Mexico’s economy continues to decelerate amid worsening economic outlook

| March 2025 economic report | |||

| GDP, real Q4 '24 |

Employment, formal March '25 |

CPI March'25 |

Peso/dollar March '25 |

| -2.4% q/q | 16,850 jobs m/m | 3.9% y/y | 20.20 |

The consensus forecast for 2025 real GDP growth (fourth quarter, year over year) compiled by Banco de México fell to 0.5 percent in March (Table 1). The latest data available indicated a slowing economy. Meanwhile, the activity index was flat, while industrial production and retail sales grew slightly. Employment grew moderately, though it remained below average. The peso strengthened, while exports and remittances declined. Moreover, inflation ticked up in March.

| Table 1 Consensus forecasts for 2025 Mexico growth, inflation and exchange rate |

|||

| February | March | ||

| Real GDP growth in Q4, year over year | 1.1 | 1.0 | |

| Real GDP growth in 2025 | 0.8 | 0.5 | |

| CPI December 2025, year over year | 3.7 | 3.7 | |

| Peso/dollar exchange rate at end of year | 20.85 | 20.80 | |

| NOTE: CPI refers to the consumer price index. The survey period was March 18–27.

SOURCE: Encuesta sobre las Expectativas de los Especialistas en Economía del Sector Privado: Marzo de 2025 (communiqué on economic expectations, Banco de México, March 2025). |

|||

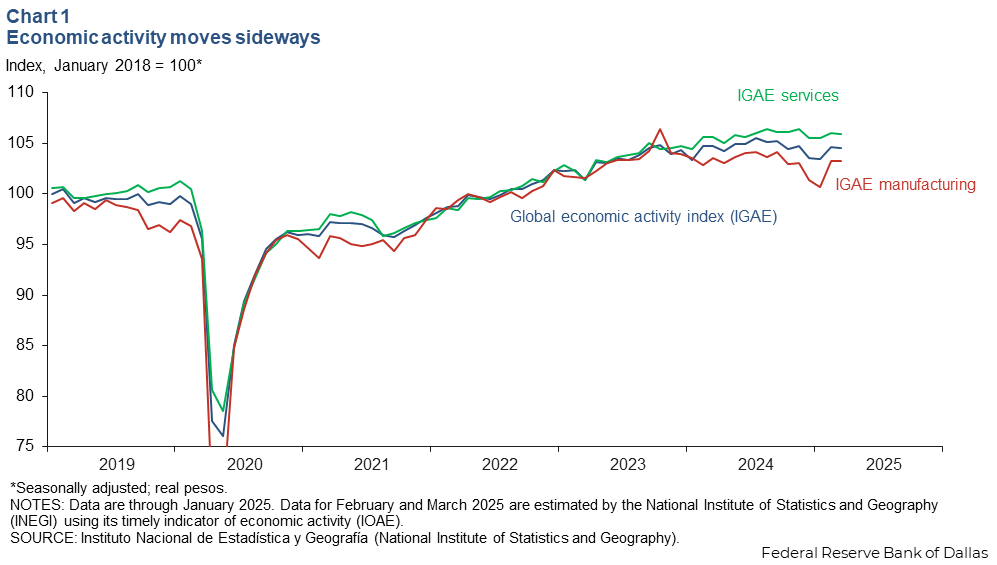

Output flat at end of first quarter

The global economic activity index (IGAE)—the monthly proxy for GDP growth—did not change month over month in March after rising 1.1 percent in February (Chart 1). The goods-producing sector (including manufacturing, construction and utilities) was also flat, while the service-related activities (including trade and transportation) ticked down 0.1 percent. The IGAE was down, however, 0.2 percent year over year.

Industrial production increases slightly

The three-month moving average of Mexico’s industrial production (IP) index, which includes manufacturing, construction, oil and gas extraction, and utilities, ticked up 0.1 percent in February after contracting 0.7 percent in January. The smoothed manufacturing IP index increased 0.2 percent from a 0.5 percent downtick the previous month (Chart 2). North of the border, the smoothed U.S. IP index grew 0.7 percent in February after increasing 0.4 percent in January.

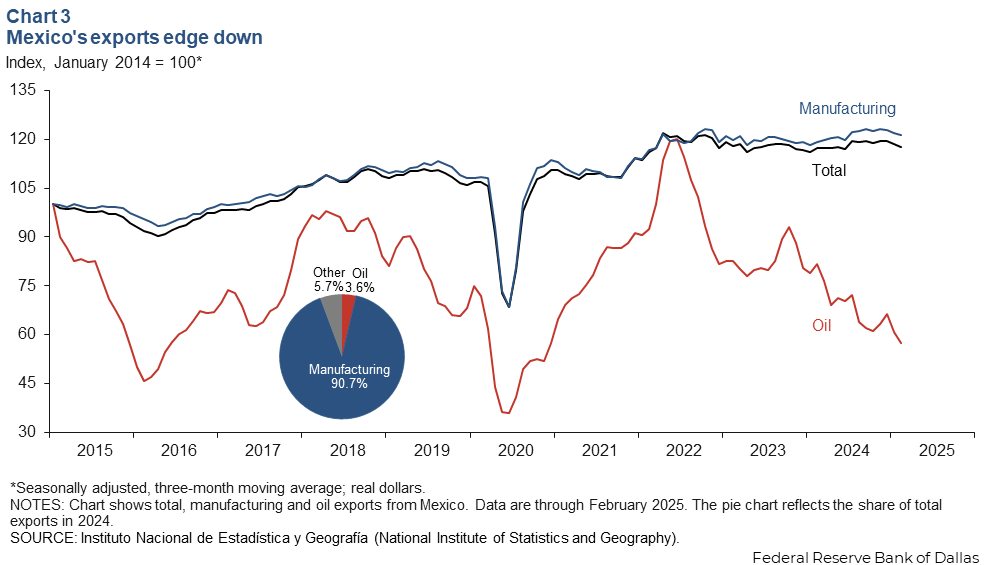

Exports tick down

Mexico’s three-month moving average of total exports fell 0.8 percent in February (Chart 3). The manufacturing sector, which accounts for a large share of exports, declined 0.6 percent, and oil exports fell 5.7 percent. On a year-over-year basis, the smoothed total exports index increased 0.2 percent, oil exports fell 29.7 percent, and manufacturing exports increased 1.6 percent.

Retail sales increase slightly in January

The three-month moving average of real retail sales edged up 0.4 percent in January, the latest data available (Chart 4). However, the smoothed retail sales index did not change year over year.

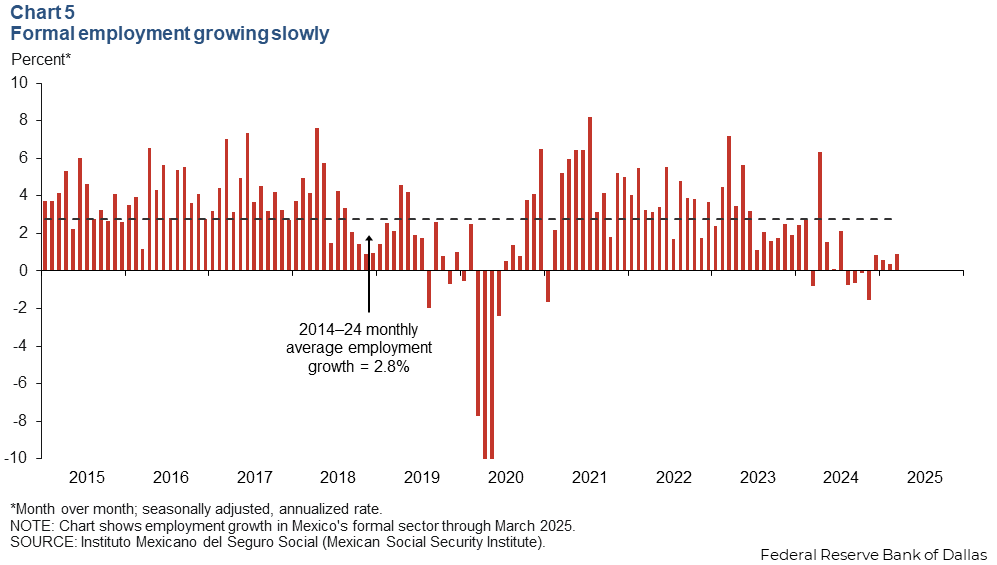

Job growth remains weak

Formal sector employment—jobs with government benefits and pensions—grew an annualized 0.9 percent (17,000 jobs) in March (Chart 5). Compared with March 2024, employment grew only 0.8 percent. The unemployment rate, which tracks only the formal sector, was 2.6 percent in February—the same as the previous three months.

Peso strengthens slightly against the dollar

The Mexican currency averaged 20.2 pesos per dollar in March, stronger than the previous month’s reading of 20.5 pesos per dollar (Chart 6). The peso gained ground against the dollar after consistently declining over the past 12 months. Some market participants have attributed the recent weakness of the dollar against the Mexican peso and other currencies to the uncertainty surrounding U.S. tariff policy.

Remittances continue downward trend

The three-month moving average of real remittances to Mexico decreased 2.6 percent in February after increasing 0.2 percent in January (Chart 7). The exchange rate plays a role in the volume of remittances because it determines the cost to the sender and the amount the recipient receives. For example, if the peso depreciates against the dollar, the recipient will receive more pesos for a given number of dollars. Even though the Mexican peso has generally depreciated against the dollar since 2024—causing recipients to receive more pesos for a given number of dollars—the slowing of the U.S. economy and recent immigration policies could be impacting remittance flows into Mexico.

Inflation ticks up in March

Mexico’s consumer price index (CPI) increased to 3.9 percent in March over the prior 12 months from 3.8 percent in February (Chart 8). Core CPI inflation, which excludes food and energy, increased slightly to 3.7 percent. Services inflation remained elevated but edged down to 4.4 percent, marking a change in the inflation composition as services inflation slowed while goods inflation accelerated. In March, Mexico’s central bank lowered its benchmark rate by 50 basis points to 9.0 percent, in line with market expectations. In its statement, the central bank noted weakening economic activity in an environment of uncertainty and trade tensions, which poses significant downward risks. The central bank expects inflation to persist and foresees reaching its 3.0 percent target in 2027.

About the authors