Mexico’s economic growth surprises to the upside

| November 2024 economic report | |||

| GDP, real Q3 '24 |

Employment, formal November '24 |

CPI November '24 |

Peso/dollar November '24 |

| 4.4% q/q* | -32,300 jobs m/m | 4.6% y/y | 20.3 |

| *Latest data available. | |||

The Mexican economy expanded an annualized 4.4 percent in the third quarter, according to official preliminary data. Output in both the services and goods-producing sectors increased, and heavy rainfall during the quarter helped the agricultural sector recover. The weakening labor market and stalled consumption growth are signs of a potential deceleration going into the fourth quarter. Nevertheless, the consensus forecast for 2024 GDP growth (fourth quarter/fourth quarter) compiled by Banco de México increased to 1.2 percent in November (Table 1).

| Table 1 Consensus forecasts for 2024 Mexico growth, inflation and exchange rate |

|||

| October | November | ||

| Real GDP growth in Q4, year over year | 1.0 | 1.2 | |

| Real GDP growth in 2024 | 1.4 | 1.5 | |

| CPI December 2024, year over year | 4.4 | 4.4 | |

| Peso/dollar exchange rate at end of year | 19.80 | 20.29 | |

| NOTE: CPI refers to the consumer price index. The survey period was Nov. 22–28.

SOURCE: Encuesta sobre las Expectativas de los Especialistas en Economía del Sector Privado: Noviembre de 2024 (communiqué on economic expectations, Banco de México, November 2024). |

|||

Output growth picks up in the third quarter

Mexico’s third quarter GDP expanded an annualized 4.4 percent after increasing 1.5 percent in the second quarter (Chart 1). On a nonannualized basis, the goods-producing sectors (manufacturing, construction, utilities and mining) grew 0.9 percent. Activity in the services-providing sectors (wholesale and retail trade, transportation and business services) also expanded 0.9 percent, a pickup from the previous quarter’s 0.3 percent growth. Agricultural output rose 4.6 percent, a sharp reversal following three consecutive quarters of declines.

Industrial production ticks down in October

The three-month moving average of Mexico’s industrial production (IP) index, which includes manufacturing, construction, oil and gas extraction, and utilities, declined 0.4 percent in October. The smoothed manufacturing IP index also ticked down 0.2 percent (Chart 2). North of the border, the smoothed U.S. IP index declined 0.1 percent in October after falling 0.3 percent in September.

Exports dip in October

The three-month moving average of total Mexican exports declined 0.3 percent in October. Exports from the manufacturing sector, which accounts for the largest share of total exports, fell 0.4 percent. Meanwhile, oil exports dropped 1.0 percent (Chart 3). Year to date, total exports were nearly on par with the same period in 2023, with manufacturing exports up 0.9 percent and oil exports down 17.5 percent.

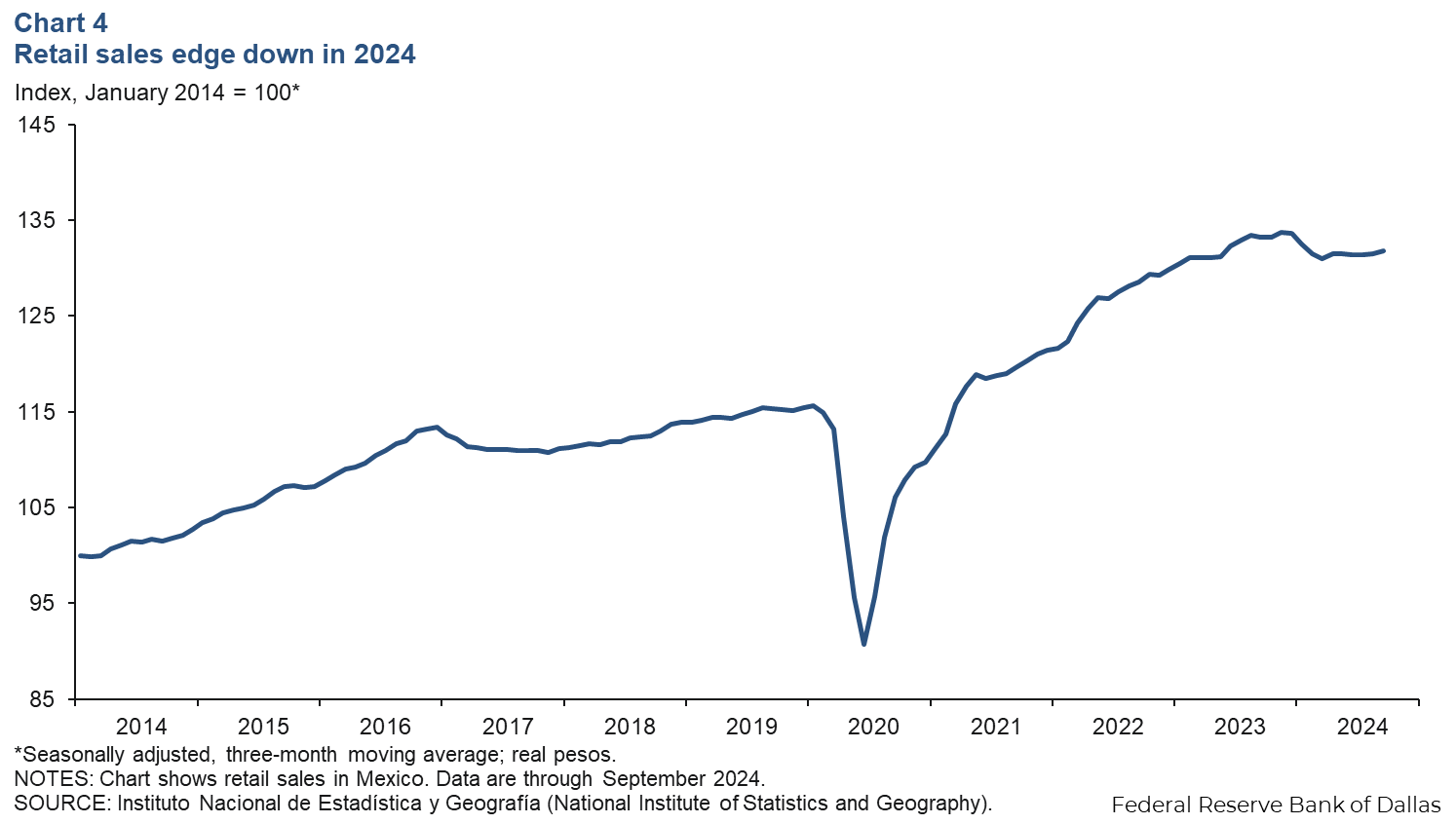

Retail sales move sideways

The three-month moving average of real retail sales increased 0.3 percent in September (Chart 4). Year over year, the smoothed retail sales index was down 1.1 percent, suggesting some weakness in consumer spending.

Payroll employment contracts further

Formal sector employment, meaning jobs with government benefits and pensions, declined for the fourth straight month in November, falling an annualized 1.7 percent (-32,300 jobs) (Chart 5). Total employment, representing 59.5 million workers (including informal sector jobs) was up 0.6 percent year over year in the third quarter. The unemployment rate ticked down for the second consecutive month to 2.5 percent in October.

Peso continues to weaken against the dollar

The Mexican currency averaged 20.3 pesos per dollar in November, down from October’s value of 19.7 pesos per dollar, a depreciation of 3.1 percent (Chart 6).

Remittances increase slightly

The three-month moving average of real remittances to Mexico rose 0.2 percent in October after decreasing 3.4 percent in September (Chart 7). Total remittances through October are up 2.3 percent compared with the same period a year ago. The exchange rate plays a role in the volume of remittances because it determines the cost to the sender and the amount the recipient receives. For example, if the peso depreciates against the dollar, the recipient will receive more pesos for a given number of dollars.

Inflation continues to trend downward

Mexico’s consumer price index (CPI) increased 4.6 percent in November over the prior 12 months, below October’s 4.8 percent rise (Chart 8). Core CPI inflation, which excludes the more volatile food and energy components, slowed to 3.6 percent. Services inflation remained elevated but ticked down to 4.9 percent after registering a 5 percent increase in October. In December, Mexico’s central bank lowered its benchmark rate by 25 basis points to 10.0 percent. This is the fifth rate cut this easing cycle, following a 25-basis-point reduction at the bank’s November meeting. In its statement, the central bank noted the inflation outlook has improved as core inflation continues decreasing. It also added that the possibility of new tariffs on imports to the U.S. from Mexico has increased uncertainty to the bank’s inflation forecast and, hence, the balance of risks for inflation were to the upside.