Panel 2: Services and Trade

Expansion of Digital Service Economy Offers North American Opportunities

If we think about this agenda more broadly, within the Americas, just improving internet access remains key. When we think about digital in the trade space, we tend to gravitate to our experience with Amazon or Google or Facebook. In fact, the commercial and economic opportunities are very much on the business-to-business end. It’s not only about these large internet companies, but it’s really about how the broad economy utilizes these digital technologies more effectively to improve productivity.

This is very much about manufacturing, it’s very much about services, it’s very much about agriculture, chemicals, energy, you name it. Different industries are adopting these technologies at different rates and becoming digitally intensive in different ways. From a policy perspective, that’s really the opportunity and the challenge. It’s not about how we use Facebook or whether or not Amazon delivers our puzzles quickly enough.

One of my points is about the enormity of the potential. A McKinsey study a few years ago estimated that the value of global data flows in 2014 was more than the value of trade in goods. Global data flows raised world GDP (gross domestic product) by 3.5 percent, or $2.8 trillion in 2014, and the contribution will rise to $11 trillion by 2025 (McKinsey, 2016). That’s a trend, which certainly seems to be going upward and helps explain a bit of why we’re seeing stagnation on the goods side. It is because we’re seeing a lot of transformation and transition to value being traded across borders using data flows rather than traditional trade in goods.

E-commerce sales were over $27 trillion in 2017 (United Nations Conference on Trade and Development, 2019); that is, $27 trillion was essentially transacted over the internet worldwide. About 88 percent of that was business to business. This is also a global phenomenon. What I think is important when one thinks about Mexico—but also more broadly—is the opportunity for developing countries to participate in international trade in ways that were previously a lot of more challenging.

In terms of the digital opportunities for the U.S., I think the International Trade Commission (ITC) has done the best work on trying to calculate the benefits of the use of the internet and data. According to the ITC, U.S. internet and data use has increased U.S. GDP by 3.4–4.8 percent and supported up to 2.4 million jobs (ITC, 2014). The internet economy has grown significantly faster than the broader economy. Chart 1 shows cross-border data flows underpinning international trade. From 2005 to 2014, there was a 45 times increase in global data flows. That trend has essentially continued and actually grown.

Chart 1

I want to talk about the ways that I see the use of data and digital commerce as transforming international trade and what it means. I’ll focus in on services a bit more and map that onto what’s happening with USMCA (United States–Mexico–Canada Agreement).

Regarding the platforms context, I simply mean here (it’s) a typical e-commerce transaction. You may be on eBay, Alibaba, Etsy; I’m essentially transacting goods online.

Now, from a trade perspective, that essentially means that you could be a small business and where your customer base used to be—whoever walks past your store in a town and maybe the next town over—now you have access to consumers globally. eBay has some good data that essentially show that this (involves) small- and medium-sized enterprises. You can see that I’ve got data for the U.S. and Canada, but this plays out for Mexico, too. It’s remarkably similar across the world. Essentially, you are almost entirely always exporting if you are on eBay as a small business, compared with offline peers. Importantly, there’s a whole sort of ecosystem that comes with an e-commerce platform. You have access to financial payment services. It’s often tied in with express delivery services; so you have access to postal services.

There are various mechanisms for creating trust on the platform. This actually brings in other services to make the actual eBay or the broad e-commerce experience work effectively. In terms of the USMCA, there’s a whole range of commitments to underpin growth in e-commerce, certainly within North America.

As Anupam [Chandler] mentioned, there’s also a lowering in USMCA of the de minimis level. When you are importing a good, if it falls below a particular value, tariff rates and other duties don’t apply. Often for the small businesses on e-commerce platforms, they’re selling essentially low-value one good or two goods. If you can avoid the tariffs and duties and all the paperwork that goes with exporting, that can be the difference between that transaction being commercial or not. So, raising the de minimis level in USMCA for Mexico was important.

Investment commitments are very important because a lot of e-commerce happens under different business models. For instance, Walmart is trying to develop what it calls an omni-channel e-commerce strategy, which means that they’ve got the big-box stores, but also increasingly, you can go online. You can purchase or you can pick it up at the store or you can pick up at a designated post office box.

These fulfillment centers may be located in Mexico rather than the goods having to cross the border every time an e-commerce transaction is made. A lot of investment comes in behind the e-commerce strategy; the protections that are in USMCA are important there.

The USITC (United States International Trade Commission) looked at the benefits of this agreement for North America. It concluded that we would see increases in exports from the U.S. over e-commerce to both Mexico and Canada (Chart 2).

Chart 2

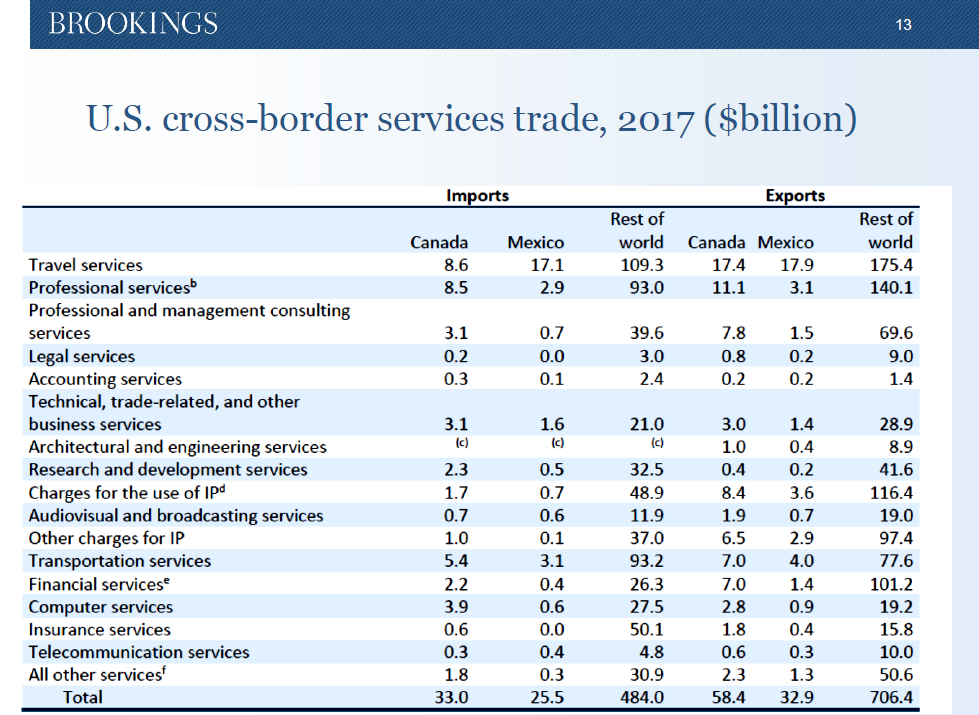

When it comes to trade and services, it’s worth noting services are about 80 percent of U.S. GDP, and while there’s been a sort of growing trade deficit in goods, there’s basically been an ongoing trade surplus in services. In fact, this slightly picks up on the cross-border services trade between the U.S. and Canada and Mexico and the rest of the world (Chart 3A).

Chart 3A

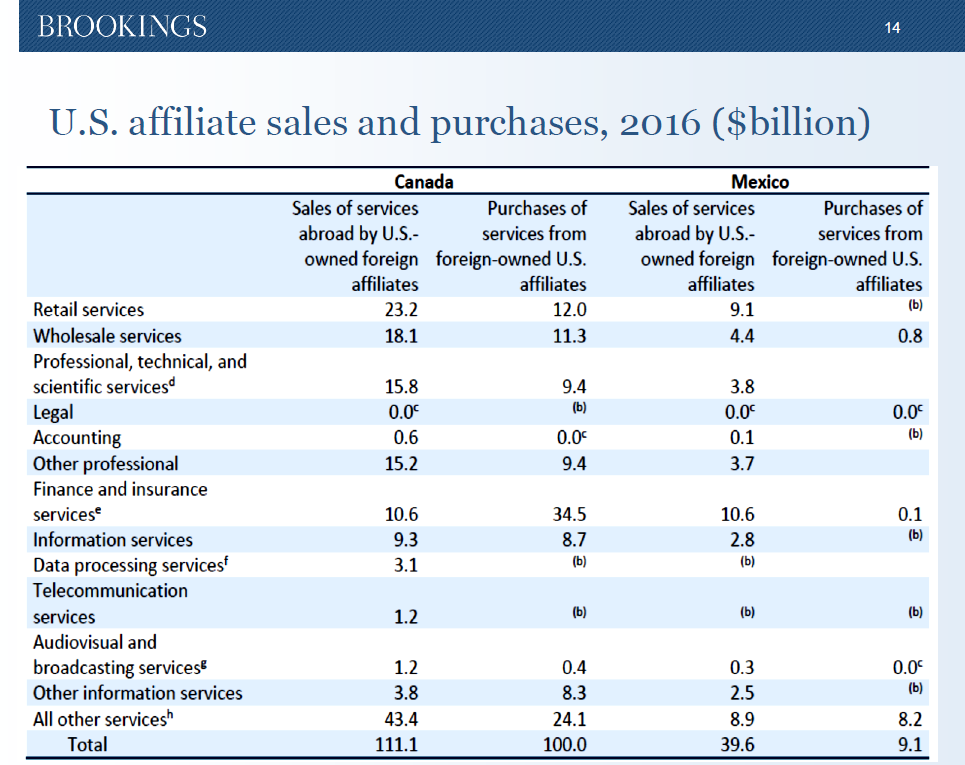

The U.S. exports not only travel services but also professional services. There are a lot of management consulting services, business services, R&D (research and development) and financial services. A lot of these services are actually increasingly delivered cross-border online. In addition, the U.S. also sells services via foreign affiliates in Mexico and Canada and has a surplus (Chart 3B).

Chart 3B

We’ve got approximately $150 billion of services delivered through affiliates in Canada or Mexico. The U.S. purchases through affiliates located in the U.S., about $110 billion, so there’s about a $40 billion surplus in there. You have some similar services there, but you see a lot more retail and wholesale services as well through these affiliates.

The USITC estimated how much of these services are digital. They believe that 61 percent of total U.S. services exports and 53 percent of U.S. services imports are digital. Why an estimate? This is because we don’t actually have statistics on how services are delivered. We don’t know if a service is delivered in person. We don’t know if it’s delivered over the telephone. We don’t know if it’s delivered online. So, you have to make an exercise where you assess what services could potentially be delivered online, and this is what is digitally deliverable. It’s probably an upper bound of what actually occurs, but it also shows where opportunities for growth lie.

Canada is the second-largest market for digital services, and it’s also one of the largest sources for the U.S. Mexico is a rapidly growing area of computer service exports as well. Certainly one would expect that there would be some growth in those areas within the North American context under USMCA. These are some of the kind of market access gains under USMCA from where we were under NAFTA. You do see that for instance, Canada has removed a lot of its provincial-level barriers to services—the citizenship test and commercial presence requirements.

Essentially, Canada is not saying anymore that if you want to deliver, you’ve got to be physically present in Canada. You can do that from the U.S., and an increase in digital technologies makes that possible. You’ve got some other services gains in Mexico—professional services gains, computer, environmental, transport and financial. Overall, we will see barriers to services trade coming down under USMCA.

In the context of an environment where you can increasingly trade services online, certainly reducing services trade barriers in USCMA expands the opportunity for more digital services trade between the U.S. and Canada and Mexico.