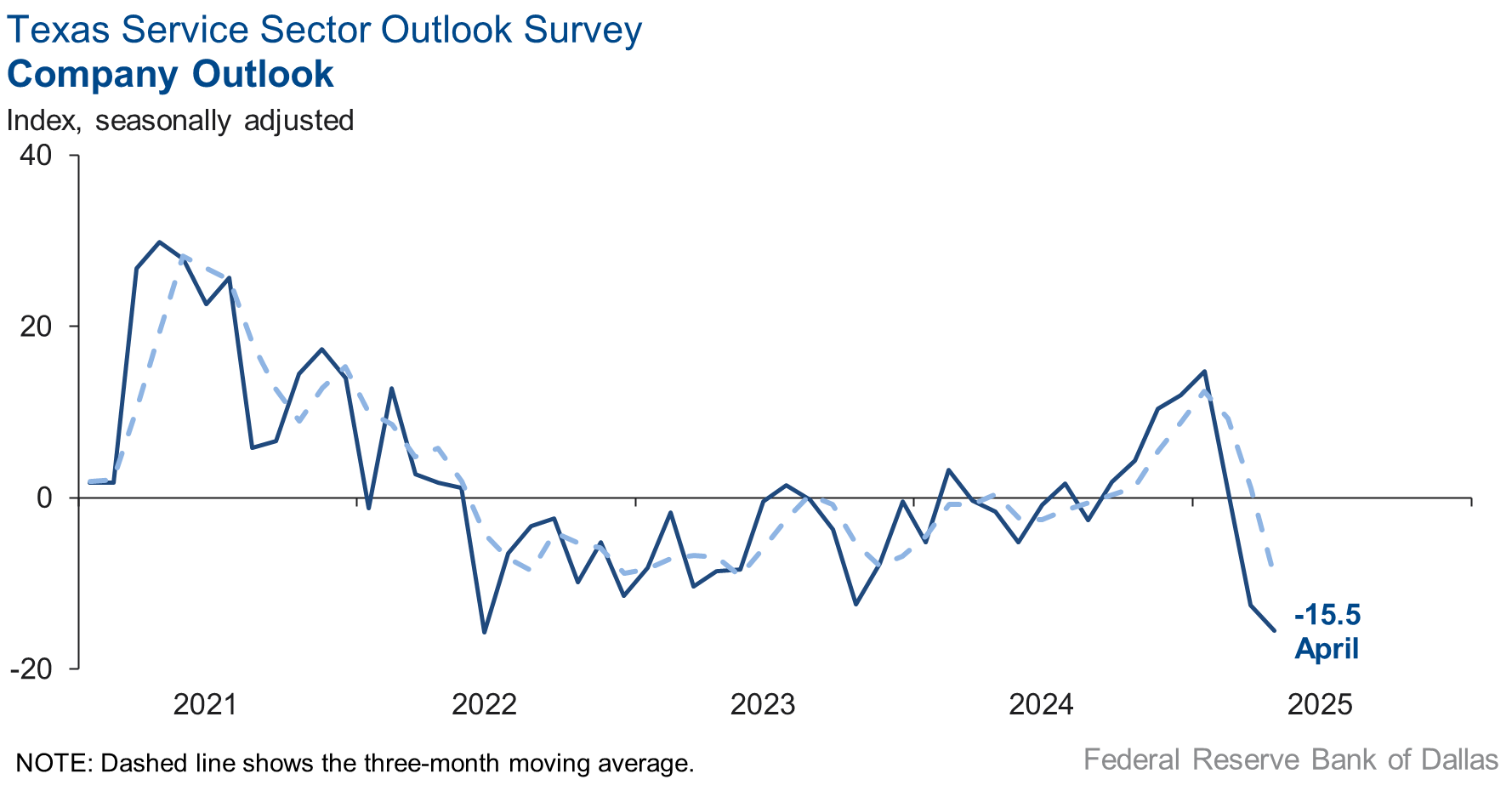

Perceptions of broader business conditions deteriorated further in April. The general business activity index dropped eight points to -19.4. In addition, outlooks worsened as the company outlook index retreated to a 34-month low of -15.5. The outlook uncertainty index jumped 13 points to 40.5—its highest level since mid-2022.

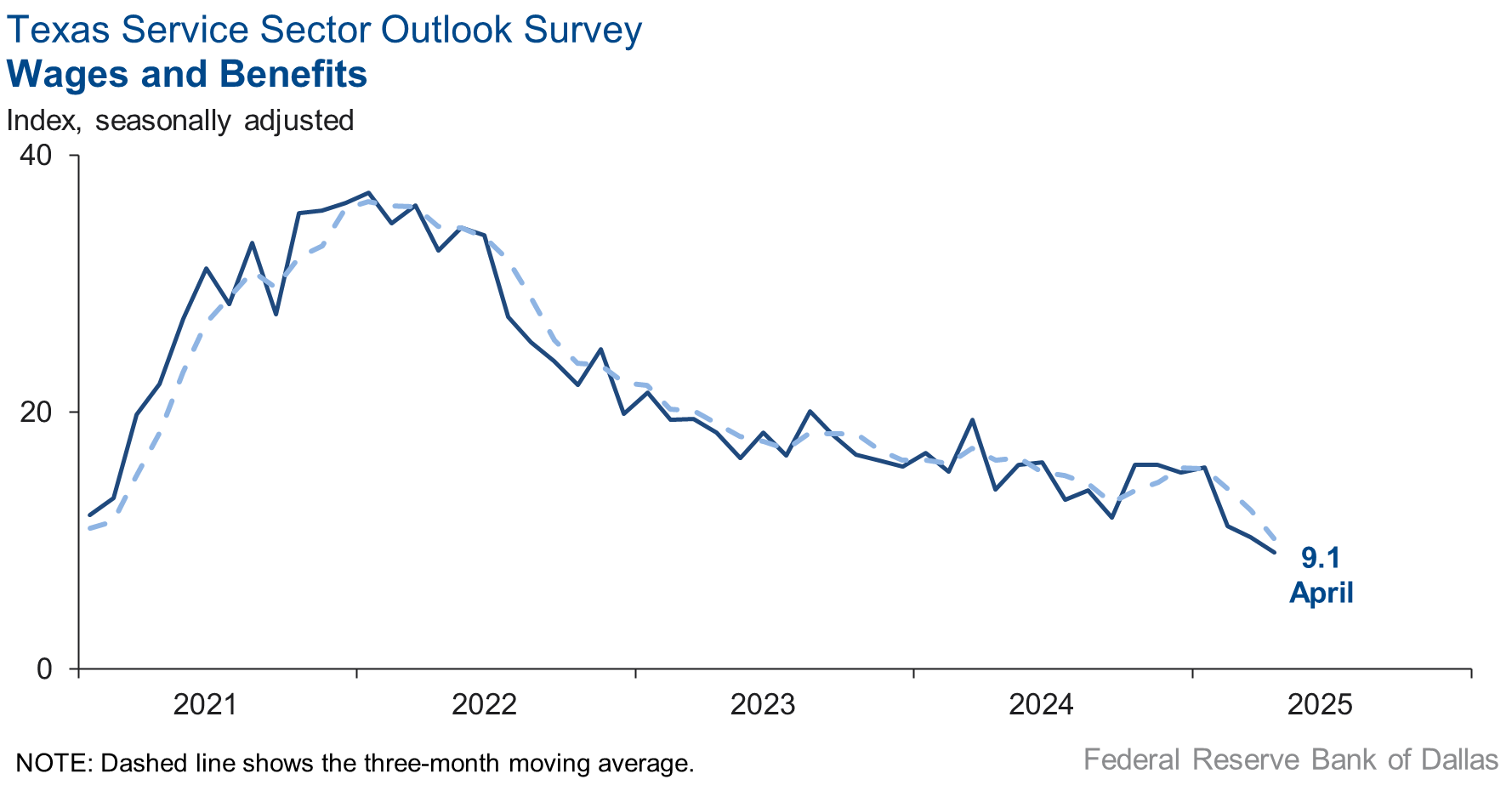

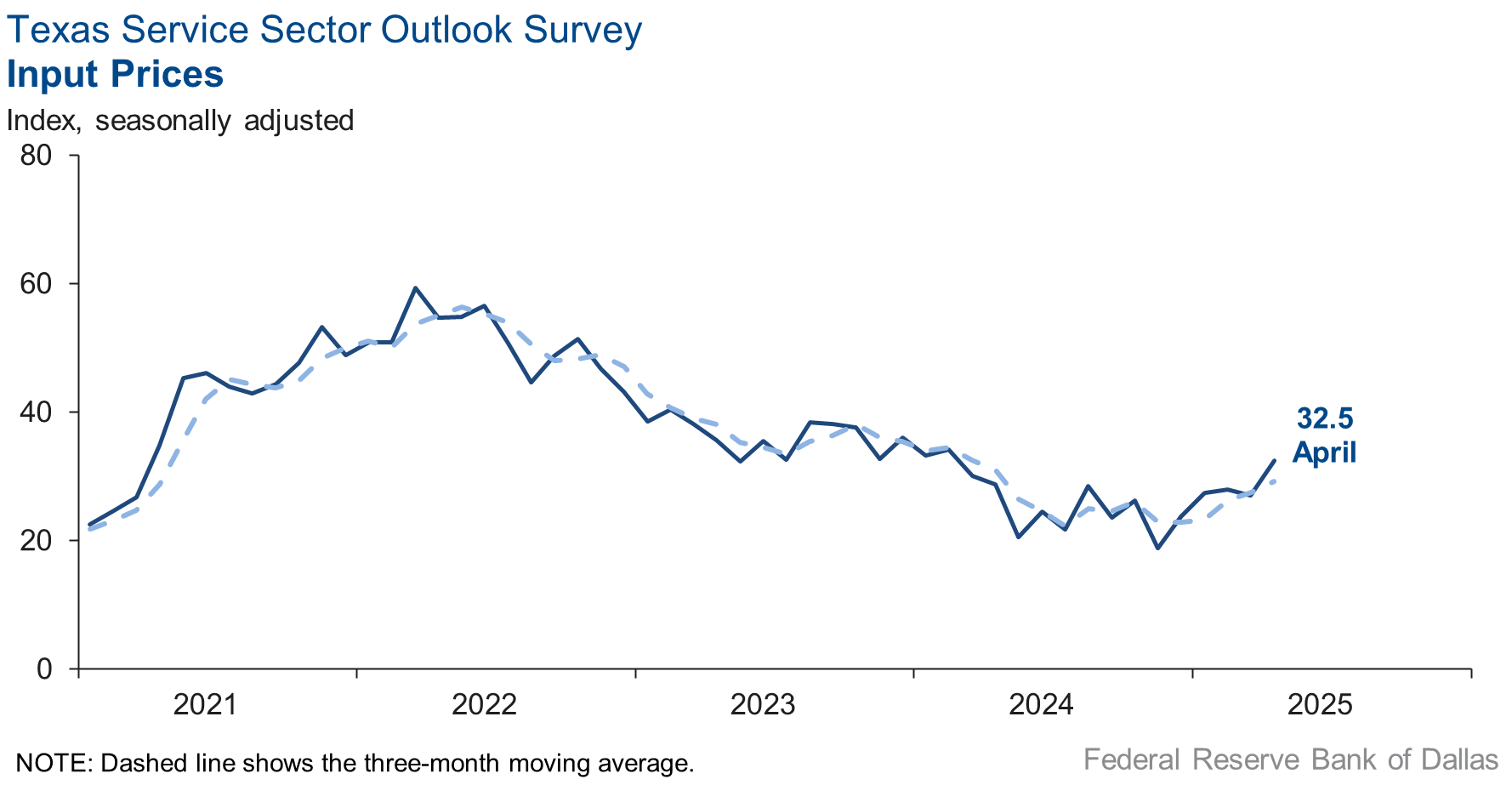

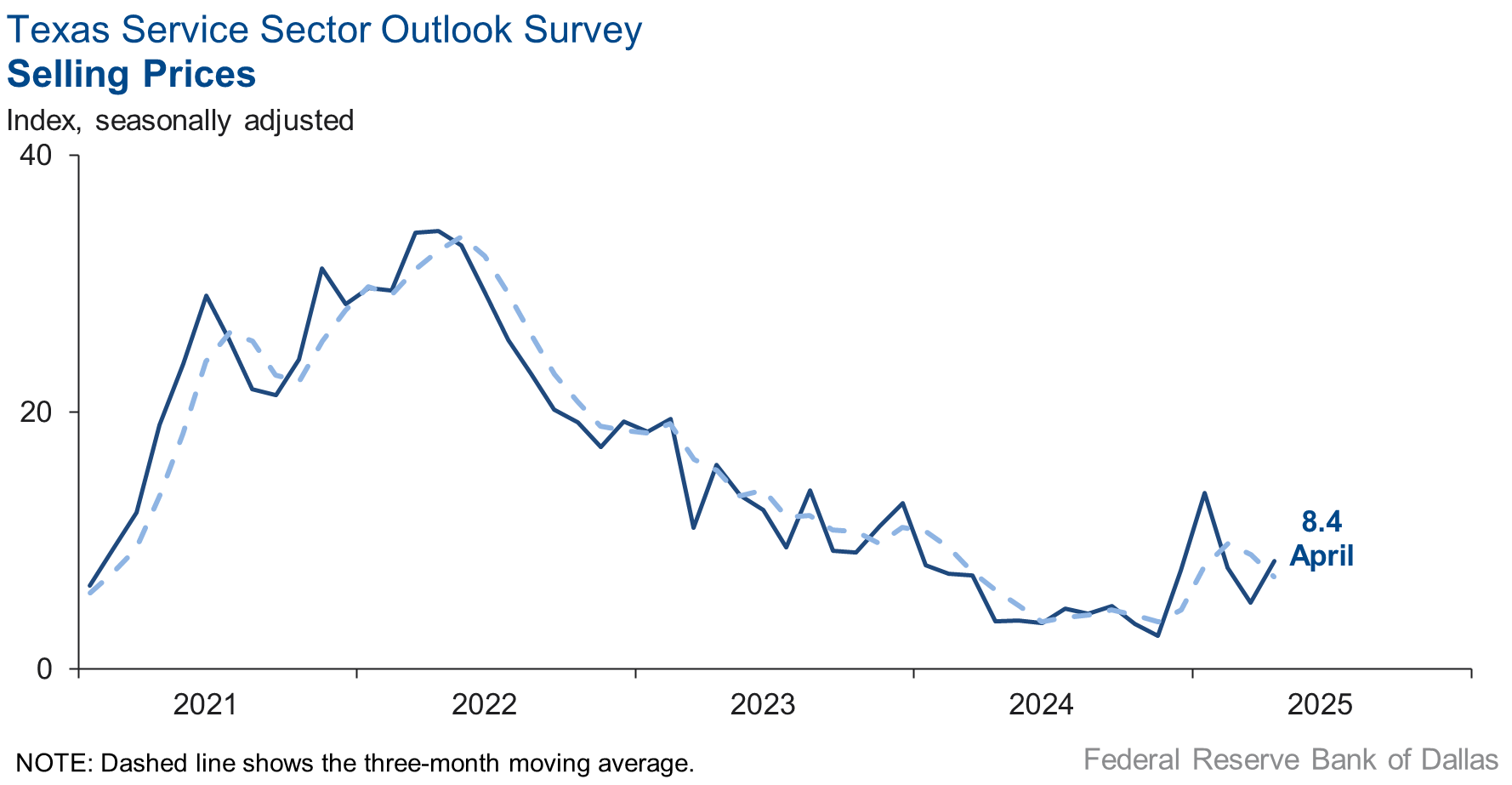

Selling and input price pressures increased in April while wage growth remained stable. The selling prices index rose three points to 8.4, and the input prices index rose to 32.5 from 27.0. The wages and benefits index moved sideways to 9.1.

Respondents’ expectations regarding future business activity continued to weaken in April. The future general business activity index pushed further negative to -16.0 from -1.1, while the future revenue index dropped 14 points to 16.8, the lowest reading since mid-2020. Other future service sector activity indexes such as employment and capital expenditures also fell but remained in positive territory, reflecting expectations for slower growth in the next six months.

Texas Retail Outlook Survey

Texas retail sales grow

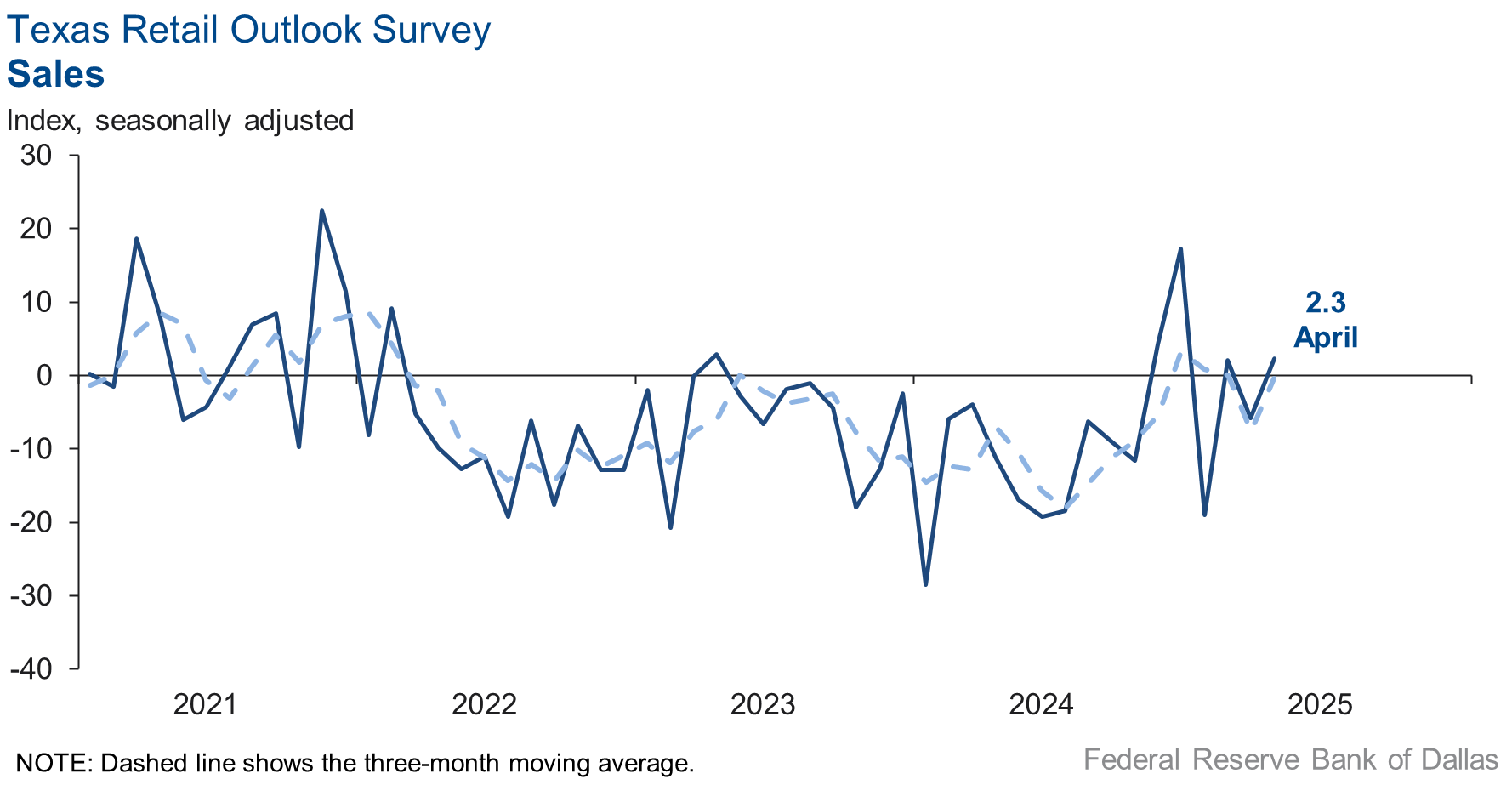

Retail sales activity increased slightly in April, according to business executives responding to the Texas Retail Outlook Survey. The sales index, a key measure of state retail activity, rose to 2.3 from -5.8. Retailers’ inventories declined over the month, with the April index ticking down to -2.4 after holding steady in March.

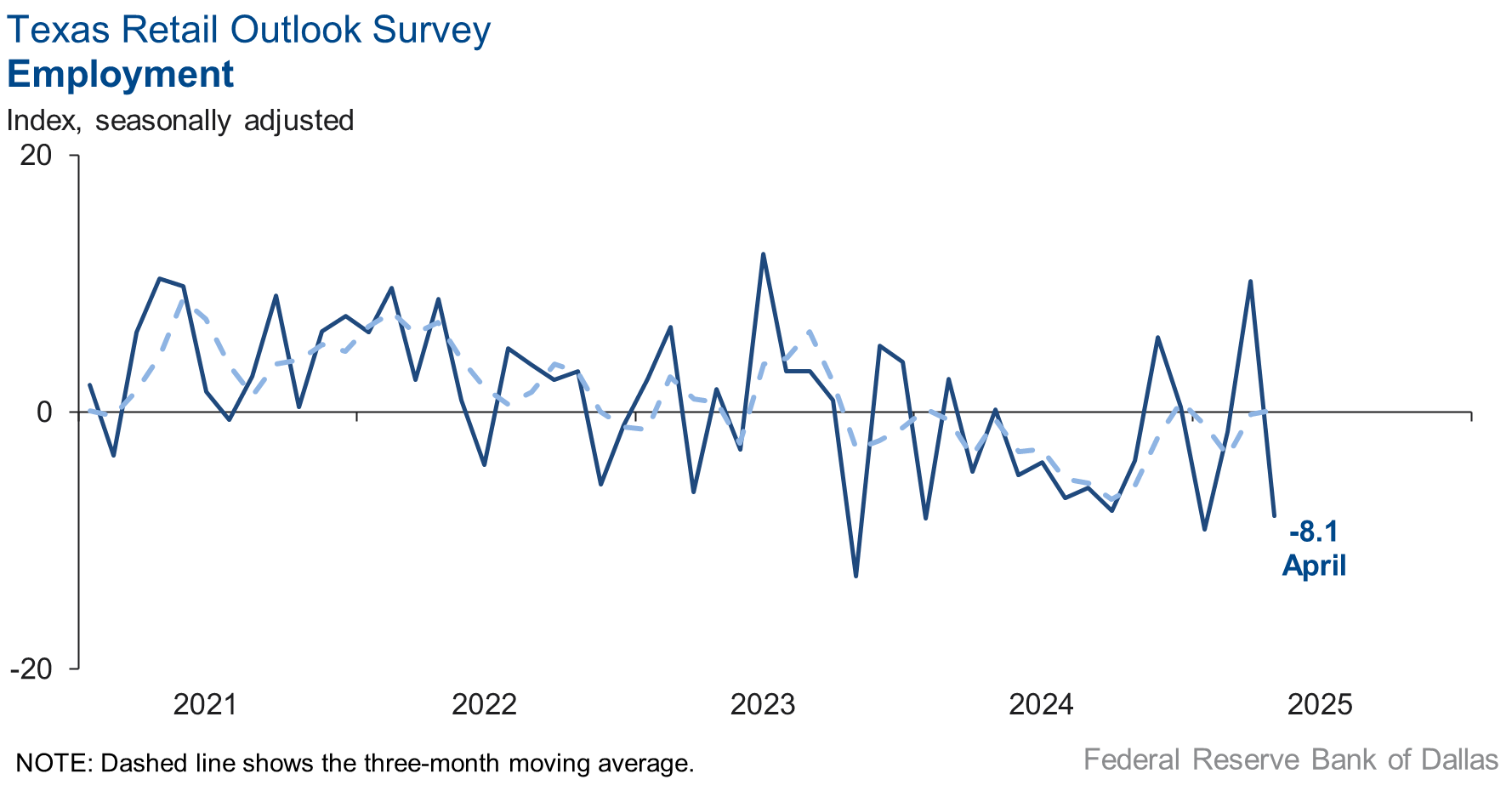

Retail sector labor market indicators suggested falling employment and a contraction in workweeks. The employment index plunged to -8.1 from 10.2. The part-time employment index fell five points to -7.2, and the hours-worked index was unchanged at -3.8.

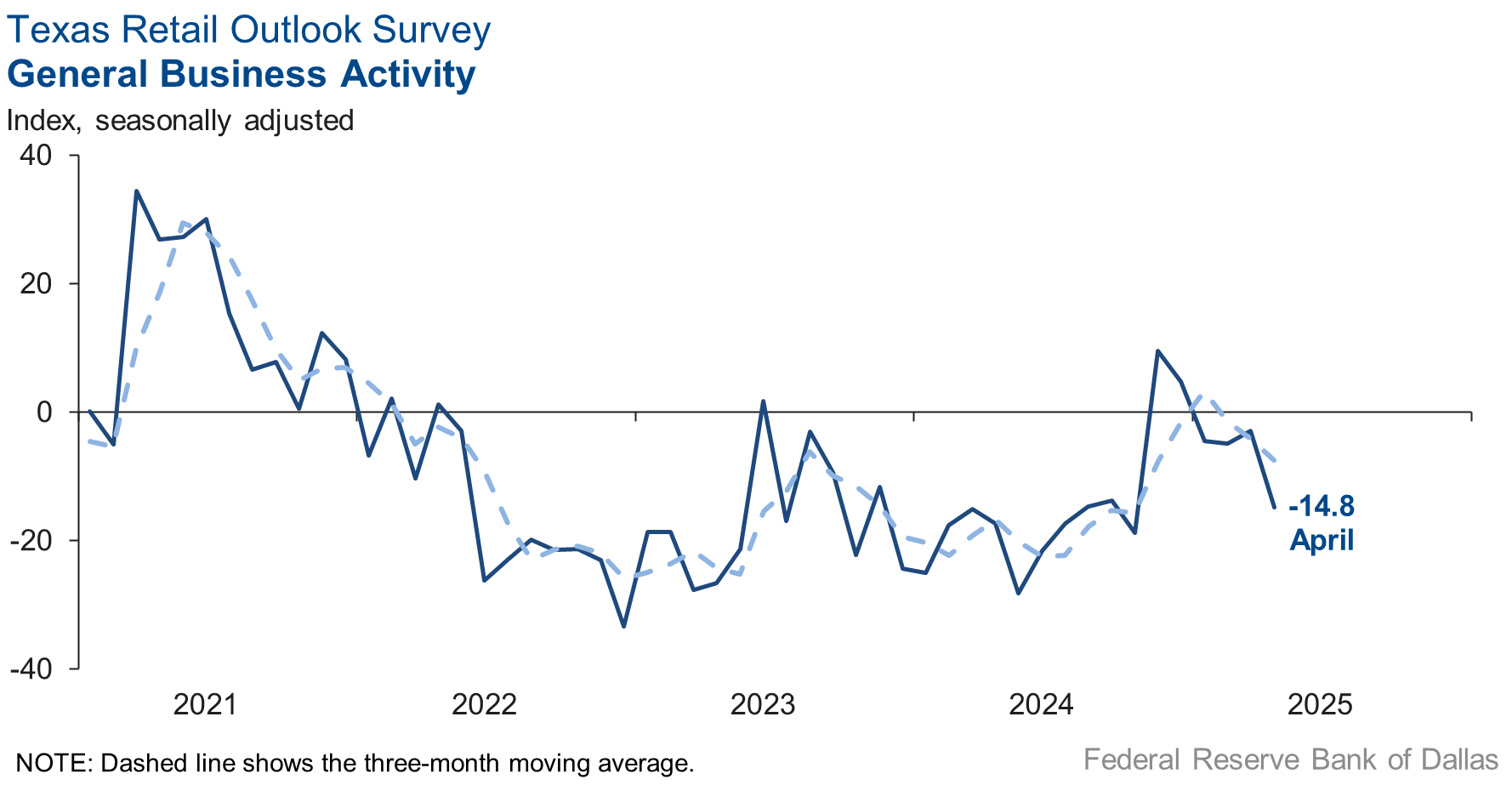

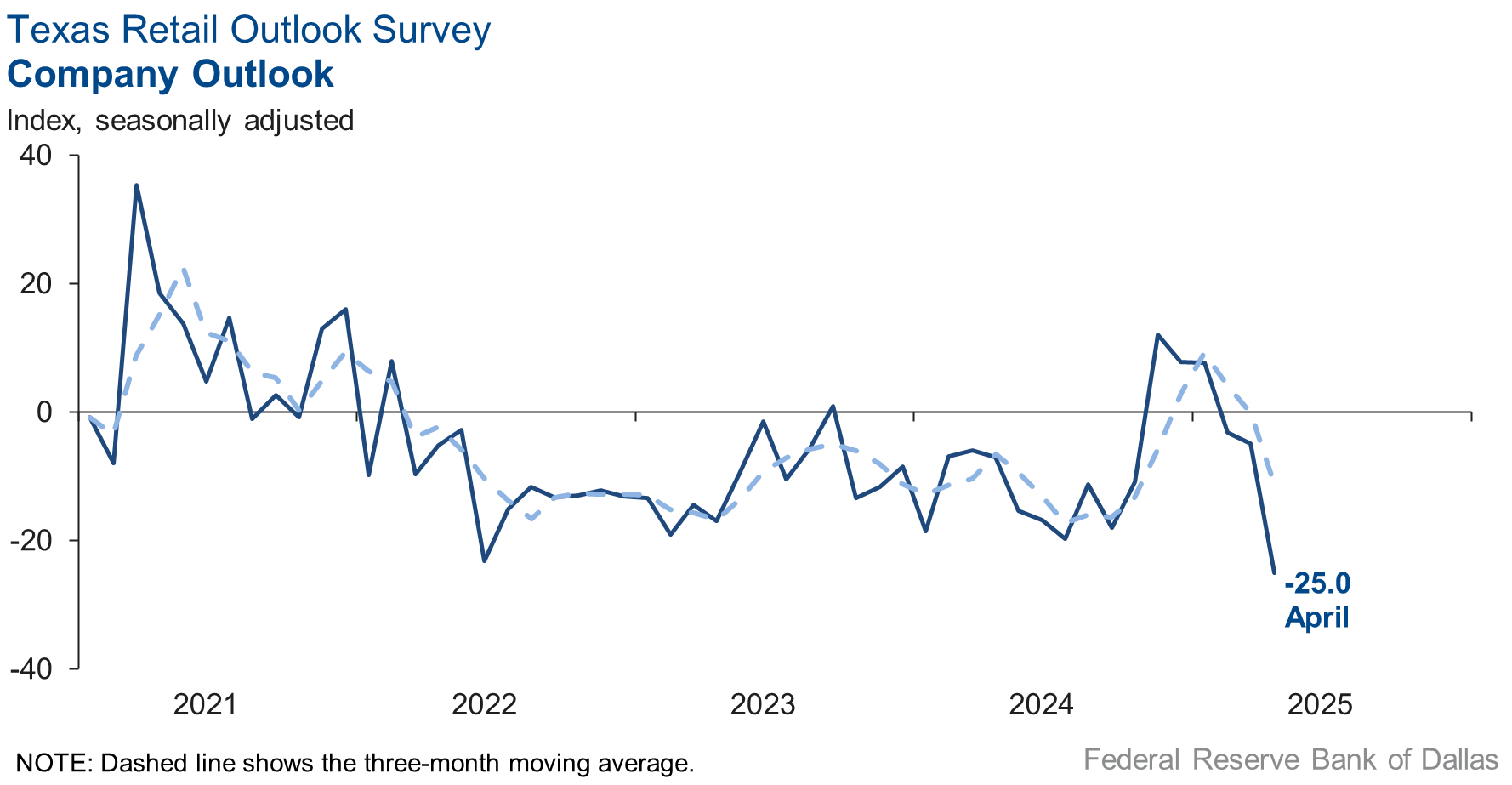

Perceptions of broader business conditions became more pessimistic in April. The general business activity index declined further into negative territory, dropping to -14.8 from -2.9, and the company outlook index nosedived to -25 from -4.9. Uncertainty in outlooks jumped 18 points to 30.9.

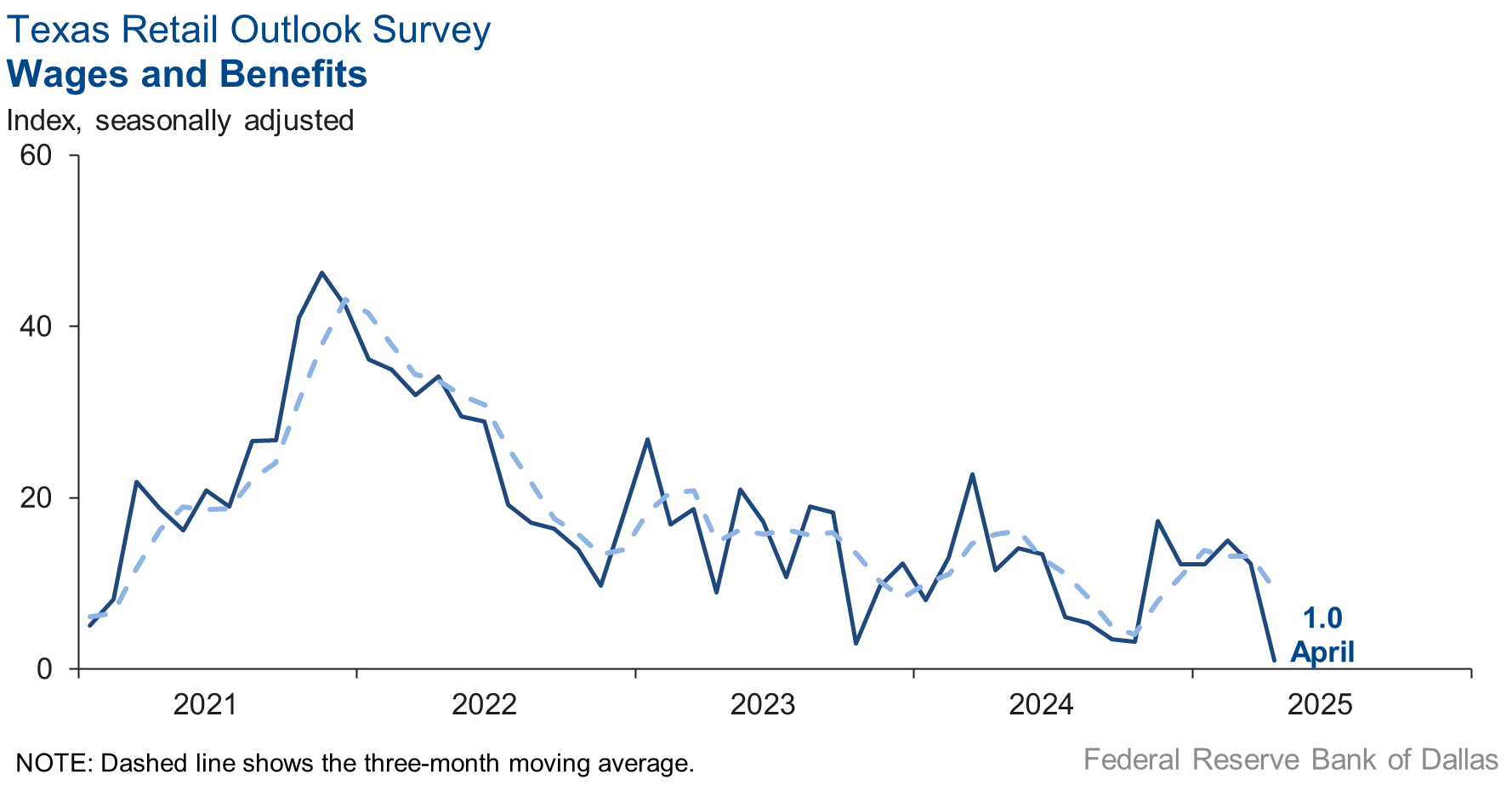

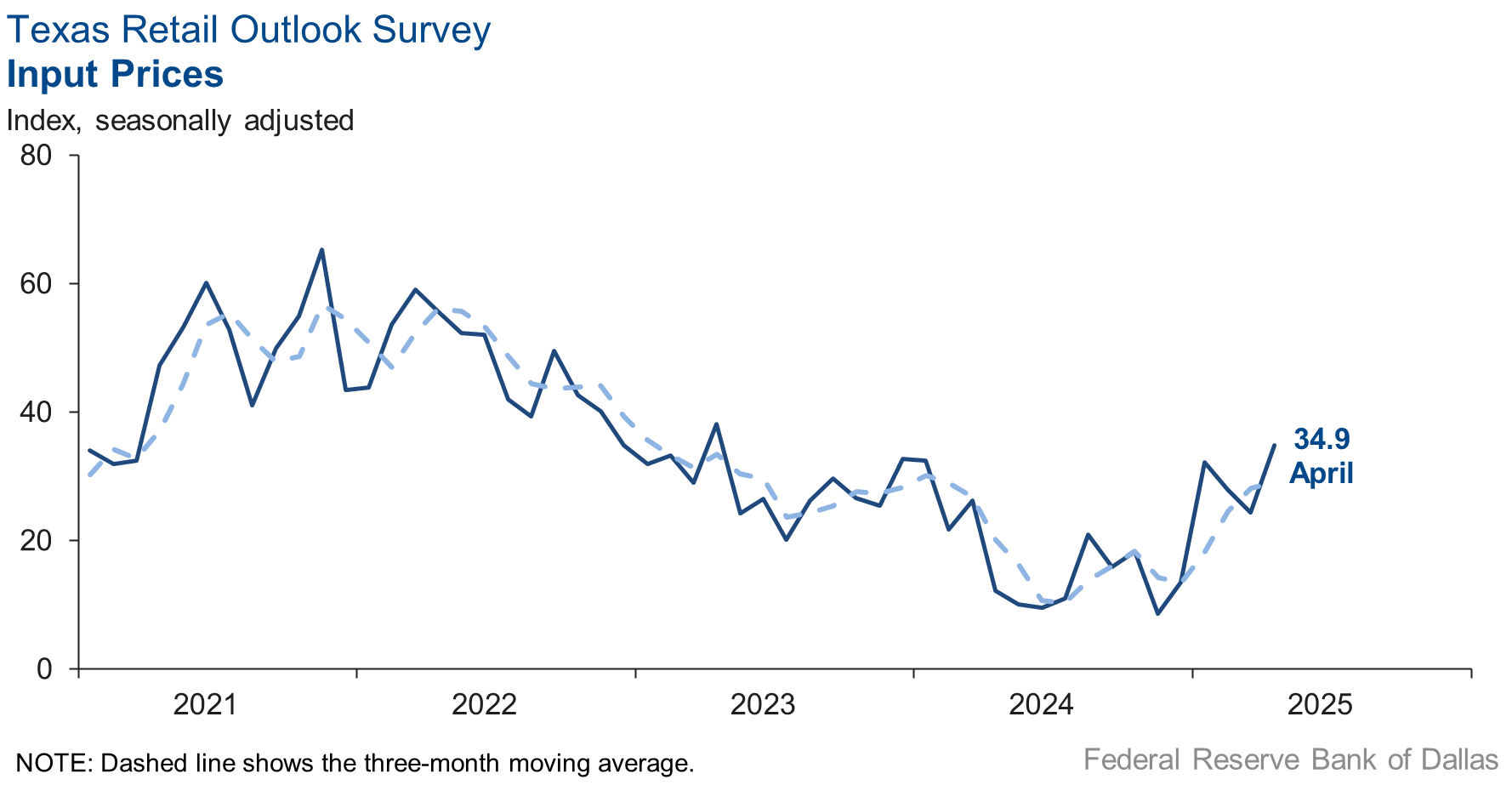

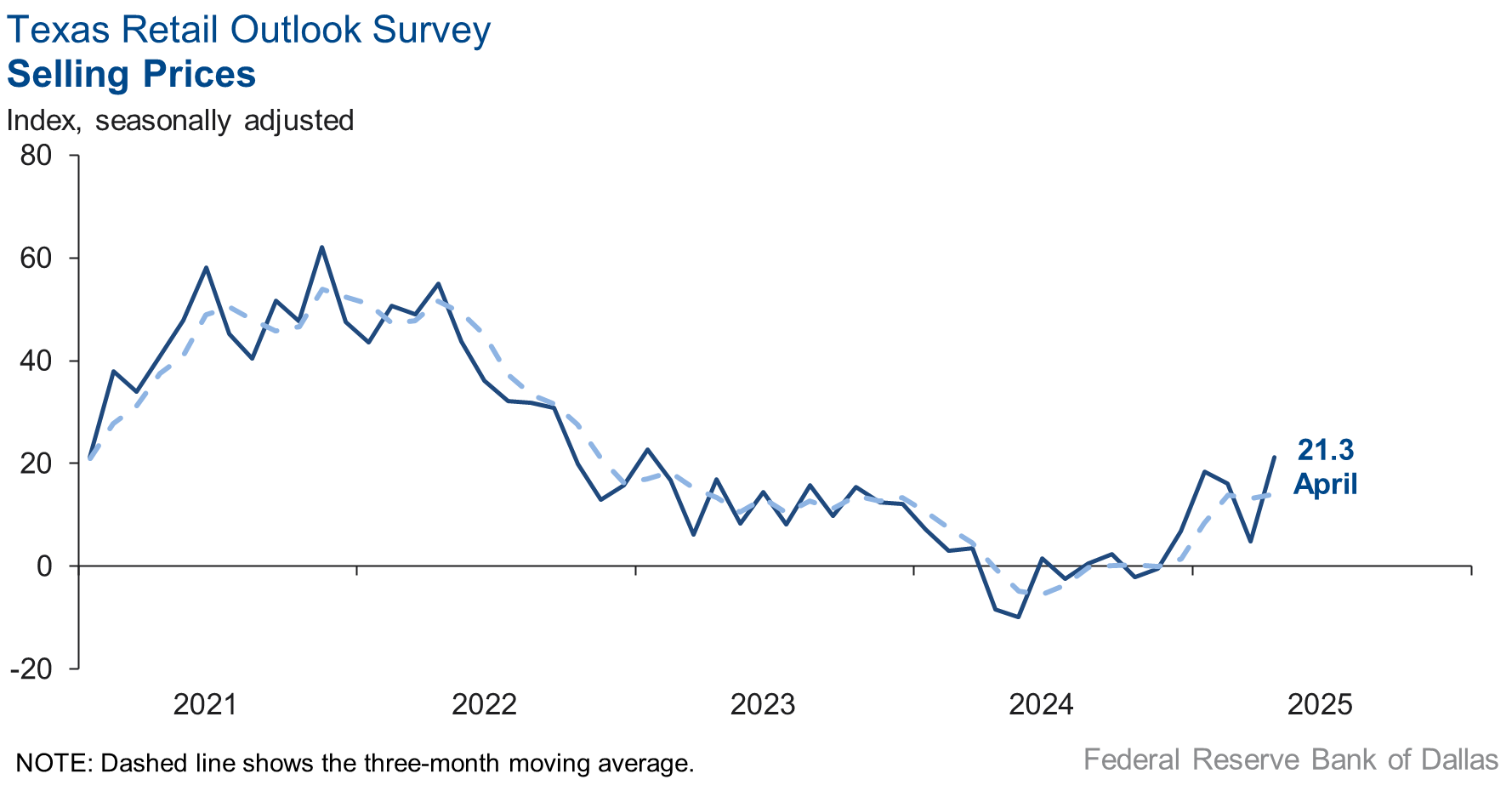

Price pressures intensified while wage pressures eased in April. The selling prices index shot up 17 points to 21.3, and the input prices index increased 11 points to 34.9. The wages and benefits index fell to 1.0 from 12.3, indicating wages and benefits remained steady over the month.

Respondents expect significantly weaker future business activity. The future general business activity index fell sharply in April to -24.2 from 6.9, and the future company outlook index dropped further into negative territory to -25.1 from -5.4. The future sales index declined 19 points to 0.1 and the future employment index dropped to -0.3, with the near-zero readings suggesting expectations of no growth in sales and employment six months from now. The future capital expenditures index fell to -12.5 from 16.7.

Next release: May 28, 2025

Data were collected April 15–23, and 275 of the 372 Texas service sector business executives surveyed submitted responses. The Dallas Fed conducts the Texas Service Sector Outlook Survey monthly to obtain a timely assessment of the state’s service sector activity. Firms are asked whether revenue, employment, prices, general business activity and other indicators increased, decreased or remained unchanged over the previous month.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior month. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior month. An index will be zero when the number of firms reporting an increase is equal to the number of firms reporting a decrease.

Data have been seasonally adjusted as necessary.

Texas Service Sector Outlook Survey

Historical data are available from January 2007 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Current (versus previous month) | ||||||||

| Indicator | Apr Index | Mar Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | 3.8 | 1.3 | +2.5 | 10.5 | 15(+) | 25.1 | 53.6 | 21.3 |

Employment | –5.1 | 2.2 | –7.3 | 6.1 | 1(–) | 8.0 | 78.9 | 13.1 |

Part–Time Employment | –3.4 | –1.7 | –1.7 | 1.3 | 2(–) | 3.8 | 89.0 | 7.2 |

Hours Worked | 1.6 | 0.8 | +0.8 | 2.6 | 2(+) | 9.1 | 83.4 | 7.5 |

Wages and Benefits | 9.1 | 10.3 | –1.2 | 15.7 | 59(+) | 15.7 | 77.7 | 6.6 |

Input Prices | 32.5 | 27.0 | +5.5 | 27.9 | 60(+) | 35.9 | 60.7 | 3.4 |

Selling Prices | 8.4 | 5.2 | +3.2 | 7.5 | 57(+) | 14.7 | 79.0 | 6.3 |

Capital Expenditures | 0.6 | 7.4 | –6.8 | 9.8 | 57(+) | 11.7 | 77.2 | 11.1 |

| General Business Conditions Current (versus previous month) | ||||||||

| Indicator | Apr Index | Mar Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –15.5 | –12.5 | –3.0 | 4.2 | 2(–) | 12.4 | 59.7 | 27.9 |

General Business Activity | –19.4 | –11.3 | –8.1 | 2.2 | 2(–) | 9.6 | 61.4 | 29.0 |

| Indicator | Apr Index | Mar Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty | 40.5 | 27.3 | +13.2 | 13.5 | 47(+) | 50.2 | 39.9 | 9.7 |

| Business Indicators Relating to Facilities and Products in Texas Future (six months ahead) | ||||||||

| Indicator | Apr Index | Mar Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | 16.8 | 30.9 | –14.1 | 37.4 | 60(+) | 42.1 | 32.5 | 25.3 |

Employment | 9.8 | 14.9 | –5.1 | 23.0 | 60(+) | 25.5 | 58.8 | 15.7 |

Part–Time Employment | –2.0 | –1.5 | –0.5 | 6.5 | 2(–) | 7.7 | 82.6 | 9.7 |

Hours Worked | –0.2 | 4.6 | –4.8 | 5.9 | 1(–) | 8.7 | 82.4 | 8.9 |

Wages and Benefits | 29.2 | 27.7 | +1.5 | 37.5 | 60(+) | 35.0 | 59.2 | 5.8 |

Input Prices | 49.7 | 41.2 | +8.5 | 44.3 | 220(+) | 54.9 | 40.0 | 5.2 |

Selling Prices | 26.2 | 20.6 | +5.6 | 24.5 | 60(+) | 36.3 | 53.6 | 10.1 |

Capital Expenditures | 8.6 | 11.9 | –3.3 | 22.7 | 59(+) | 22.6 | 63.4 | 14.0 |

| General Business Conditions Future (six months ahead) | ||||||||

| Indicator | Apr Index | Mar Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –11.7 | –0.6 | –11.1 | 15.5 | 2(–) | 20.7 | 46.9 | 32.4 |

General Business Activity | –16.0 | –1.1 | –14.9 | 12.1 | 2(–) | 19.6 | 44.9 | 35.6 |

Historical data are available from January 2007 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Retail (versus previous month) | ||||||||

| Indicator | Apr Index | Mar Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

| Retail Activity in Texas | ||||||||

Sales | 2.3 | –5.8 | +8.1 | 3.1 | 1(+) | 27.5 | 47.3 | 25.2 |

Employment | –8.1 | 10.2 | –18.3 | 1.5 | 1(–) | 4.0 | 83.9 | 12.1 |

Part–Time Employment | –7.2 | –2.2 | –5.0 | –1.5 | 2(–) | 0.6 | 91.6 | 7.8 |

Hours Worked | –3.8 | –5.0 | +1.2 | –2.2 | 5(–) | 7.5 | 81.2 | 11.3 |

Wages and Benefits | 1.0 | 12.3 | –11.3 | 11.2 | 57(+) | 16.5 | 68.0 | 15.5 |

Input Prices | 34.9 | 24.4 | +10.5 | 22.5 | 60(+) | 42.5 | 50.0 | 7.6 |

Selling Prices | 21.3 | 4.8 | +16.5 | 13.1 | 5(+) | 27.9 | 65.5 | 6.6 |

Capital Expenditures | –2.5 | 7.6 | –10.1 | 7.5 | 1(–) | 12.5 | 72.5 | 15.0 |

Inventories | –2.4 | –1.0 | –1.4 | 2.8 | 3(–) | 22.3 | 53.0 | 24.7 |

| Companywide Retail Activity | ||||||||

Companywide Sales | 4.7 | –11.0 | +15.7 | 4.4 | 1(+) | 28.3 | 48.2 | 23.6 |

Companywide Internet Sales | –2.8 | –1.6 | –1.2 | 3.8 | 2(–) | 12.5 | 72.2 | 15.3 |

| General Business Conditions, Retail Current (versus previous month) | ||||||||

| Indicator | Apr Index | Mar Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –25.0 | –4.9 | –20.1 | 1.3 | 3(–) | 4.6 | 65.8 | 29.6 |

General Business Activity | –14.8 | –2.9 | –11.9 | –2.6 | 4(–) | 9.8 | 65.7 | 24.6 |

| Outlook Uncertainty Current (versus previous month) | ||||||||

| Indicator | Apr Index | Mar Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty | 30.9 | 12.8 | +18.1 | 11.2 | 9(+) | 45.7 | 39.5 | 14.8 |

| Business Indicators Relating to Facilities and Products in Texas, Retail Future (six months ahead) | ||||||||

| Indicator | Apr Index | Mar Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

| Retail Activity in Texas | ||||||||

Sales | 0.1 | 18.6 | –18.5 | 30.2 | 23(+) | 33.0 | 34.1 | 32.9 |

Employment | –0.3 | 16.4 | –16.7 | 12.6 | 1(–) | 21.9 | 55.9 | 22.2 |

Part–Time Employment | –16.7 | 2.5 | –19.2 | 1.5 | 1(–) | 0.5 | 82.3 | 17.2 |

Hours Worked | –14.5 | –7.7 | –6.8 | 2.3 | 4(–) | 1.3 | 82.9 | 15.8 |

Wages and Benefits | 17.2 | 12.3 | +4.9 | 28.9 | 60(+) | 31.2 | 54.8 | 14.0 |

Input Prices | 49.7 | 35.0 | +14.7 | 33.9 | 60(+) | 54.9 | 40.0 | 5.2 |

Selling Prices | 8.6 | 26.8 | –18.2 | 28.4 | 60(+) | 22.6 | 63.4 | 14.0 |

Capital Expenditures | –12.5 | 16.7 | –29.2 | 16.4 | 1(–) | 14.3 | 58.9 | 26.8 |

Inventories | –3.7 | 9.9 | –13.6 | 10.6 | 1(–) | 24.3 | 47.6 | 28.0 |

| Companywide Retail Activity | ||||||||

Companywide Sales | –6.8 | 18.8 | –25.6 | 28.6 | 1(–) | 28.7 | 35.7 | 35.5 |

Companywide Internet Sales | 40.5 | 9.4 | +31.1 | 21.1 | 15(+) | 50.2 | 39.9 | 9.7 |

| General Business Conditions, Retail Future (six months ahead) | ||||||||

| Indicator | Apr Index | Mar Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –25.1 | –5.4 | –19.7 | 14.8 | 2(–) | 20.9 | 33.1 | 46.0 |

General Business Activity | –24.2 | 6.9 | –31.1 | 10.3 | 1(–) | 20.1 | 35.6 | 44.3 |

*Shown is the number of consecutive months of expansion or contraction in the underlying indicator. Expansion is indicated by a positive index reading and denoted by a (+) in the table. Contraction is indicated by a negative index reading and denoted by a (–) in the table.

**Shown is the number of consecutive months of improvement or worsening in the underlying indicator. Improvement is indicated by a positive index reading and denoted by a (+) in the table. Worsening is indicated by a negative index reading and denoted by a (–) in the table.

Data have been seasonally adjusted as necessary.

Texas Service Sector Outlook Survey

Texas Retail Outlook Survey

Texas Service Sector Outlook Survey

Comments from survey respondents

Survey participants are given the opportunity to submit comments on current issues that may be affecting their businesses. Some comments have been edited for grammar and clarity.

- President Donald Trump has a very chaotic style of dealing with the economy.

- The first three months were light due primarily to the January winter freeze and rainy weather across much of Texas and Louisiana. Land development surprisingly was the bright spot, with a record number of active jobs on the books throughout this period. Year over year we have seen an increase in the total number of jobs. However, the average size of those jobs decreased, leading to a decrease in revenue versus last year. We are seeing a record number of infrastructure and oil and gas proposals to break ground in May and June across major markets in Houston, Dallas, Austin, the Rio Grande Valley and Beaumont. National sentiment surveys in recent weeks may seem dour, but we see no slowdown in development across the state. We are expecting the next three-month revenue numbers to exceed those of last year.

- We have high levels of anxiety as a result of the fast-moving changes in government restructuring and tariff policies. Although we are hoping for the best end results, the overall business environment is very volatile. It is very difficult to provide fixed price quotes for construction contracts. There is definitely an increased risk factor for contractors, owners and the architecture, engineering and construction industry.

- I am hearing a lot of chatter about the tariffs and am getting a lot of communications from our suppliers of apparel and hard goods about their intention to raise prices and plans to work with more U.S.-based warehouses. We are leaning that way as well, but domestic warehouses all tend to be so much more expensive.

- Nothing is getting better.

- The biggest expense remains business and health insurance and taxes on increased value. Labor costs appear to have stabilized for now.

- I am comfortable where business is right now as we continue to get leads. Still, I have enough experience to know that although we may be the last ones to experience it, the nonprofit sector is typically the hardest hit by any economic uncertainty. And our runway out of it is often much longer than other sectors. I am nervous about what the next several quarters hold for the nonprofit sector.

- [We are concerned about] tariff uncertainty and price increases, mostly related to products from China; plus, we are experiencing longer lead times for orders. The normal lead time of two weeks has slipped to 30 days.

- Giving legal employment advice to clients' prospective business activities is nearly impossible given the uncertainty created by ongoing changes at the federal level.

- There's a lot of media coverage on the economy. It's hard to tell how things are going to be in the last two quarters of the year. I think everyone is having trouble planning right now.

- Negativity regarding oil prices and ongoing tariff issues is causing continued uncertainty in the near and middle term. Until oil gets above $70 per barrel, expect low rig utilization and fewer wells coming online. Weak commodity prices are expected due to an increase in Saudi production and soft global demand (mild recession in China).

- Potential supply chain impacts of proposed tariffs are being evaluated industrywide.

- All of the uncertainty is slowing private business. Much of our work is governmental, so the changes in government have affected that stream of revenue as well.

- Until we have clear direction on where we are going, real estate transactions will not pick up. This feels like a recession, and hopefully it will not last long.

- Tariffs are bringing a high level of uncertainty to our business. It is hard to tell what will happen in one week, let alone six months

- Erratic leadership style in Washington has led to high levels of uncertainty impacting decision making and spending.

- The on-again, off-again psychodrama in Washington with respect to tariffs is upsetting to almost the entirety of the business community. If the unprecedented tariffs continue, the commercial real estate and construction industries will slow to a halt soon.

- Uncertainty has grown about federal policies (i.e. trade tariffs, funding for infrastructure, immigration) and upcoming state legislation (i.e. local government and school bond elections) and funding. Any one of these could have a material impact on public and private construction projects moving forward. We haven't experienced the full impact of any changes yet. Ongoing uncertainty in and of itself will slow or halt some projects. The six-month increase in activity for our firm relates to the start of some major liquefied natural gas energy projects. Other slowdowns could blunt the impact.

- There are clear signs of pressure on prices for goods and services requested by the Department of Defense and federal agency contractors. Any new increase in tariffs on imports such as steel, aluminum, semiconductors and electronics will result in increased buying costs for contractors. These additional costs impact budgeting, pricing and project timelines.

- The insane chaos that is running the White House makes it impossible to plan anything. Anybody there that thinks tariffs will have any immediate impact on building manufacturing facilities in the U.S. has no concept of the time it takes to build anything. A major facility is five years minimum. Smaller facilities may only take three years. The building "announcements" that have been made since the tariffs began have been for facilities that were already made public months or years ago. These projects have nothing to do with the tariffs.

- Daily instability in D.C. continues to create chaos. Businesses don't like that, but that's the way the current president operates and always has, by creating chaos.

- The current tariffs in effect will increase our cost of goods due to increased produce prices and certain imported proteins.

- Annual sales are flat. There is little opportunity to raise prices, and federal economic forecasts are sending mixed messages. My expectation is that West Texas Intermediate oil will fall, threatening jobs and leading to corporate budget slashes. That will cause a trickle-down effect resulting in a local recession.

- The policy swings and uncertainty coming out of Washington are not only having negative effects on the stock market; they are also putting group meetings and the summer travel season at risk.

- The six-month outlook is very difficult due to all the uncertainty. For this exercise, I assumed that the tariff issue would be just the10 percent across the board, nothing more. I also assumed the Fed chair was still in place.

- Customers are very slow to spend. They’re deliberating their purchases much more than previously and are much less likely to spend if they do not perceive adequate value.

- Federal policies relating to higher education have dramatically increased uncertainty on multiple fronts.

- We have had two clients within the past seven days put their senior managerial-level job searches on hold, and they are pausing making offers until they have more clarity around tariffs and interest rates. It is a very difficult market to manage clients who need to hire, were committed to hiring and feel uncertain in the current political climate. [The clients] don't understand that the labor force is maximized and unemployment is still low, making it difficult to find strong talent when and if they decide to pull the trigger on a hire.

- We are government contractors. All the changes affecting the federal government and Department of Defense seriously affect our business. Our corporate, college and school accounts remained steady.

- We need clarity on what the tariff strategy is in the long or medium term. It is very difficult to forecast or project when changes happen every 24 hours.

- We are unable to find labor. It remains an issue.

- Historically high interest rates coupled with increased uncertainty regarding tariffs, growth and inflation are expected to negatively impact the business environment.

- The randomness of our current president is causing paralysis.

- The almost daily shifts on tariffs create havoc on the bond markets, which affects the ability of companies to borrow money for capital expenditures and the ability of company buyers to finance acquisitions.

- The tariff issue is starting to affect our operations, with our current vendors having trouble sourcing consumables from overseas suppliers. There were fewer requests for quotations in the last month, and a general unease has set in with our vendors and clients alike. As China begins to exert pressure on President Trump, the immediate consequence will be the cessation of access to the necessary supplies required for the operation of our service sector. I can appreciate the tack taken by the current administration. Adjustments were necessary, but I think it will cause the U.S. to suffer the most. Not a well-thought-out plan of action on our president’s part. Pulling the pin on the economy is not a fix; it is a child’s reaction.

- The high-interest-rate environment and uncertainty about tariffs’ impact create uncertainty in the real estate markets. It appeared that banks were starting to quote and lend again on real estate assets. The imposition of tariffs has created uncertainty in the border-area markets, and sponsors are waiting for more clarification and impact before moving forward with additional acquisitions and developments. This has adversely affected the need for real estate valuations provided by my business.

- Tariffs [are a concern].

- Even though there is uncertainty right now regarding changes that the president is making, our clients are feeling good that there is leadership in our government. The buyers are now comfortable with 6 percent mortgage rates. The feedback I get is that most buyers are cautious but hopeful that the changes being made will be best in the long run for our economy and the American people.

- Consumers are on the fence. This will turn eventually.

- We are realizing how many products were sourced from China, either directly or through third parties. We are in the middle of budget season and recognize it will change as we move forward. It’s difficult to know to what extent we should increase our expenses under this uncertainty.

- Uncertainty in the markets is a killer. Erratic behavior of leadership is even worse.

- Some inputs like fuel have decreased in price.

- We are highly concerned about a downturn in activity from a recession caused by the tariffs. We are even more concerned about recent comments about firing Chair Powell and the executive branch taking control of the Fed and monetary policy, which will result in rapid increases in inflation.

- The discourse around tariffs and impact on broader economic indicators is top of mind.

- The drought in South Texas is still our major concern. The second concern is the uncertainty of tariffs.

- [We are] devastated. We are a trucking company specializing in transporting international shipping containers, and there is no other word that captures what we are facing. The fragile balance that underpins the global equipment supply chain has collapsed. Ocean container bookings have plummeted by 64 percent, which means 64 percent of our business has vanished overnight. Without incoming containers, there is nothing to reload, nothing to export and no way to keep our trucks moving. This loss of freight in the market will bleed into every area of transportation. I have already had to make the heartbreaking decision to lay off one third of my staff. Any further cuts would cripple our ability to operate at even the most basic level. At this point, we are staring down the very real possibility of shutting down entirely. Ten years of fighting to keep a company alive and people employed through a global pandemic, the freight recession of 2023–24, and now this.

- We are experiencing a seasonal decline in cruises as winter season draws to a close. This is an expected cycle and will increase in late October when winter season begins and the cruise terminal complex under construction opens. Also, major capital improvements are underway on the cargo side. Due to this, we will have slight decrease in lay dockage business, which will increase as bulkhead and dock work is completed in early 2026. These are much-needed capital improvements.

- We are becoming increasingly pessimistic. Additional charges on Chinese-built ships could significantly impact the ability of our customers to find vessels to move American-made energy products overseas, decreasing the competitiveness of those products.

- In addition to increased risks for potential government and Department of Defense business, we also see growing uncertainty for general predictable trends and business growth in the mid- and longer term.

- Given the continuing uncertainty around tariffs, inflation, government spending and access to global markets, we are planning for an extreme downside scenario while evaluating opportunities to expand outside the U.S. to ensure we can help our customers access the most favorable markets. While the United States will always be the most valuable market, in a rising cost-of-sales environment domestically, it behooves us to look beyond U.S. borders for opportunities.

- What will interest rates do? What will inflation do?

- It is a complex time with very little understanding of the direction the economy is headed due to all the actions that could affect the economic environment. The money supply is still heavy in cash, and interest rates were stalled until the tariffs strategy was introduced. Banks that are in the trading business did well during the turbulent Wall Street swings. Community banks are working hard to maintain liquidity and fund acceptable loans. I can say the livestock market has been at record highs due to demand exceeding inventory. We just need more rain to raise the livestock we have on hand. The cotton crop generally was a bust in most parts of Texas. Most farm operators are collecting insurance checks, hoping to break even at best. Wheat production in Central Texas also was very spotty, with most producers just collecting insurance.

- The significant spike in the 10-year Treasury yield has caused a slowdown due to increased cost of debt capital for the commercial real estate market. We think that this is a temporary situation.

- Customers are beginning to experience cash flow problems. Delinquent payments have increased on consumer and small business accounts.

- We haven't directly seen the impact of tariffs on our revenue, but we are hearing the chatter from our clients. I feel like the fear of the unknown has potential to cause paralysis over the balance of the year. Fundamentals in our business and our clients feel fine right now, but we expect that hiring and capital deployment will slow to an as-needed pace until some clarity surfaces from D.C.

- Continued high interest rates combined with ongoing inflation presents continued challenges for real asset owners. The noise around tariffs has caused many investors to pause, and we believe the result will be a measurable decline in capital flows over the next quarter or two.

- Recent rain has helped. Employment is up, with retail sales flat and tourism slumping.

- The risk of the capital markets freezing up has subsided, but who knows what tomorrow brings?

- The president’s tariff tantrum has created heightened uncertainty throughout the economy and in our business.

- President Trump’s tariffs and energy prices have created uncertainty in our business-cost inputs and opportunities. We are treading cautiously in taking on additional costs and trying to expand our services.

- The uncertainty caused by the administration is brutal. Prior to the tariffs and general upheaval, our outlook was great. Now, we have numerous projects on hold and are delaying future investments.

- We are insurance brokers, and people still need to control risk. But the uncertainty of the economy and tariffs is concerning for general business activity.

- Uncertainty about everything is affecting our insurance companies and clients. No one knows how to accurately budget for the short term due to the political climate.

- We are experiencing an unexpected decline in business activity. I see customers becoming more price sensitive and cutting back on general expenditures.

- Our supply-chain decisions are in wait-and-see mode while we await tariff certainty. Green coffee, bags, cups and other consumables make up most of our material costs, and all are sourced internationally. Anticipating the tariffs, we were able to forward-lock green coffee for several months, so we have not been impacted. We are hoping that the issue is resolved before supply chain lead times begin to threaten availability. We have been forced to research domestic suppliers for bags and cups. Most suppliers are Chinese, and tariffs will directly impact those costs. However, of note, the 145 percent Chinese tariffs are tolled on their cost, not on sale price. Most, if not all, foil and plastic materials necessary for domestic production are also supplied by China, so there is no truly realistic tariff avoidance available. This is a complicated matter, and absent resolutions to the tariff agreements within the next 45 to 60 days, our input and sales prices will rise on the order of 10 percent or more, which is material.

- [Our concerns are] tariffs, tariffs, tariffs.

- The tariff situation is still very concerning and creates unknowns that we are unable to predict.

- I am concerned that the tariffs will indirectly affect my business.

- We export food to many countries in Latin America. We are also in discussions with new restaurant franchisees in Guatemala, Chile, Ecuador, Mexico and Costa Rica. Everyone is talking about the tariff environment and the potential impact. It is still too early to determine the impact, but it's going to color the conversations for the foreseeable future. In most cases, I don't think the 10 percent blanket will cripple agricultural trade on products imported from Latin America. I know Chile has a large poultry producer that sells in the U.S., and I don't think 10 percent will have a significant impact to deter trade. I'm assuming similar discussions are being had in Brazil. We don't trade with Brazil, but it has the largest protein producer in the world, with a significant presence in the U.S. I have not heard of any reciprocal tariffs from our current trading partners that are directly impacting the foodstuffs we export. If the Latin American tariffs are limited to the current list, everyone—both U.S. and Latin American trading partners—may absorb them as a cost of doing business (or pass along as the markets allow). If other countries decide they want to aggressively retaliate, things could get ugly for both sides.

- One of our contract manufacturers is in Canada. We didn't know whether we would be impacted by tariffs. Fortunately, we were spared, as our products are covered by USMCA [U.S.–Mexico–Canada Agreement]!

- Uncertainty is a major concern for us. How can you predict the balance of 2025 with the uncertainty that exists? You can't make long-term plans without direction and actions leading to stability in the marketplace. The impact of tariffs is unknown!

- Our major concern is the effect of tariffs.

- The retail automobile business is embroiled in uncertainty as we struggle to understand tariffs’ effects on vehicle pricing.

- We are devoting so much time to mitigating the chaos this administration is creating that we have little time left to run our business.

- Tariffs are making it difficult with all the quotes we have out to customers. Manufacturers apply them to us, but we are having a hard time going back to customers to add the tariffs, so we are eating them. Although, I am for [tariffs] for the long term.

- People are acting almost in a panic about the economy.

- We are beginning to get more price-increase notices from vendors. Product delays are increasing.

- I'm not too worried about the new tariffs. I think other countries will soon be negotiating with President Trump, and six months from now the national discussion will have moved on.

Historical Data

Historical data can be downloaded dating back to January 2007.

Indexes

Download indexes for all indicators. For the definitions of all variables, see data definitions.

Texas Service Sector Outlook Survey |

Texas Retail Outlook Survey |

| Unadjusted | Unadjusted |

| Seasonally adjusted | Seasonally adjusted |

All Data

Download indexes and components of the indexes (percentage of respondents reporting increase, decrease, or no change). For the definitions of all variables, see data definitions.

Texas Service Sector Outlook Survey |

Texas Retail Outlook Survey |

| Unadjusted | Unadjusted |

| Seasonally adjusted | Seasonally adjusted |

Questions regarding the Texas Service Sector Outlook Survey can be addressed to Mariam Yousuf at mariam.yousuf@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Texas Service Sector Outlook Survey is released on the web.