Oil and gas industry shows discipline on capex, but risks remain

Capital expenditure (capex) is a key measure of financial health in the oil and gas industry due to its long investment horizons and boom-bust cycles. According to the fourth quarter 2024 Dallas Fed Energy Survey, companies in the upstream oil and gas industry expect to have slightly increased capex in 2025. Consistent with the survey, energy executives at a recent Dallas Fed Energy Advisory Council meeting indicated oil and gas companies will likely maintain a conservative stance toward production growth, with continued focus on capital discipline and maintenance capex.

This points to a healthy oil and gas industry. Companies are generating sufficient cash flows to support capex for production to meet global demand. For many participants in this highly cyclical industry, the lessons of the most recent downturn less than a decade ago are still fresh: Financial health is more important than excessive growth through overinvestment.

Still, the industry remains subject to uncertainty in global demand and supply, financing accessibility and anticipated sequential decline in demand that can challenge that capex discipline. At a time of geopolitical change, increasing natural disasters and the transition away from fossil fuels, there’s reason for caution. It’s important for bankers and banking supervisors to monitor industry developments to understand oil and gas financial exposure.

Capex remains essential in the energy sector

Capex in the upstream oil and gas sector refers to financial investments toward maintaining and growing production, acquiring properties and equipment, and exploring for new energy reserves. This includes activities such as drilling and completing wells, developing infrastructure such as oilfield roads and electric distribution, conducting geological surveys and drilling exploratory wells in new areas.

The outlook for capex is especially important, as capex directly affects the future supply of oil and gas, thus influencing both current and future energy prices. Given the vital role energy plays in the global economy, information about the energy sector can have significant implications for global economic measures such as GDP, employment and inflation.

Capex is also important from a banking supervision perspective. Oil and gas companies make large up-front investments that can take many years to earn back. Therefore, the companies often rely on external financing, raising equity and debt from both public and private investors.

Bank loans have been a critical debt funding source for the oil and gas industry, particularly for smaller producers who lack access to public capital markets. These producers tend to have small operations, weak cash flows from operations and high leverage. Furthermore, their operations are not large enough to vertically integrate, which makes them vulnerable to unfavorable price movements.

A cyclical industry faces a volatile environment

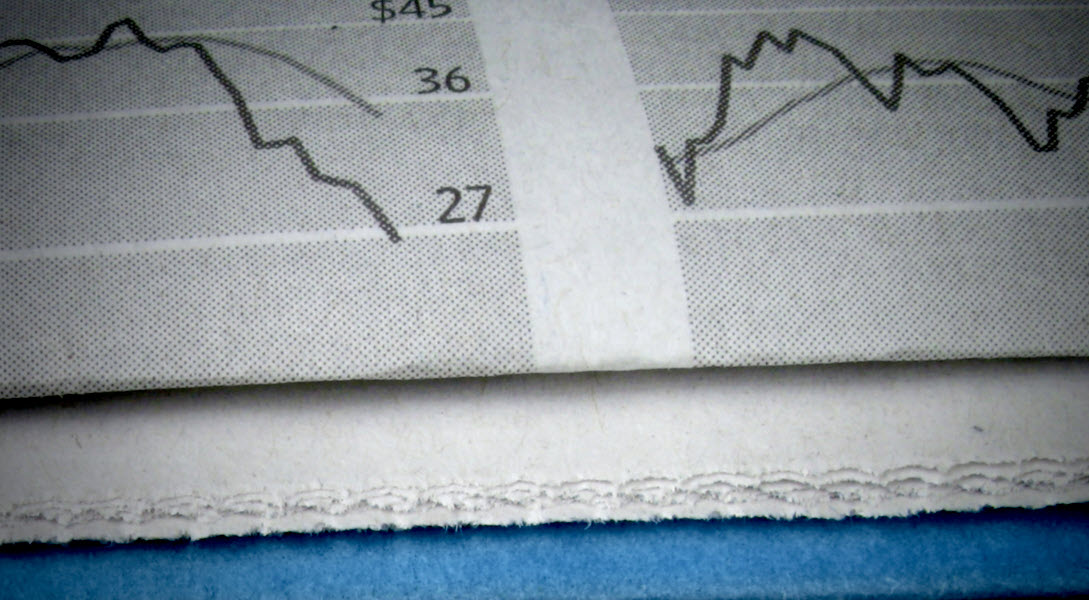

The oil and gas industry is highly cyclical. Fluctuations in oil and gas prices trigger significant boom and bust cycles, heavily influenced by global demand and geopolitical factors. When average oil prices fell from $93 per barrel in 2014 to $43 per barrel in 2016, bankruptcies in the industry surged, and that strained the credit quality and performance of loan portfolios for banks with high exposure to oil and gas. Chart 1 shows the cyclical nature of the oil and gas industry.

Subsequent periods of low oil and gas prices have significantly impacted the upstream oil and gas industry (Chart 2). Although the industry restructured through liquidation and consolidation, most surviving operators were still carrying weak liquidity and high leverage, a result of a prolonged period of poor profitability until recently.

In the late 2010s, the upstream sector shifted focus from expanding production to maximizing free cash flow generation, leading to more-controlled capex spending. While global upstream oil and gas capex increased in 2022 following the recovery of global demand and the Russia–Ukraine conflict, it only reached $514 billion—approximately $70 billion less than the peak levels in 2011—at the onset of the U.S. shale boom, according to estimates from the International Energy Forum. This is due in part to cost deflation and significantly improved oilfield efficiency, with positive operating cash flows during the recent recovery. The result, as seen in Charts 3 and 4, was an improvement in oil and gas balance sheets.

Two key trends bankers should track

Despite the industry’s stronger balance sheets and disciplined capital budgets, there are two key reasons for caution about developments in the global oil and gas markets: Oil and gas prices and financing. Monitoring trends on these topics can help bankers and banking supervisors track key developments in the industry.

The oil and gas markets are highly volatile, with prices subject to fluctuations driven by geopolitical events, supply-demand imbalances, natural disasters and policy changes. Sudden price drops or spikes can significantly affect the financial stability of companies and the broader economy, potentially leading to loan defaults or increased credit risk for banks with exposure to the industry. In the past, downturns in oil and gas markets led to surges in bankruptcies, loan defaults and impaired asset quality for banks.

Since late 2022, OPEC+, the Organization of the Petroleum Exporting Countries plus non-OPEC participants, has followed a policy of reducing oil production to support oil prices. The current voluntary cuts of 2.2 million barrels per day are set to be phased out gradually by December 2026, but the policy could instead be extended or increased if participants agree. Oil market uncertainty is partly rooted in the dilemma OPEC faces. Increasing production is risky if global demand weakens, but cutting production makes it difficult for OPEC countries to meet budgetary needs.

At the same time, the oil and gas industry is capital-intensive, and capital projects can take years or even decades to become profitable. Access to financing is crucial for sustaining operations and growth. Shifts in investment trends, such as changes in financing sources or magnitudes, can affect the long-term viability of companies and influence credit conditions. Notably, we have observed a resurgence of private equity financing and the reduction in capex following the COVID-19 pandemic. Given a sizable reduction in the number of drilled but uncompleted wells, the industry will likely need to spend more on exploration and production activities, which entails searching for new fields and completing well developments. This may necessitate increased reliance on external financing sources.While the oil and gas industry has recovered financially since the pandemic and embraced capex discipline, developments in these areas warrant continued vigilance.

About the author