Dallas-Fort Worth Economic Indicators

Dallas–Fort Worth’s economic expansion remains on track. Payroll employment rose slightly faster than its long-term average rate in August, and unemployment stayed low. The Dallas and Fort Worth business-cycle indexes expanded further. Home sales rose and inventories remained tight, particularly at the lower price points. Home prices continued to appreciate at a moderate pace.

Labor Market

Payroll Expansion Continues

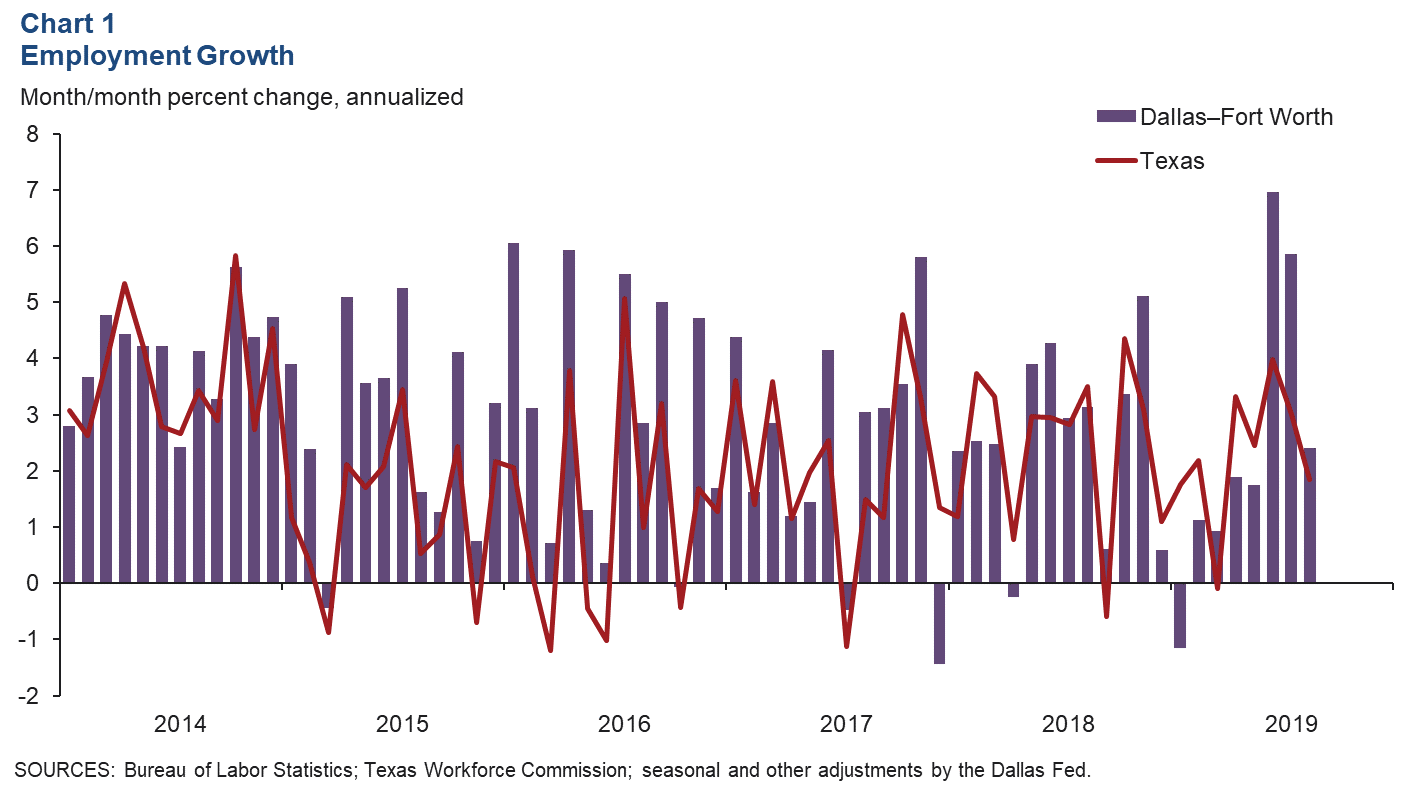

DFW employment rose at an annualized 2.4 percent rate in August (Chart 1). Dallas payroll expansion was robust at 3.4 percent, while employment in Fort Worth dipped last month. Year to date, DFW job growth remains mostly broad based across sectors, led by gains in the construction and mining and financial activities sectors. Employment gains are sluggish in the metro’s largest sector—trade, transportation and utilities—at 0.4 percent. Through August, payrolls in DFW have grown 2.4 percent, for a net addition of over 60,000 jobs.

Unemployment Holds Steady

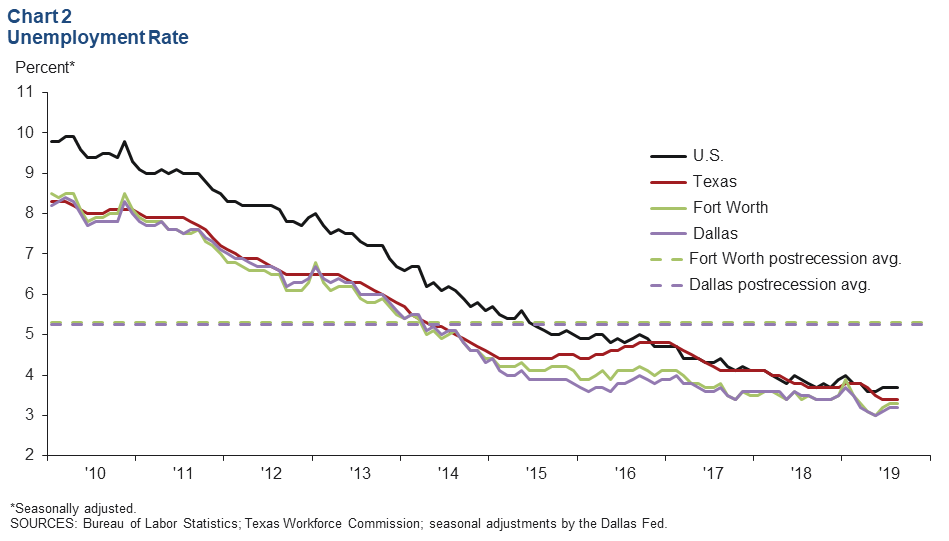

The DFW labor market continued to be tight, with unemployment close to multiyear lows. In August, the unemployment rate was unchanged at 3.2 percent in Dallas and 3.3 percent in Fort Worth (Chart 2). Unemployment remains below the state and U.S. rates, which held steady at 3.4 percent and 3.7 percent, respectively.

Business-Cycle Indexes

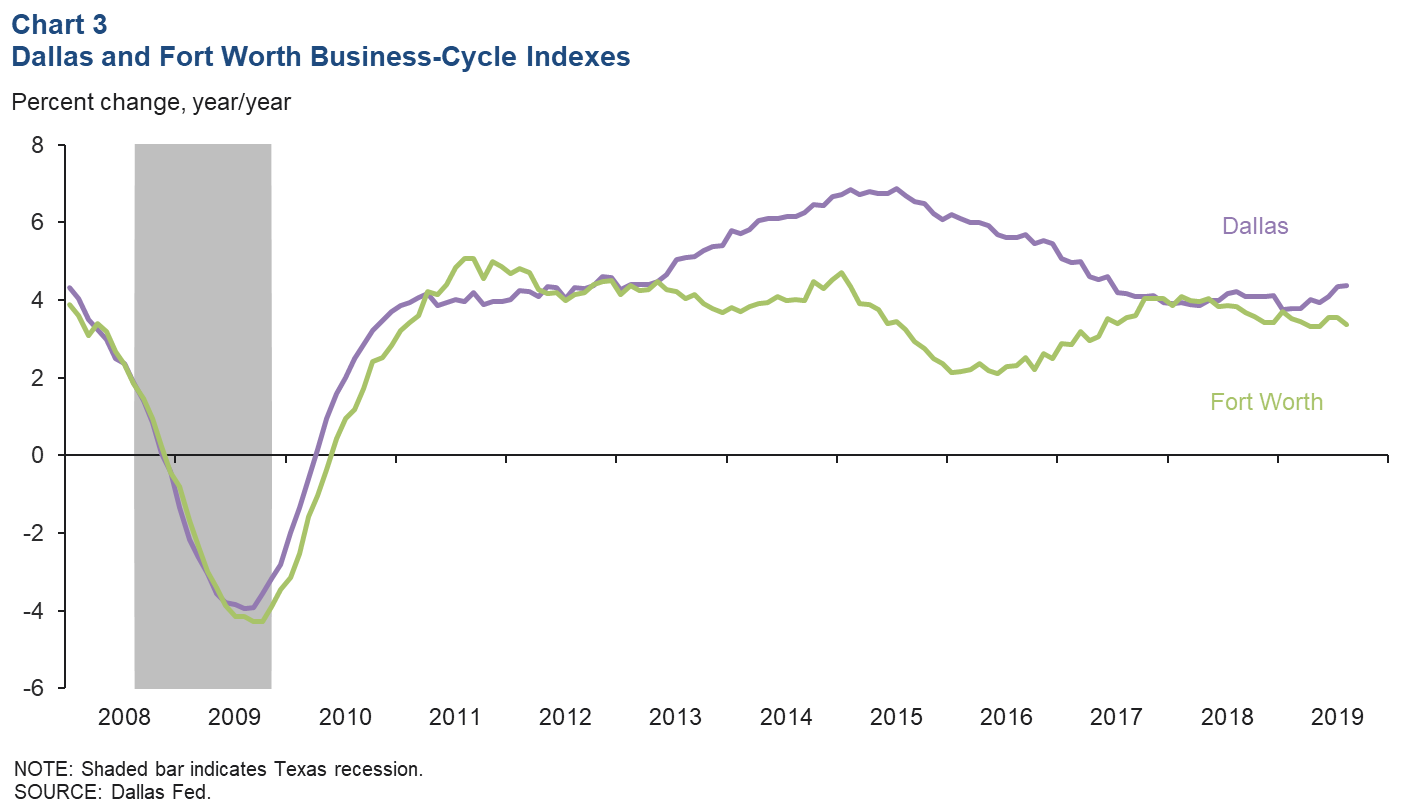

Expansion in the Dallas and Fort Worth business-cycle indexes continued in August, supported by persistent job growth. The Dallas index rose an annualized 5.4 percent, above its trend rate. Growth in the Fort Worth index was slower at 1.8 percent. Year over year in August, the Dallas and Fort Worth indexes expanded at an above-average pace, with the Dallas index growing 4.4 percent and the Fort Worth index up 3.4 percent (Chart 3).

Housing Market

Home Sales Rise

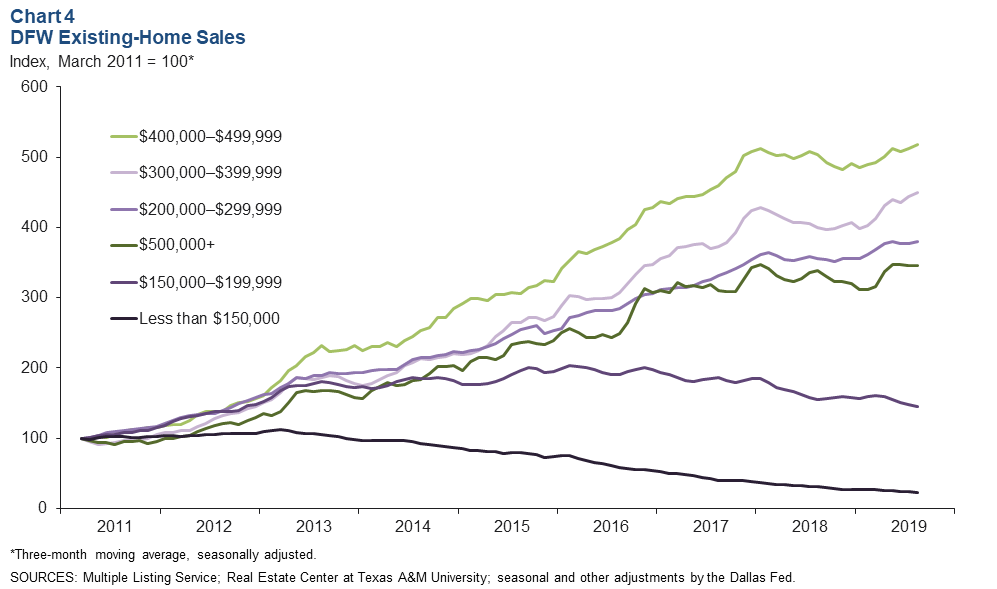

DFW existing-home sales climbed in August, led by growth in the Fort Worth metropolitan division. Sales of homes priced from $200,000 to $500,000 have seen the largest gains this year, while sales of homes priced under $200,000 continue to slide due to lack of inventory (Chart 4). Business contacts responding to the most recent Beige Book also noted sustained growth in new-home sales, with builders generally on plan for the year. Lower interest rates are likely boosting home sales. Through August, total existing-home sales in the metroplex are slightly ahead of last year.

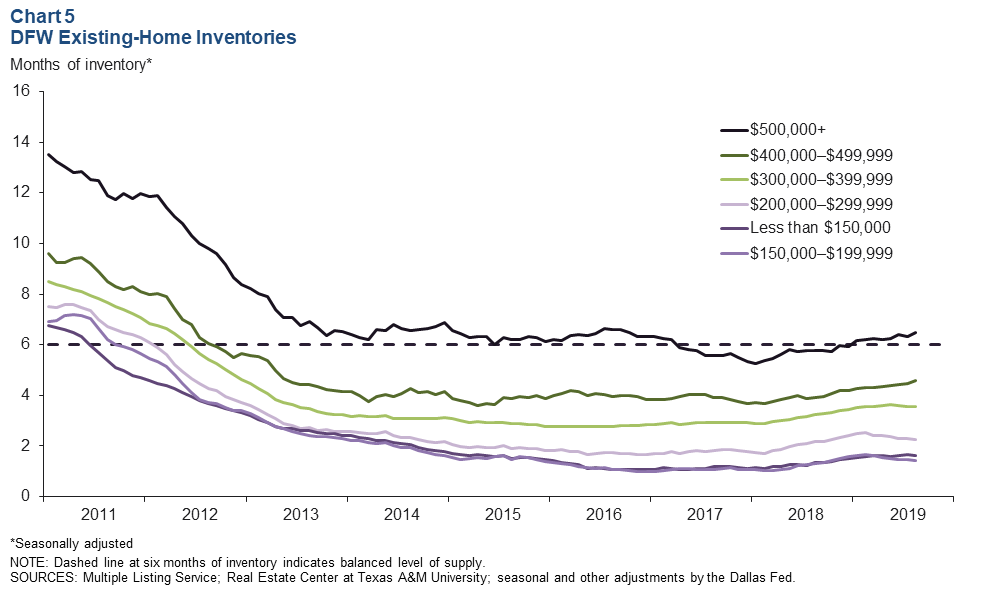

Home Inventories Remain Tight

DFW existing-home inventories remained tight and well below the six months’ supply typically associated with a balanced market. Inventories have been fairly stable this year and in August were at 3.2 months in Dallas and 2.5 months in Fort Worth, below the Texas and U.S levels of 3.7 months and 3.9 months, respectively. Inventories of entry-level homes (priced below $200,000) were the tightest at around 1.5 months of supply—a level that has changed little the past three years (Chart 5). Inventories of homes priced from $200,000 to $299,999 remain under three months, while inventories of homes priced above $500,000 are plentiful and have ticked up above the six-month mark.

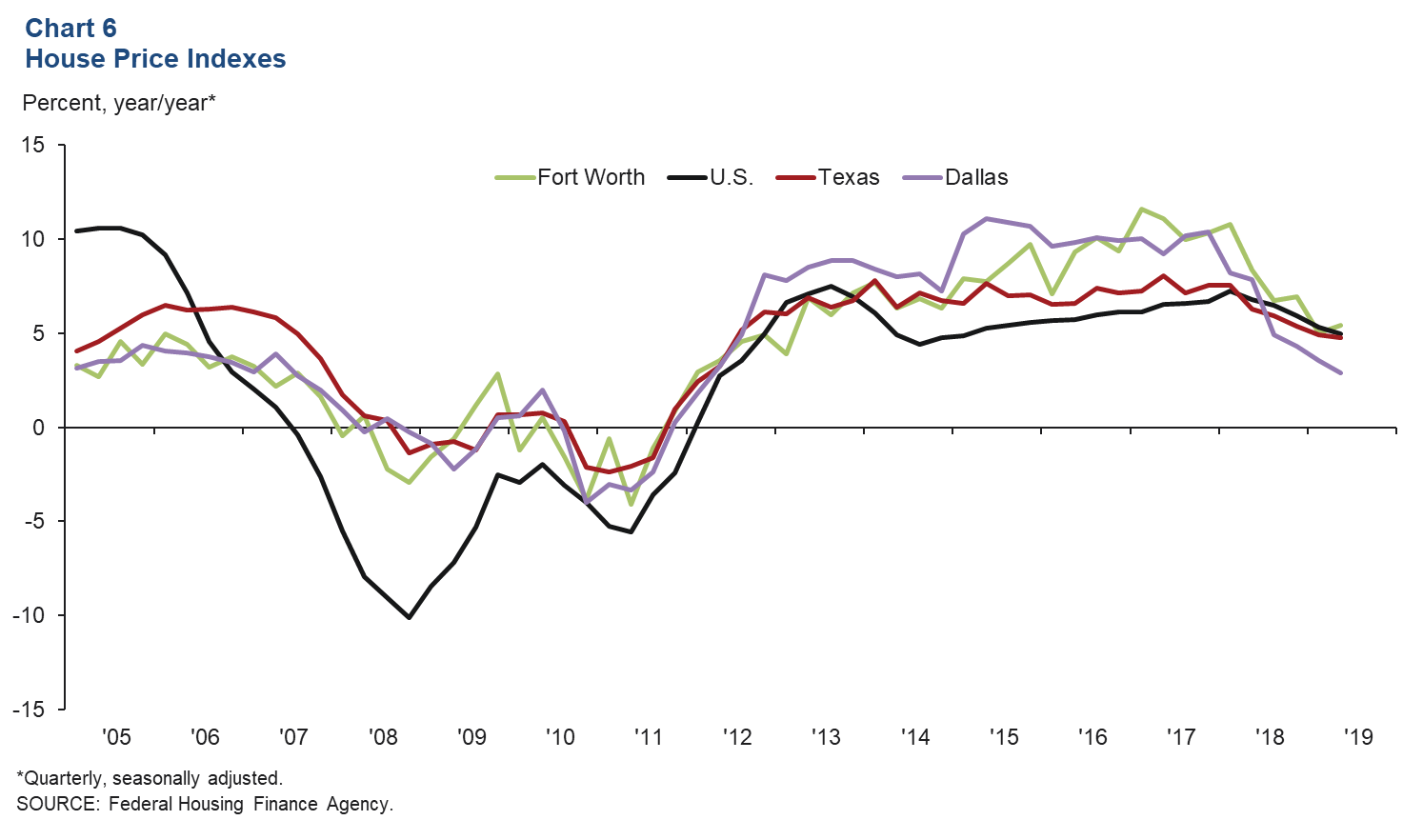

Home Prices Appreciate

DFW home price appreciation continued in the second quarter as solid job creation and tight home inventories propelled increases. Prices rose 0.9 percent in Dallas and 1.3 percent in Fort Worth in the second quarter, according to the Federal Housing Finance Agency’s house price purchase-only index. On a year-over-year basis, prices in the quarter were up 2.9 percent in Dallas and 5.4 percent in Fort Worth (Chart 6). Home price increases in Fort Worth are ahead of the state and the country, where prices rose 4.8 percent and 5.0 percent, respectively. Home-price appreciation in the metroplex has slowed from its torrid pace in 2015–17, when prices in both Dallas and Fort Worth rose by 10 percent annually.

NOTE: Data may not match previously published numbers due to revisions.

About Dallas–Fort Worth Economic Indicators

Questions can be addressed to Laila Assanie at laila.assanie@dal.frb.org. Dallas–Fort Worth Economic Indicators is published every month on the Tuesday after state and metro employment data are released.