Houston Economic Indicators

| Houston economy dashboard (October 2024) | |||||

| Job growth (annualized) July–Oct. '24 |

Unemployment rate |

Avg. hourly earnings | Avg. hourly earnings growth y/y |

||

| 4.1% | 4.6% | $34.22 | -1.2% | ||

Payrolls in Houston expanded strongly from July through October, while unemployment in the metro area ticked up from September to October. Inflation in food and shelter continued to fall in October; however, core inflation ticked up. Average hourly earnings in Houston fell year over year on both a nominal and real basis.

Labor market

Three-month growth was broad based

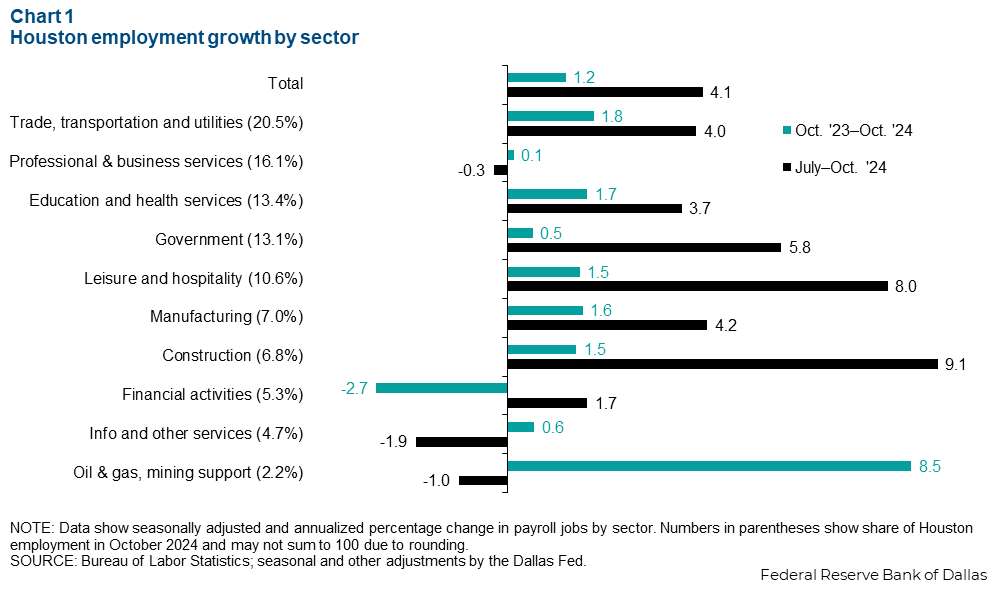

Houston dropped 5,164 jobs in October, but there were upward revisions to already-strong payroll growth in August and September that kept recent job growth strong. For the three months ending in October, employment in Houston grew an annualized 4.1 percent, with 34,488 jobs added (Chart 1).

From July through October, construction payrolls expanded the fastest with 9.1 percent annualized growth. Growth in construction employment was strong across subsectors, but specialty trade contractors saw the fastest growth with 12.6 percent annualized growth. Leisure and hospitality added the most jobs (9,963) over that period.

However, during that time, employment in oil and gas and information and other services declined. Professional and business services, Houston’s second largest employment sector, remained flat.

Year over year in October, Houston’s labor market grew below trend, with employment expanding 1.2 percent. Oil and gas grew the most, with year-over-year gains of 8.5 percent. Despite the strong growth, oil and gas comprises a small share of the metro’s labor market, just 2.2 percent. Larger sectors such as trade, transportation and utilities and professional and business services grew modestly, at 1.8 and 0.1 percent, respectively.

Unemployment continues to rise

The Houston unemployment rate ticked up to 4.6 percent in October from 4.4 percent in September where it had been holding steady for three months (Chart 2). A year prior, the Houston unemployment rate was 4.1 percent. Houston’s labor force grew an annualized 0.5 percent in October, which was a significant slowdown. From January through September, the average monthly labor force growth rate was 3.3 percent.

For context, Texas’ unemployment rate has held steady at 4.1 percent since July, and unemployment rate fell slightly. In October, U.S. unemployment was also 4.1 percent, down from 4.3 percent in July.

Prices and earnings

Core inflation ticks up

Houston consumer price inflation edged up to 2.1 percent annual growth in October from 1.9 percent in September (Chart 3). Core inflation, which excludes the volatile food and energy categories, also accelerated, to 2.8 percent annual growth in October. Food prices rose 1.7 percent in October, the slowest increase since March 2020. Shelter inflation remained high at 2.6 percent but is steadily moving down to match market rents that have been below 2.0 percent since mid-2023. Measurement of shelter inflation often reflects long lags.

Real earnings decline

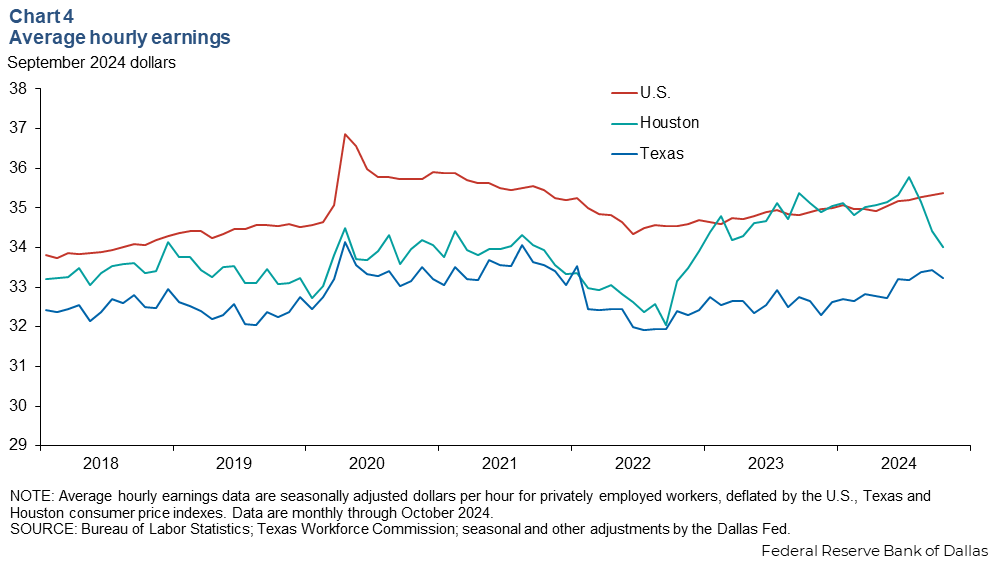

Seasonally adjusted hourly earnings in Houston were $34.12 per hour in October (Chart 4). Year-over-year real earnings fell 3.2 percent. Non-inflation-adjusted wages in Houston fell 1.1 percent over the past year.

Houstonians’ hourly earnings were slightly below the national average of $35.46 per hour in October. Earnings in both Houston and the nation tend to be higher than the state overall. Texas’ hourly earnings in October were $33.23. Houston’s unique industry mix tends to boost average wages in the metro area.

The Houston Employment Cost Index (ECI) is a better but less timely measure of wage growth than hourly earnings. The annual percent change in the Houston ECI fell to 4.4 percent in third quarter 2024 . This is down from a high of 5.3 percent in first quarter 2024. The U.S. ECI has been steadily slowing since second quarter 2022.

NOTE: Data may not match previously published numbers due to revisions.

About Houston Economic Indicators

Questions or suggestions can be addressed to Robert Leigh at robert.leigh@dal.frb.org. Houston Economic Indicators is posted on the second Monday after monthly Houston-area employment data are released.