Austin Economic Indicators

| Austin economy dashboard (February 2025) | |||

| Job growth (annualized) Nov. '24–Feb. '25 |

Unemployment rate |

Avg. hourly earnings |

Avg. hourly earnings growth y/y |

| 0.8% | 3.5% | $35.52 | 2.9% |

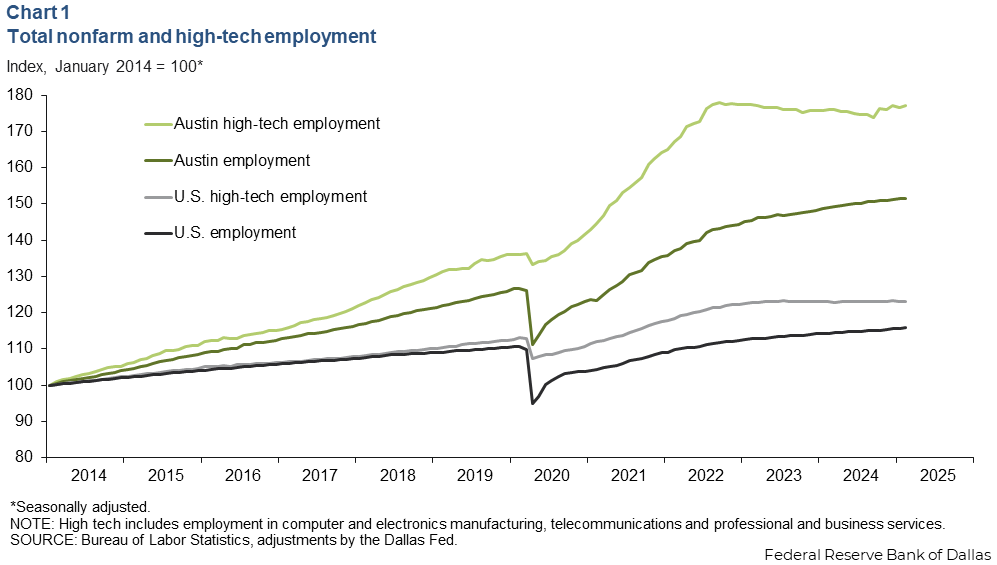

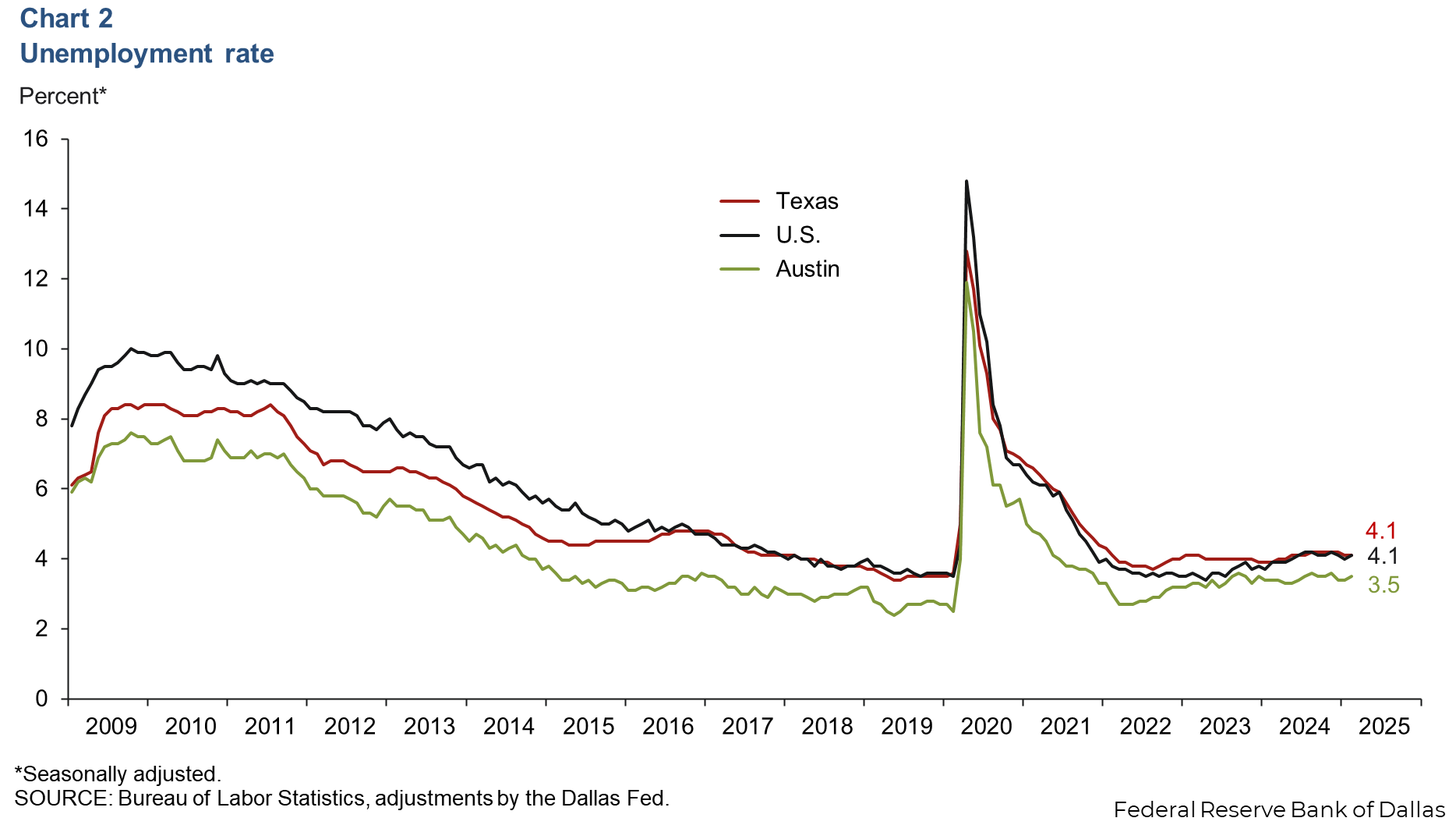

Austin employment slowed in February, and the unemployment rate ticked up. Austin’s high-tech sector has grown faster than the nation’s high-tech employment. Housing prices moved up, while rents continued to decline.

Labor market

High-tech employment growth stronger than the nation

Austin’s high-tech sectors have grown at a faster rate than Austin’s total nonfarm employment, as well as the nation’s nonfarm and high-tech growth (Chart 1). High-tech employment includes computer and electronics manufacturing, telecommunications and professional and business services .

Unemployment ticks up

Austin’s unemployment rate moved up to 3.5 percent in February, below the state and national rates of 4.1 percent (Chart 2). In February, the local labor force increased slightly, up 0.6 percent, while the state’s increased 1.5 percent, and the nation’s fell 2.7 percent.

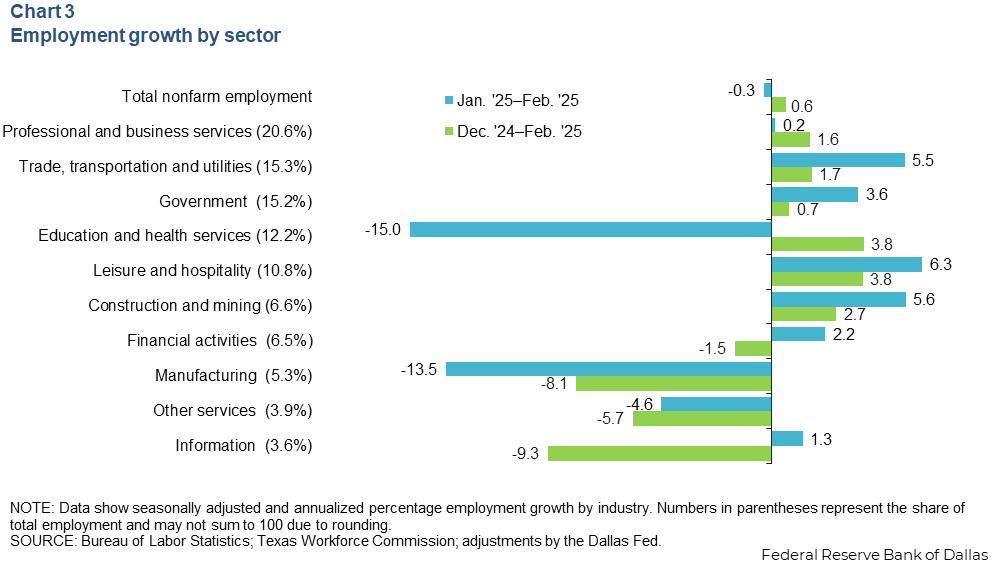

Employment growth slows

Austin employment fell an annualized 0.3 percent in February (Chart 3). That’s slower than the 1.5 percent growth in January. The greatest gains were in trade, transportation and utilities (940 jobs) and leisure and hospitality (750 jobs). Federal government employment decreased an annualized 0.7 percent in February. Sectors that declined included education and health services (2,260 jobs) and manufacturing (880 jobs). Year over year, Austin’s employment growth was slow at an annualized 1.5 percent, but it’s faster than the state’s 1.4 percent increase and the nation’s 1.2 percent growth.

Housing

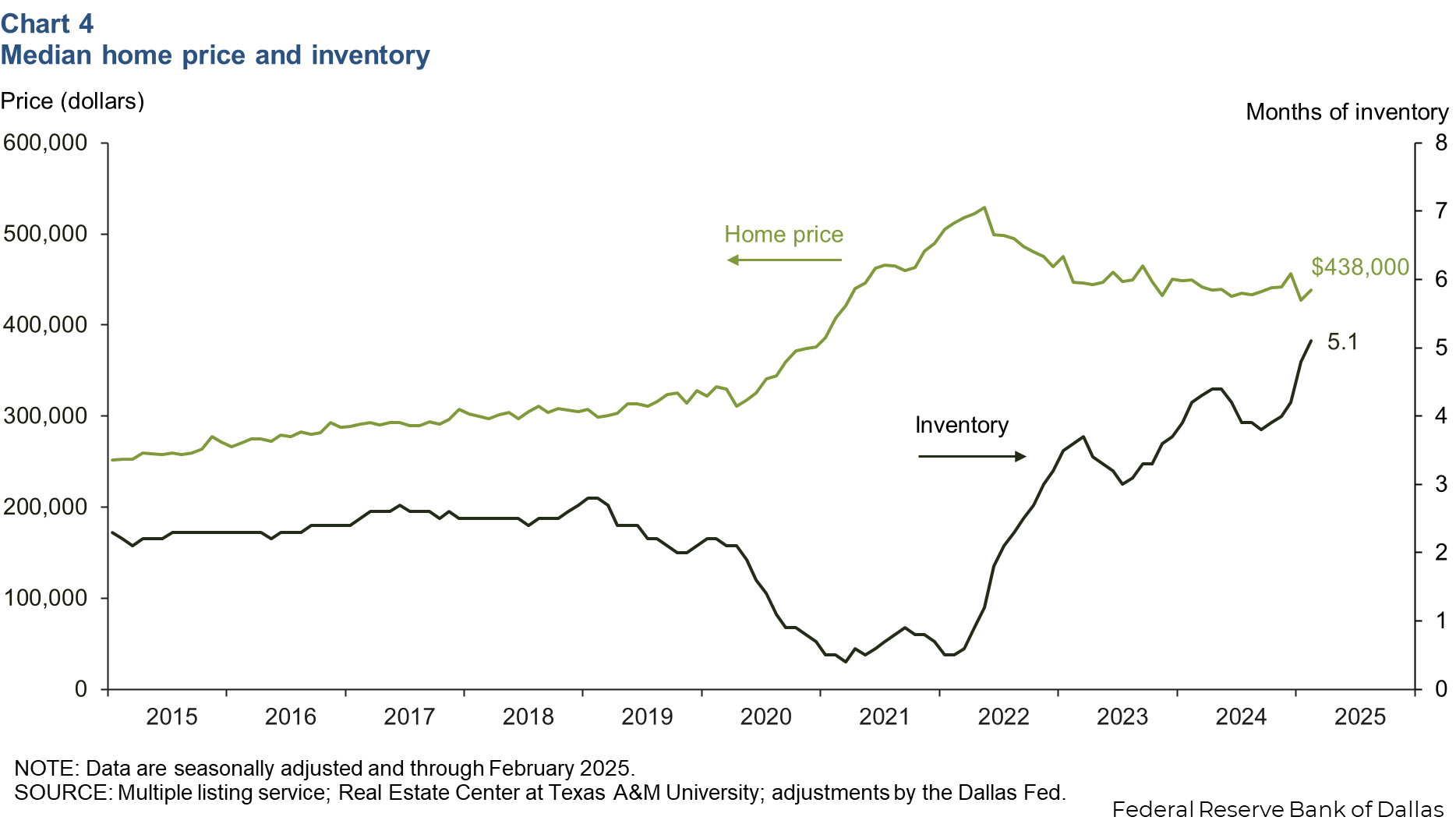

Housing prices edge up

Austin’s median home price increased 2.7 percent in February (Chart 4). Year over year, median home prices fell 2.4 percent in the metro area and 1.1 percent in Texas. Austin home inventories ticked up to 5.1 months in February, remaining below six months, which is generally considered a balanced housing market. A year ago, home inventory levels in Austin were 4.2 months.

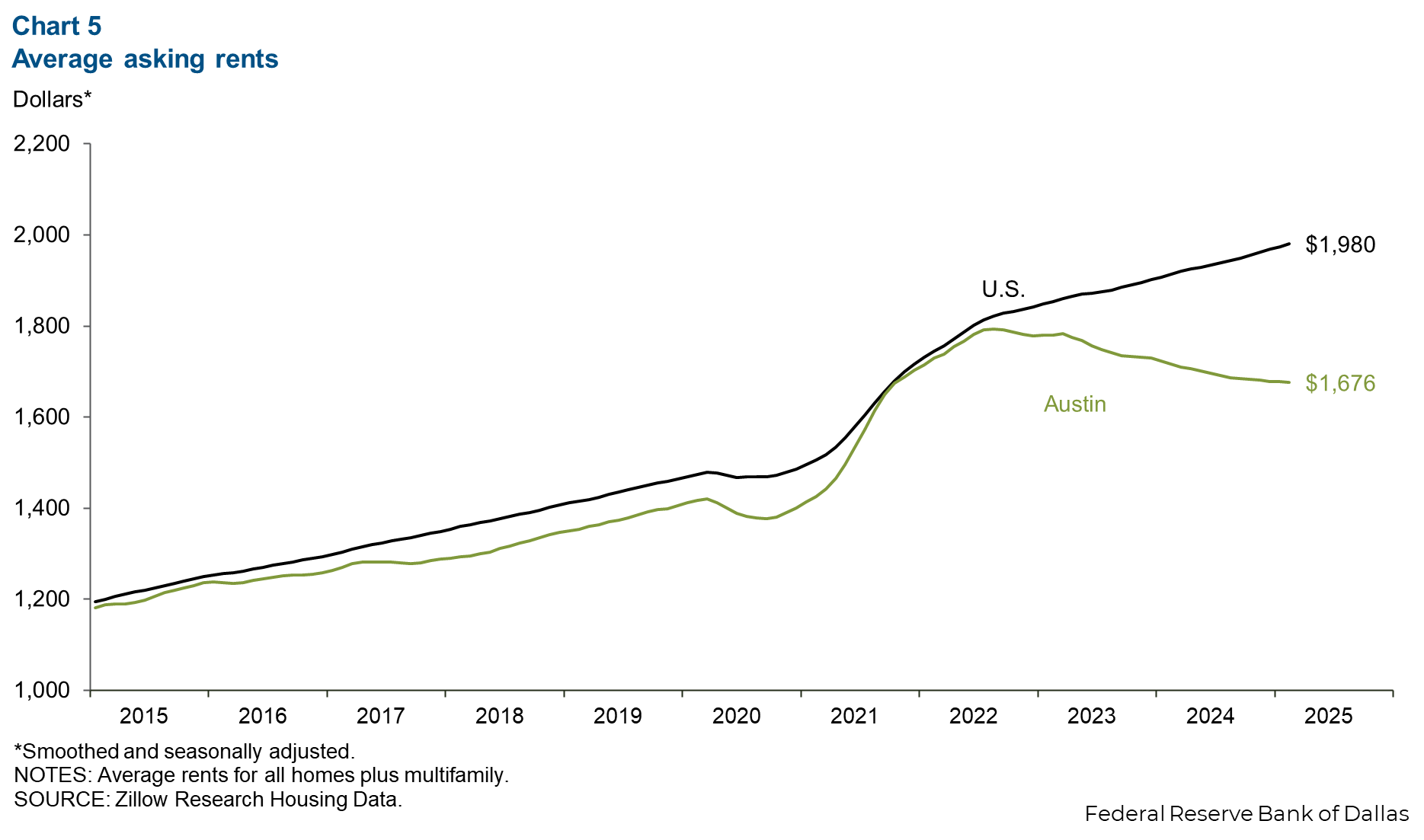

Rents continue to decline

Rents in Austin fell 0.1 percent in February and were down 2.4 percent year over year. February marked the 23rd consecutive month that asking-rents fell (Chart 5). Austin rent prices peaked in August 2022 and have fallen 6.6 percent since. Rents in the U.S. were up 0.3 percent in February and 3.4 percent year over year and were 8.7 percent higher than August 2022.

NOTE: Data may not match previously published numbers due to revisions.

About Austin Economic Indicators

Questions or suggestions can be addressed to Isabel Dhillon at Isabel.Dhillon@dal.frb.org.

Austin Economic Indicators is released on the first Thursday of every month.