Texas Manufacturing Outlook Survey

Growth continues in Texas manufacturing sector, but outlooks worsen

For this month’s survey, Texas business executives were asked supplemental questions on the impact of tariffs. Results for these questions from the Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey have been released together. Read the special questions results.

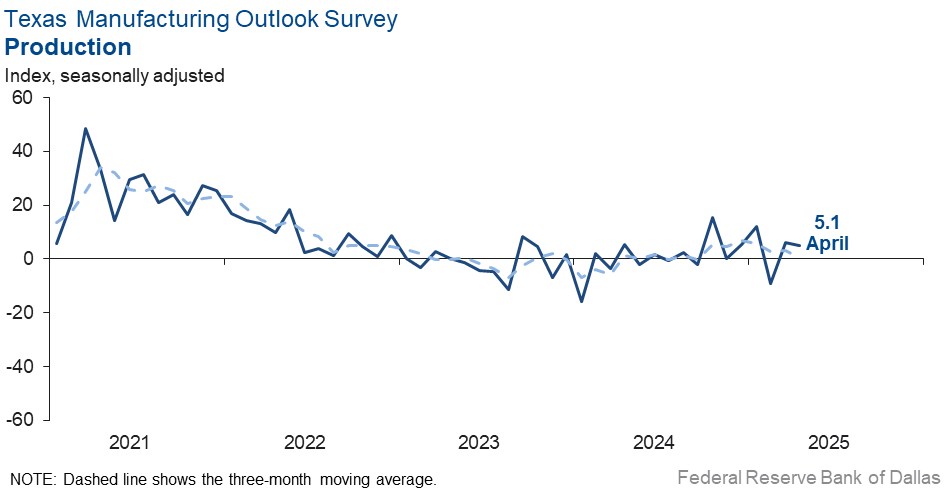

Texas factory activity continued to rise in April, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, was largely unchanged at 5.1, a reading indicative of modest growth.

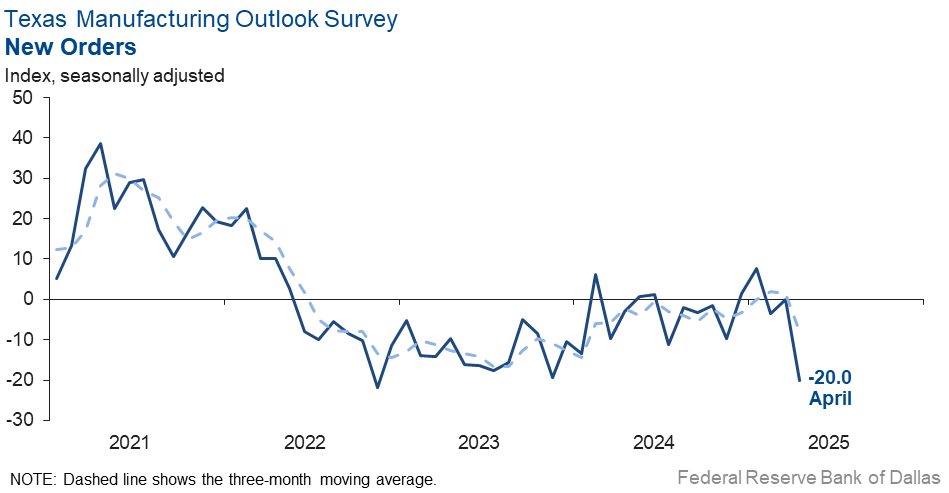

Other measures of manufacturing activity signaled contraction, however. The new orders index plummeted 20 points to -20.0. The capacity utilization index edged down to -3.8, and the shipments index fell into negative territory for the first time this year, slipping to -5.5 from 6.1.

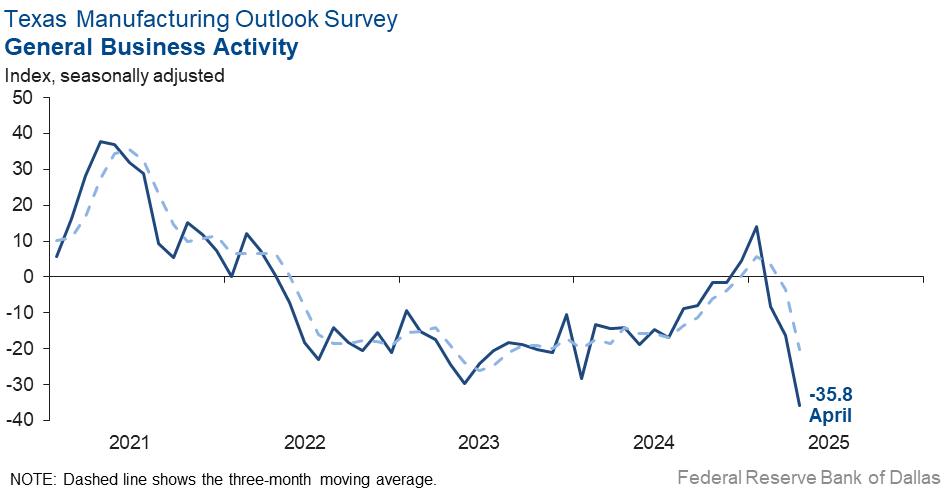

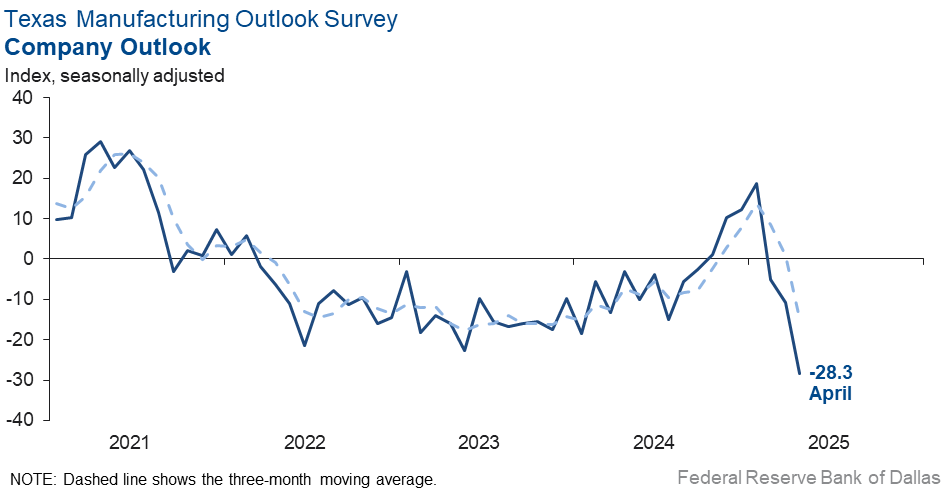

Perceptions of broader business conditions continued to worsen notably in April. The general business activity index fell 20 points to -35.8, its lowest reading since May 2020. The company outlook index also retreated to a postpandemic low of -28.3. The outlook uncertainty index pushed up 11 points to 47.1.

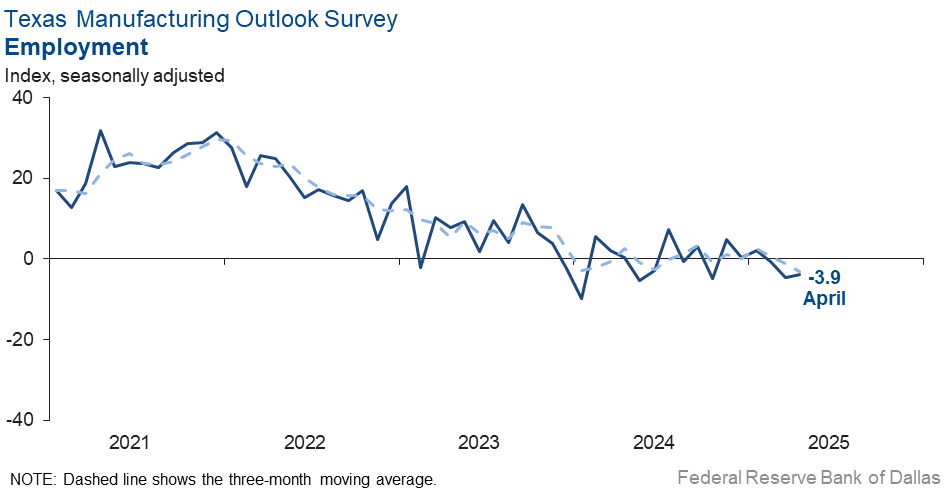

Labor market measures suggested a slight decrease in head counts and shorter workweeks this month. The employment index held fairly steady at -3.9, with 9 percent of firms noting net hiring and 13 percent noting net layoffs. The hours worked index slipped to -6.4 from -2.9.

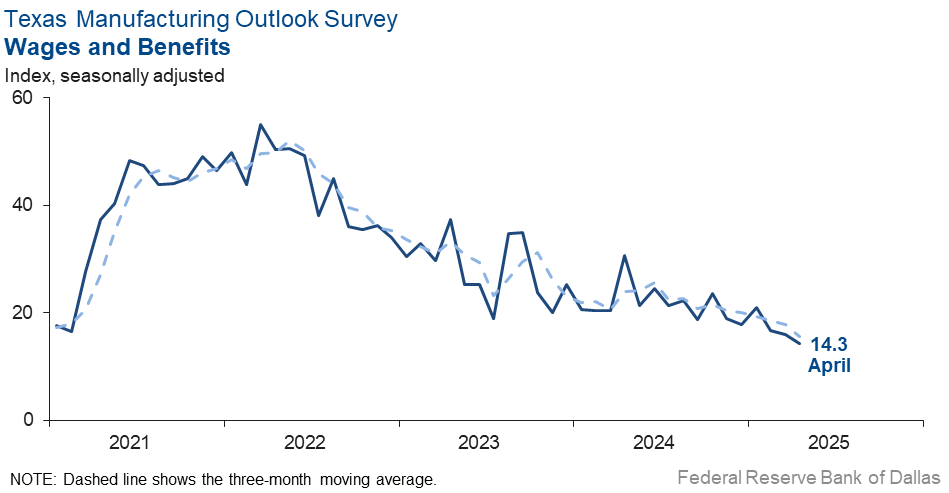

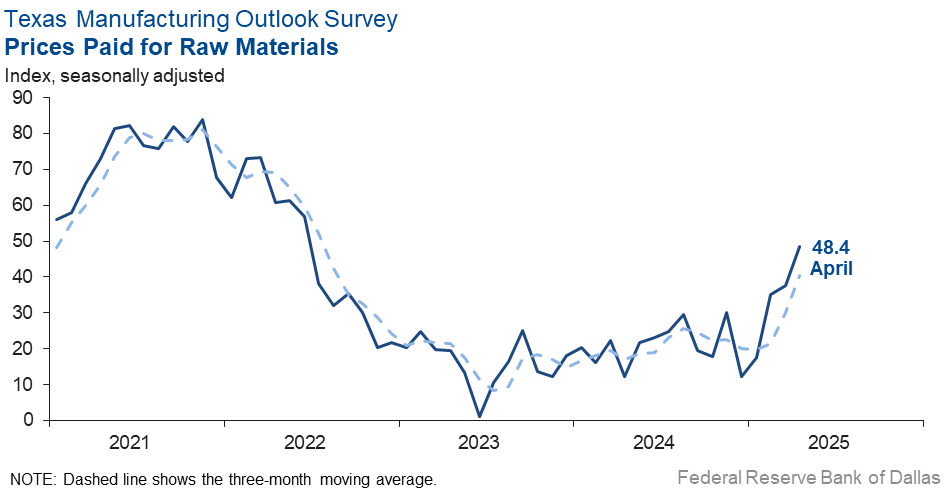

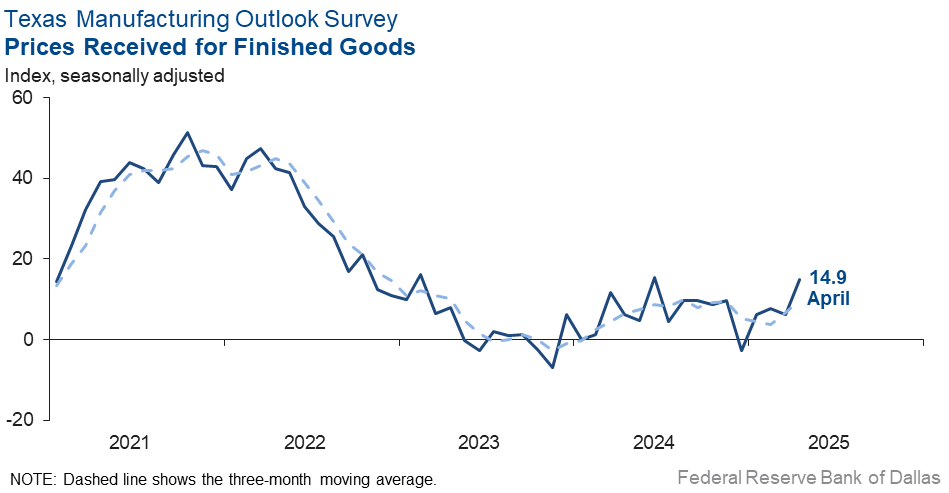

Price pressures accelerated in April, while wage growth remained fairly stable. The raw materials prices index jumped 11 points to 48.4, its highest reading since mid-2022. The finished goods prices index rose nine points to 14.9, a reading well above average. Meanwhile, the wages and benefits index held mostly steady at 14.3, below its average reading.

Expectations for manufacturing activity six months from now remained mixed. The future production index was positive but retreated 13 points to 14.8, while the future general business activity index pushed further negative to -15.2. Most other indexes of future manufacturing activity remained positive but slipped further below average.

Next release: Tuesday, May 27

Data were collected April 15–23, and 87 of the 117 Texas manufacturers surveyed submitted a response. The Dallas Fed conducts the Texas Manufacturing Outlook Survey monthly to obtain a timely assessment of the state’s factory activity. Firms are asked whether output, employment, orders, prices and other indicators increased, decreased or remained unchanged over the previous month.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior month. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior month. An index will be zero when the number of firms reporting an increase is equal to the number of firms reporting a decrease. Data have been seasonally adjusted as necessary.

Results summary

Historical data are available from June 2004 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Current (versus previous month) | ||||||||

| Indicator | Apr Index | Mar Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Production | 5.1 | 6.0 | –0.9 | 9.6 | 2(+) | 26.3 | 52.5 | 21.2 |

Capacity Utilization | –3.8 | –2.3 | –1.5 | 7.5 | 3(–) | 18.0 | 60.2 | 21.8 |

New Orders | –20.0 | –0.1 | –19.9 | 4.8 | 3(–) | 14.0 | 52.0 | 34.0 |

Growth Rate of Orders | –22.0 | –8.1 | –13.9 | –0.9 | 3(–) | 9.4 | 59.2 | 31.4 |

Unfilled Orders | –13.4 | –8.3 | –5.1 | –2.5 | 8(–) | 7.3 | 72.0 | 20.7 |

Shipments | –5.5 | 6.1 | –11.6 | 7.9 | 1(–) | 20.6 | 53.3 | 26.1 |

Delivery Time | –9.3 | 3.4 | –12.7 | 0.7 | 1(–) | 8.4 | 73.9 | 17.7 |

Finished Goods Inventories | 4.6 | 7.2 | –2.6 | –3.1 | 2(+) | 18.6 | 67.4 | 14.0 |

Prices Paid for Raw Materials | 48.4 | 37.7 | +10.7 | 27.2 | 60(+) | 54.6 | 39.2 | 6.2 |

Prices Received for Finished Goods | 14.9 | 6.3 | +8.6 | 8.6 | 4(+) | 22.2 | 70.5 | 7.3 |

Wages and Benefits | 14.3 | 16.0 | –1.7 | 21.1 | 60(+) | 18.6 | 77.1 | 4.3 |

Employment | –3.9 | –4.6 | +0.7 | 7.3 | 3(–) | 9.1 | 77.9 | 13.0 |

Hours Worked | –6.4 | –2.9 | –3.5 | 3.0 | 3(–) | 7.8 | 78.0 | 14.2 |

Capital Expenditures | –0.4 | –0.6 | +0.2 | 6.6 | 2(–) | 16.8 | 66.0 | 17.2 |

| General Business Conditions Current (versus previous month) | ||||||||

| Indicator | Apr Index | Mar Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –28.3 | –10.7 | –17.6 | 4.4 | 3(–) | 6.9 | 57.9 | 35.2 |

General Business Activity | –35.8 | –16.3 | –19.5 | 0.5 | 3(–) | 5.4 | 53.4 | 41.2 |

| Indicator | Apr Index | Mar Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty | 47.1 | 36.2 | +10.9 | 17.3 | 48(+) | 56.3 | 34.5 | 9.2 |

| Business Indicators Relating to Facilities and Products in Texas Future (six months ahead) | ||||||||

| Indicator | Apr Index | Mar Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Production | 14.8 | 27.6 | –12.8 | 36.2 | 60(+) | 37.7 | 39.3 | 22.9 |

Capacity Utilization | 11.5 | 16.3 | –4.8 | 33.1 | 60(+) | 32.7 | 46.1 | 21.2 |

New Orders | 10.1 | 28.6 | –18.5 | 33.7 | 30(+) | 31.1 | 48.0 | 21.0 |

Growth Rate of Orders | 9.5 | 18.1 | –8.6 | 24.9 | 23(+) | 30.3 | 48.9 | 20.8 |

Unfilled Orders | –6.1 | –1.9 | –4.2 | 2.8 | 3(–) | 7.9 | 78.1 | 14.0 |

Shipments | 13.2 | 21.7 | –8.5 | 34.6 | 60(+) | 31.5 | 50.2 | 18.3 |

Delivery Time | –7.3 | –7.9 | +0.6 | –1.4 | 2(–) | 5.5 | 81.7 | 12.8 |

Finished Goods Inventories | –16.5 | –1.3 | –15.2 | –0.2 | 2(–) | 7.6 | 68.4 | 24.1 |

Prices Paid for Raw Materials | 47.6 | 53.2 | –5.6 | 33.5 | 61(+) | 58.1 | 31.4 | 10.5 |

Prices Received for Finished Goods | 29.6 | 27.6 | +2.0 | 21.0 | 60(+) | 39.5 | 50.6 | 9.9 |

Wages and Benefits | 22.5 | 27.2 | –4.7 | 39.2 | 60(+) | 24.8 | 73.0 | 2.3 |

Employment | 13.1 | 17.6 | –4.5 | 22.8 | 59(+) | 27.2 | 58.7 | 14.1 |

Hours Worked | 0.2 | 1.2 | –1.0 | 8.8 | 13(+) | 12.2 | 75.8 | 12.0 |

Capital Expenditures | 7.6 | 10.1 | –2.5 | 19.4 | 59(+) | 26.5 | 54.6 | 18.9 |

| General Business Conditions Future (six months ahead) | ||||||||

| Indicator | Apr Index | Mar Index | Change | Series Average | Trend** | % Reporting Increase | % Reporting No Change | % Reporting Worsened |

Company Outlook | –6.0 | 4.2 | –10.2 | 18.3 | 1(–) | 25.8 | 42.4 | 31.8 |

General Business Activity | –15.2 | –6.6 | –8.6 | 12.3 | 2(–) | 23.3 | 38.2 | 38.5 |

*Shown is the number of consecutive months of expansion or contraction in the underlying indicator. Expansion is indicated by a positive index reading and denoted by a (+) in the table. Contraction is indicated by a negative index reading and denoted by a (–) in the table.

**Shown is the number of consecutive months of improvement or worsening in the underlying indicator. Improvement is indicated by a positive index reading and denoted by a (+) in the table. Worsening is indicated by a negative index reading and denoted by a (–) in the table.

Data have been seasonally adjusted as necessary.

Comments from survey respondents

Survey participants are given the opportunity to submit comments on current issues that may be affecting their businesses. Some comments have been edited for grammar and clarity.

- It is a very dynamic time. I agree with the approach and need to bring manufacturing back to the U.S. so that we have the internal capability for national security interests. The ability to forecast and to understand consumer confidence drivers to the basic materials, construction, automotive markets, etc., are the most difficult we have seen since the COVID era.

- Tariff uncertainty and actual impact is likely to be significant for the business and ongoing projects.

- This has been a crazy few weeks in the news. We export about 20 percent of our production. Our largest customers are in the United Kingdom and France, but we also export to China and many other countries. We import a few raw materials, but this isn't directly significant. The current tariff negotiations are having an effect in several ways. We accelerated one order to China to beat the reciprocal tariffs, and we expect our China sales to go to zero until the tariff situation changes. We are seeing some European customers stock up on inventory in anticipation of future tariffs. Most of our U.S. customers continue to buy, but we have seen a 25 percent drop in incoming RFQs [requests for quotations] in April compared with the average of previous months. Assuming this continues, we expect to see roughly a 10–15 percent decline in sales in May. We believe that this is largely due to uncertainty in our customer base driven by the tariff situation and potential knock-on effects to the general economy.

- There is really no way to predict anything accurately six months out or even six weeks out now for our industry due to the tariff and trade uncertainty. Carve-outs for large electronics businesses (cellphones and laptops) leaves small business burdened to deal with tariffs on our own, which are likely to cause delays, cancellations and early product obsolescence on existing products and orders. We have already had to turn around and refuse shipments because customers cannot afford the tariffs, delaying our ability to build, which will eventually lead to job losses. If this continues for any length of time, many small companies are likely to be significantly hurt or even gone. If we want to bring manufacturing back to the U.S., can we try not to kill the companies that can actually help do that before we get the chance? Maybe we can think about using a scalpel rather than a sledgehammer? The risk we face now is far greater and less understood than what we saw during the COVID shutdown. Consumers and businesses will limit investment and orders until there is some sense of stability, and we have already experienced this with smaller orders and delayed orders. It's chaos right now.

- Please lower interest rates. We need it in order to boost the economy due to the uncertainty and tariffs.

- President Trump, tariffs and maximum business uncertainty [are issues affecting our business]. [We see a] probable recession soon.

- There is no stability in business, so it is difficult to plan. Thus, we are not making commitments for future growth, not knowing if or when future growth will exist.

- Our backlog is not building. Bid activity is moderate, but projects are not being released/started.

- There was a temporary supply hiccup in April on a key component; we expect it to resolve in the next month or two.

- The current economic environment is confusing. President Trump keeps things in turmoil, and we do not know what he will do next. So far, import prices for raw materials have not increased. Food service and retail sales have maintained their growth projections.

- Chaos at the federal level, tariffs and resulting raw ingredient costs, decimation of partner relationships due to canceled contracts "for convenience" along with stagflation concerns [are issues affecting our business]. DOGE [Department of Government Efficiency] is needed. The DOGE without a follow-up plan does nothing for the domestic tranquility needed (stable arena for business to function within).

- Tariffs and tariff uncertainty are wreaking havoc on our supply lines and capital spending plans.

- It is unknown what effect the tariffs are going to have on the general economy. Luckily, we do not import or export many items (except for spices), so we are not directly impacted by the contemplated tariffs.

- We are still worried about labor price increases due to the trade war and immigration.

- Nothing is easy. Forecasting is extremely challenging in this time of uncertainty. Committing to growth initiatives is anxiety-riddled. Helping our employees keep beans on their table and a roof over their heads is harder. We believe the direction the current administration is leading our country is on target, but the pain to get there may be longer and more intense than originally anticipated.

- We are experiencing a strong month and, hopefully, this trend will continue.

- Due to tariffs, we do not know what to expect.

- There is too much uncertainty all over for any increases [in business] soon.

- Tariffs and the general market have made decisions challenging. Items we are only able to source internationally are making our daily business decisions difficult. Raw materials have increased, and there is not an easy way to pass those increases to our customers.

- Tariffs are causing uncertainty and a reduction in demand for our products. We buy all raw materials domestically but are still experiencing adverse business climate due to reduction in demand.

- Tariffs may drive us out of business.

- Tariffs [are an issue affecting our business].

- Tariffs. Tariffs. Tariffs. There was a better way to do this.

- We have seen continued slow order entry now for four months.

- Tariffs are impacting factory input costs significantly.

- Capital expenditures are focused on adding new product offerings.

- The aluminum industry is currently in a holding pattern, awaiting final decisions on tariffs. If the Section 232 tariffs on Mexico and Canada remain in place, it would help level the playing field and remove their pricing advantage when selling into the U.S. However, if Mexico and Canada continue to receive exemptions—as they have since the initial implementation of Section 232 during the first Trump administration—it will likely lead to further job losses in our segment of the aluminum industry. Our company, for example, has put a multimillion-dollar project on hold until we receive clear direction on this issue. China is now building aluminum plants in Mexico to avoid tariffs if they ship from China. Our company is a proponent of tariffs to combat dumping and subsidies other countries are doing for shipments into the U.S.

- The tariff issue is a mess, and we are now starting to see vendors passing along increases, which we will have to in turn pass along to our customers. Because of this, we are very concerned about general business activity for the next six to nine months or until these trade agreements get worked out.

- The administration’s tariff policy is insanity. It is creating havoc in the manufacturing business.

- Sales are down, and uncertainty is very high. We import raw materials and finished goods and are very nervous about tariff impacts (especially China). We will likely need to increase prices, which will likely hurt demand/sales. We are expecting to get hit on both the supply and demand side. There is a lot of uncertainty.

- We are unsure of the tariff impact.

- There is too much uncertainty, including a possible recession. Interest rates are too high. The Federal Reserve always seems to be late for their own party.

Historical Data

Historical data can be downloaded dating back to June 2004.

Indexes

Download indexes for all indicators. For the definitions of all variables, see Data Definitions.

| Unadjusted |

| Seasonally adjusted |

All Data

Download indexes and components of the indexes (percentage of respondents reporting increase, decrease, or no change). For the definitions of all variables, see Data Definitions.

| Unadjusted |

| Seasonally adjusted |

Questions regarding the Texas Business Outlook Surveys can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Texas Manufacturing Outlook Survey is released on the web.