Houston Economic Indicators

| Houston economy dashboard (November 2024) | |||||

| Job growth (annualized) Aug. –Nov. '24 |

Unemployment rate |

Avg. hourly earnings | Avg. hourly earnings growth y/y |

||

| 2.0% | 4.6% | $34.40 | 0.2% | ||

Houston’s payroll employment growth was broad based in November and outpaced both the state and nation over the past three months. However, month-to-month measures of payroll growth have been volatile, and unemployment rose in November. Average real hourly earnings in Houston fell year over year.

Labor market

Key employment sectors see strong growth

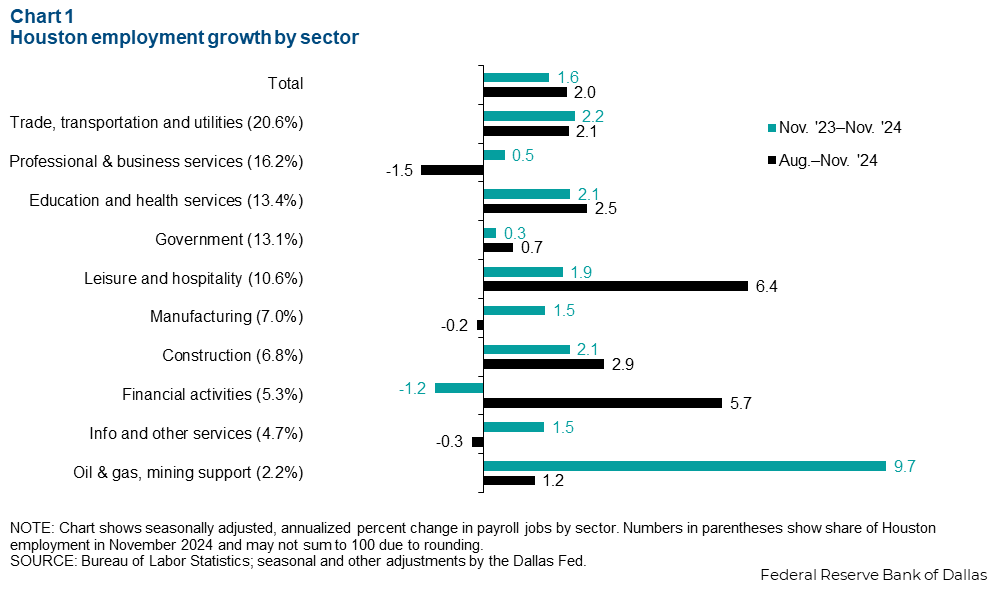

Over the three months ending in November, employment in Houston grew an annualized 2.0 percent, or 17,083 jobs (Chart 1). Over this period, leisure and hospitality grew the fastest at 6.4 percent annualized (5,612 jobs). Financial services also grew a robust 5.7 percent annualized (2,550). Professional and business services payrolls declined an annualized 1.5 percent, while manufacturing and information and other services were flat.

Year over year, most employment sectors posted robust payroll growth. Employment in the metro grew 1.6 percent from November 2023 to November 2024 (53,701 jobs). Mining grew the fastest with 9.7 percent growth year over year, or 6,716 jobs. Trade, transportation and utilities added the most jobs (15,257) at an above-trend 2.2 percent pace. Over the same period, payrolls in financial activities were down 1.2 percent, or a loss of 2,172 jobs. Professional and business services and government employment were both flat.

Overall employment growth volatile

Houston’s employment growth over the past three months has fallen from previous highs. The three-month annualized growth rate in November was 2.0 percent (Chart 2). This is down from a peak of 4.4 percent in October. Despite employment growth cooling from a fall pickup, the metro’s labor market is still very strong. Current three-month annualized growth is higher than both the state’s (1.5 percent) and nation’s (1.3 percent).

Unemployment picks up

The Houston unemployment rate increased to 4.6 percent in November (Chart 3). Since mid-2022, metro unemployment has been stable between 4.1 percent and 4.4 percent. Unemployment is now the highest it’s been since January 2022. Texas unemployment rose to 4.2 percent in November. U.S. unemployment ticked down to 4.1 percent in December from 4.2 percent in November.

The rise in unemployment comes as growth in the local labor force has slowed. The metro’s labor force grew an annualized 2.7 percent in November, down from a high of 4.9 percent annualized growth in September. For context, U.S. labor force growth has been slower. The nation’s labor force contracted an annualized 0.9 percent in November. More recent data show the national labor force growing an annualized 1.8 percent in December.

Real earnings hold steady

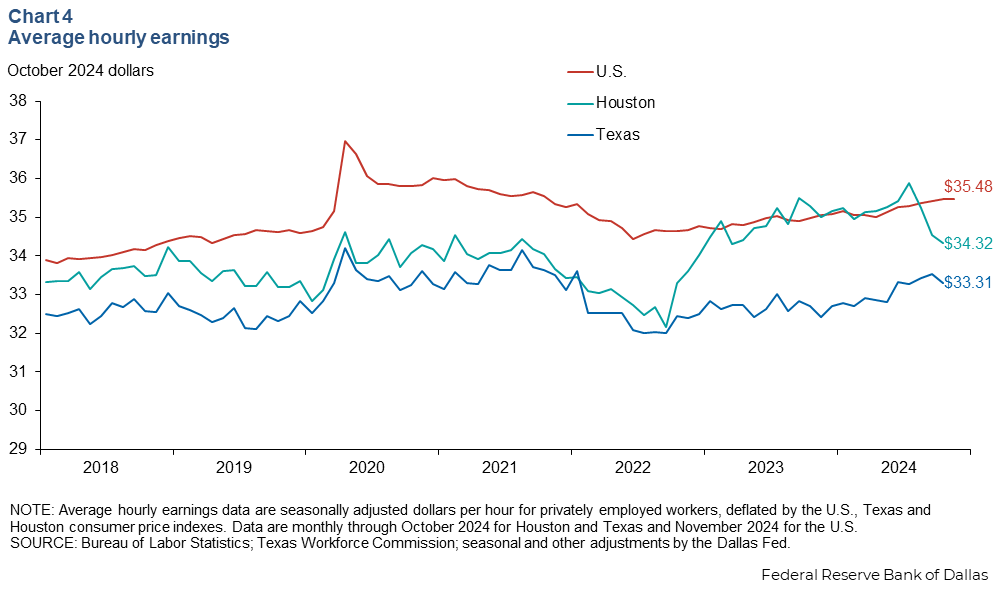

Hourly earnings in Houston were $34.32 per hour in October (Chart 4). Year over year, real earnings fell 2.7 percent. Non-inflation-adjusted wages in Houston were flat, growing just 0.2 percent year over year.

Houstonians’ real hourly earnings in October were below the national average of $35.46 per hour. Real earnings in both Houston and the nation tend to be higher than the state overall. Texas’ real hourly earnings in October were $33.31. Houston’s unique industry mix tends to boost average wages in the metro compared with other areas in Texas.

U.S. real hourly earnings ticked up to $35.48 in November.

NOTE: Data may not match previously published numbers due to revisions.

About Houston Economic Indicators

Questions or suggestions can be addressed to Robert Leigh at robert.leigh@dal.frb.org. Houston Economic Indicators is posted on the second Monday after monthly Houston-area employment data are released.