Dallas-Fort Worth Economic Indicators

Dallas–Fort Worth economic growth strengthened in July. Payroll employment grew at a rapid clip, and unemployment stayed low. The Dallas and Fort Worth business-cycle indexes expanded further. Housing market indicators suggest a cooling in home price appreciation and homebuilding activity, and inventories remained tight, particularly at the lower price points. Revised (benchmarked) data indicate that DFW employment grew 2.6 percent in the first seven months of 2019—slightly above its long-term trend rate.

Labor Market

Job Growth Stays Strong

DFW employment rose notably for the second straight month in July (Chart 1). Dallas payroll expansion was robust, and employment in Fort Worth expanded for the third straight month after dipping from February to April.

The DFW labor market continued to be tight, with unemployment close to multiyear lows. In July, the unemployment rate ticked up to 3.2 percent in Dallas and 3.3 percent in Fort Worth. Unemployment remains below the state and U.S. rates.

Benchmarked Data Indicate Lower but Still Solid Job Gains in 2019

With the Dallas Fed’s early benchmark revisions to first quarter 2019 data, DFW job growth was revised down to an annualized 2.6 percent from its previous estimate of 3.8 percent for the first seven months of 2019—still above its long-term average pace (Chart 2). In the Dallas–Plano–Irving metropolitan division, employment grew by 2.4 percent year to date—slower than its earlier estimate of 4.7 percent. Meanwhile, job gains in Fort Worth–Arlington were revised up from 1.4 percent to 3.1 percent.

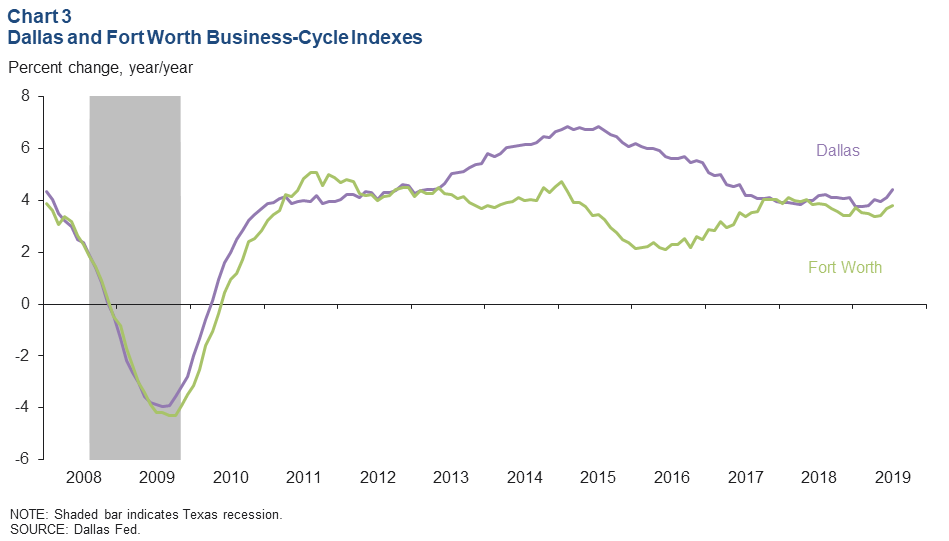

Business-Cycle Indexes

Expansion in the Dallas and Fort Worth business-cycle indexes continued in July, supported by strong job growth (Chart 3). The Dallas index rose an annualized 7.7 percent, slightly faster than June’s rate. Growth in the Fort Worth index was solid as well at 4.9 percent. Year over year in July, the Dallas index rose 4.4 percent, and the Fort Worth index was up 3.8 percent.

Housing Market

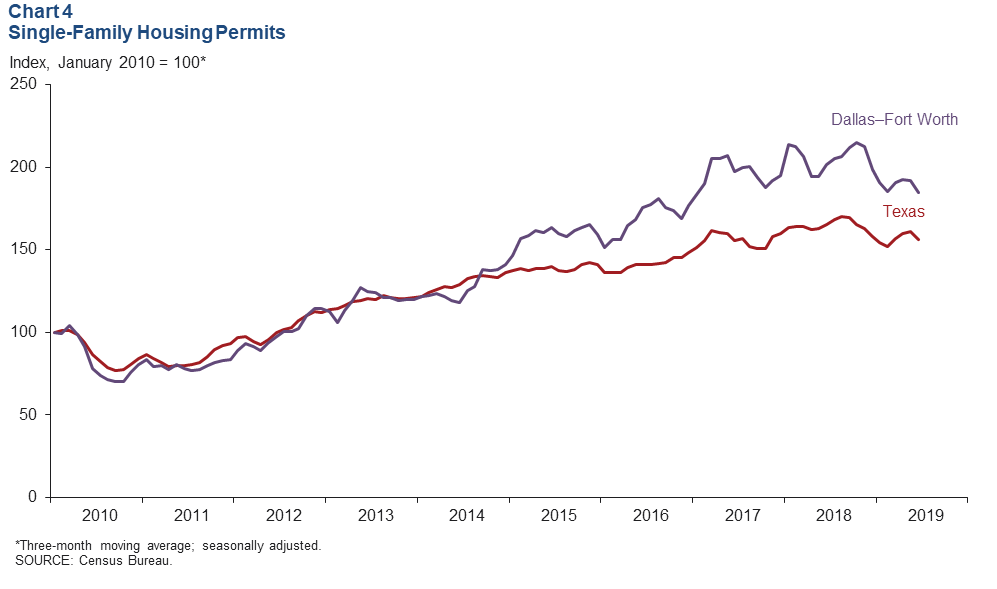

Single-Family Construction Softens

DFW single-family housing permits dipped for the second straight month in June, in part due to spring rains that delayed lot development and homebuilding activity (Chart 4). In the first half of the year, total single-family permits were trailing issuance for the same period last year by 7.8 percent in DFW and 5.0 percent in Texas. DFW single-family permit growth decelerated to 3.4 percent last year after climbing 15.8 percent in 2017.

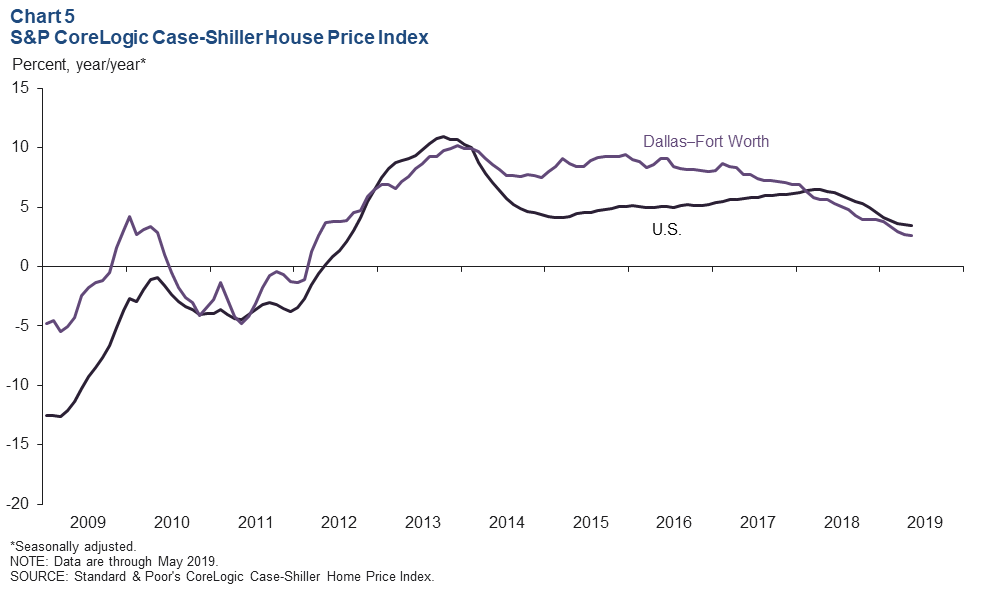

Home Prices Decelerate

The pace of home price appreciation has cooled in the metroplex. The S&P CoreLogic Case-Shiller House Price Index, which tracks repeat sales, shows growth in DFW staying below the U.S. rate (Chart 5). Year over year in May (the most recent data available), prices in DFW were up 2.6 percent, slower than the nation’s 3.5 percent increase. In 2018, home prices in DFW rose at 3.9 percent rate compared with 4.5 percent nationally. Multiple Listing Service data also show deceleration in median home prices in the metroplex.

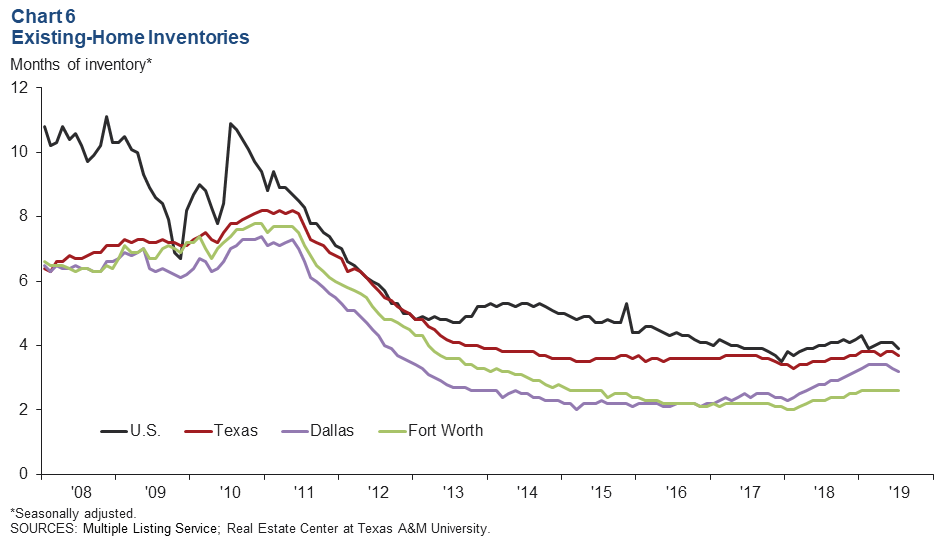

Home Inventories Tight

DFW existing-home inventories remained tight and well below the six months’ supply typically associated with a balanced market. Inventories inched up in 2018 but have been fairly stable this year; at mid-year 2019, they were at 3.2 months in Dallas and 2.6 months in Fort Worth, slightly below the Texas and U.S levels of 3.7 months and 3.9 months, respectively (Chart 6). Inventories of entry-level homes (priced below $200,000) were the tightest around 1.5 months of supply—a level that has changed little the past three years. Inventories of homes priced from $200,000 to $299,999 were under three months.

NOTE: Data may not match previously published numbers due to revisions.

About Dallas–Fort Worth Economic Indicators

Questions can be addressed to Laila Assanie at laila.assanie@dal.frb.org. Dallas–Fort Worth Economic Indicators is published every month on the Tuesday after state and metro employment data are released.