Student Loans Part 1: Get the Numbers Right

December 2014

Student loan borrowing presents an exception to the trend of lower household debt since the recent recession. The total amount of student loan debt almost tripled in a decade, from about $346 billion in fourth quarter 2004 to $1.12 trillion in second quarter 2014, based on the Federal Reserve Bank of New York Consumer Credit Panel/Equifax data.

Amount Borrowed and Number of Borrowers Both Contribute to the Accumulation

The increase in aggregate student loan debt, which accounts for 10 percent of total consumer debt,[1] has come from not only a higher amount borrowed at the individual level but also an increase in the number of borrowers. In Texas, the average nominal dollars borrowed grew at a compound annual rate of about 8 percent from 2000 to 2012.[2] That was slower than the growth in number of borrowers, which posted an annualized rate of 9.6 percent (Chart 1). The annualized growth rate of enrollment in Texas colleges and universities was 3.4 percent during the same period.

Chart 1

Number of Student Loan Borrowers and Average Balance Growing in Texas

SOURCE: Federal Reserve Bank of New York Consumer Credit Panel/Equifax.

Student Loans Perform Worse Than Other Consumer Loan Types

Most recent data suggest that student loan delinquency based on overall balance has begun to stabilize. However, it has remained above 10 percent at the national level, while delinquencies for most other forms of credit, including mortgages, have been declining (Quarterly Report of Household Debt and Credit by the Federal Reserve Bank of New York). In Texas, like in the nation, student loan delinquencies based on overall balance have exceeded delinquencies of credit cards and mortgages and hovered around 13 percent in recent quarters (Chart 2). The state’s serious delinquency rate was also about 2 percentage points higher than the nation’s in second quarter 2014 (Federal Reserve Bank of Dallas Consumer Credit Conditions Report Map).[3] In contrast, overall consumer loan performance in Texas is better than in the nation and has improved in recent years (Federal Reserve Bank of Dallas Consumer Credit Conditions Report Map), largely because of the low delinquencies of home loans and their larger share in the composition of consumer debt. For a typical Texas borrower, student loan debt accounts for about 11 percent of total debt, while mortgage debt accounts for about 62 percent.

Chart 2

Texas Student Loan Delinquencies Highest Among Major Consumer Loans

SOURCE: Federal Reserve Bank of New York Consumer Credit Panel/Equifax.

Another Crisis?

Student loans are predominantly guaranteed by the federal government, and only a small portion is securitized and sold to investors. This helps limit the exposure of the financial market to the student loan segment, and we are unlikely to see a crisis similar to the mortgage meltdown before the Great Recession. However, the debt burdens, the associated payments and high delinquency rates may lead to financial predicaments for many borrowers.

How Much Are Texans Borrowing in Student Loans?

An analysis of the distribution of student loan debt could mitigate some concerns regarding borrowing. In Texas, the average age of student loan borrowers is 36 years old. About 37 percent of borrowers were under 30 years old, and 33 percent were over 40 years old. The median (midpoint) student loan borrower in second quarter 2014 owed $12,811 in student loan debt, $1,214 lower than the national median. The average amount of student loan debt was $23,965, which is $2,075 lower than the national average (Chart 3). The difference between the median and the average reflects the existence of borrowers at the top of the distribution with especially large amounts of student loan debt. About 3.3 percent of borrowers had six-figure student loan debt, while 0.5 percent had balances over $200,000. In most cases, high levels of debt accrue to those pursuing a graduate degree or going to a private institution.[4] About 25 percent of borrowers held more than $29,394 in student loan debt, while another 25 percent held less than $5,500 in student loan debt in second quarter 2014. About 59 percent of the borrowers were in repayment in second quarter 2014.[5]

Chart 3

Texas Average Student Loan Balance Ranked Lower than National Average ($26,040), June 2014

| RANK | STATE | DOLLAR AMOUNT |

| 1 | DC | 42,921 |

| 2 | MD | 30,321 |

| 3 | GA | 29,275 |

| 4 | NY | 28,157 |

| 5 | VA | 28,044 |

| 37 | TX | 23,965 |

| 47 | WI | 22,899 |

| 48 | IA | 22,824 |

| 49 | ND | 21,737 |

| 50 | SD | 21,606 |

| 51 | WY | 21,310 |

| SOURCE: Authors’ calculations based on Federal Reserve Bank of New York Consumer Credit Panel/Equifax | ||

Different Delinquency Measurements Tell Different Stories

Only 30 percent of student loan borrowers in second quarter 2014 had prime credit scores (680 and above), 21 percent had near prime scores (between 620 and 679) and 49 percent were subprime (less than 620). The average Equifax risk score was 625. With this risk profile, many student loan borrowers are having difficulty repaying the loan even without a high balance.

Student loan borrowers typically take out multiple loans of different types at different times and sometimes from different lenders. If not consolidated, these loans end up having various terms, balances and delinquency statuses. Student loan performance for a region is often calculated based on the amount of total outstanding balance. As shown in Table 1, Texas’ serious student loan delinquency rate based on total outstanding balances was 12.8 percent, which ranked ninth among all states, despite the relatively lower average balance, which ranked 37th.

States with Highest and Lowest Serious Delinquencies on Student Loans, June 2014

| RANK | STATE | PERCENT |

| 1 | NM | 15.7 |

| 2 | WV | 15.4 |

| 3 | OK | 14.8 |

| 4 | MS | 14.3 |

| 5 | NV | 14.1 |

| 9 | TX | 12.8 |

| 47 | NE | 7.9 |

| 48 | ND | 7.8 |

| 49 | WI | 7.7 |

| 50 | MN | 7.5 |

| 51 | VT | 7.5 |

| RANK | STATE | PERCENT | |

| 1 | MS | 46.9 | |

| 2 | NM | 38.7 | |

| 3 | GA | 37.7 | |

| 4 | WV | 37.3 | |

| 5 | AR | 36.7 | |

| 14 | TX | 30.6 | |

| 47 | NE | 18.5 | |

| 48 | MA | 17.1 | |

| 49 | MN | 16.8 | |

| 50 | VT | 15.9 | |

| 51 | ND | 15.2 | |

| SOURCE: Authors’ calculations based on Federal Reserve Bank of New York Consumer Credit Panel/Equifax | |||

Another delinquency measure is based on number of borrowers. Borrower delinquency status can be indicated by the worst-performing loan among all loans the consumer holds. For example, if a borrower is late on one loan while staying current on other loans, he or she is considered delinquent. In second quarter 2014, the serious delinquency rate in Texas was 19.8 percent for all student loan borrowers (Table 2). Borrower delinquencies are in general higher than delinquency rates based on balance, likely because many borrowers are not necessarily late on all loans. Also, larger loans are more likely to be loans for education at a private institution or a graduate degree that might lead to better job prospects and higher repayment capacity.

Serious Delinquency Rates Based on Borrower, June 2014

| RANK | STATE | PERCENT |

| 1 | MS | 24.1 |

| 2 | WV | 22.3 |

| 3 | OK | 22 |

| 4 | NV | 21.4 |

| 5 | NM | 21.1 |

| 11 | TX | 19.8 |

| 47 | SD | 12 |

| 48 | WI | 11.9 |

| 49 | MN | 11.3 |

| 50 | VT | 11 |

| 51 | ND | 10.5 |

| RANK | STATE | PERCENT | |

| 1 | MS | 47.4 | |

| 2 | AR | 37.6 | |

| 3 | WV | 37.3 | |

| 4 | NM | 37 | |

| 5 | GA | 37 | |

| 15 | TX | 33.2 | |

| 47 | MA | 19.2 | |

| 48 | SD | 18.4 | |

| 49 | MN | 17 | |

| 50 | VT | 16 | |

| 51 | ND | 15.1 | |

| SOURCE: Authors’ calculations based on Federal Reserve Bank of New York Consumer Credit Panel/Equifax | |||

Delinquent loans, no matter how small, can have considerable consequences on individual consumers, while only delinquencies of large loans have big direct impacts on the student loan market. Using both measures of delinquencies, we can better understand how student loan performance influences borrowers and the economy.

However, a delinquency measure based on either total balance or number of borrowers can understate the repayment issue because a large amount of outstanding loans are in deferment or forbearance and are not considered past due. We calculated the delinquency rates for loans in repayment by eliminating from the total the loans or borrowers with a nondeclining balance from the previous quarter and those that are not past due (see Table 1). The serious delinquency rates in Texas based on balance in repayment went up to 30.6 percent (more than double the rate for all outstanding balances), which ranked 14th among states. The serious delinquency rates in Texas based on borrowers in repayment was 33.2 percent, ranking 15th among all states (see Table 2).

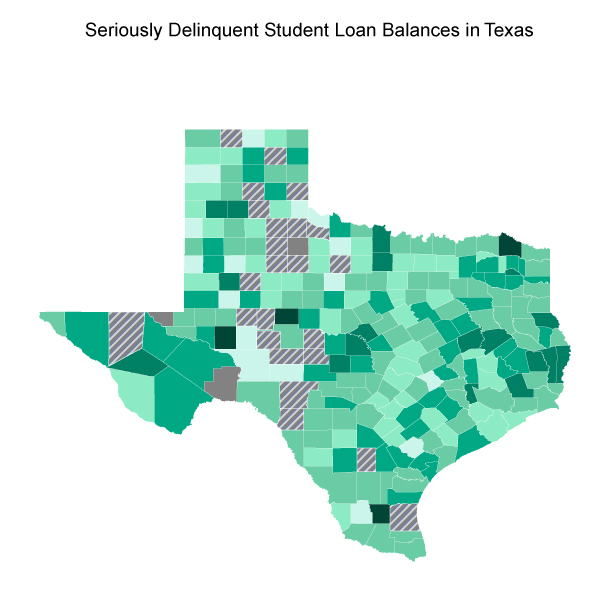

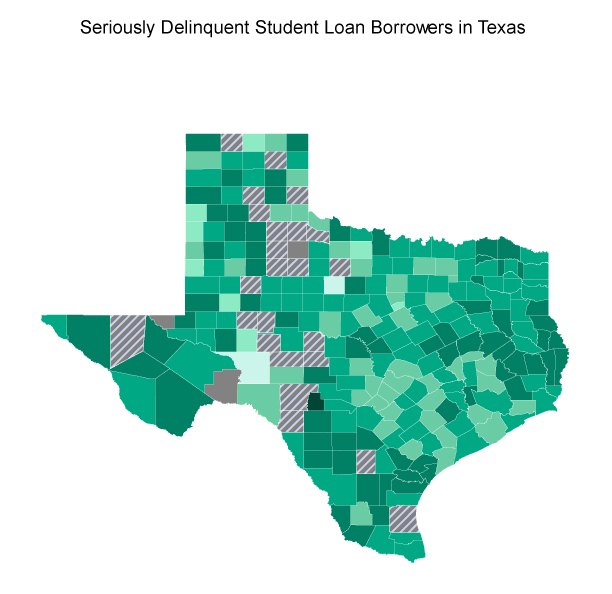

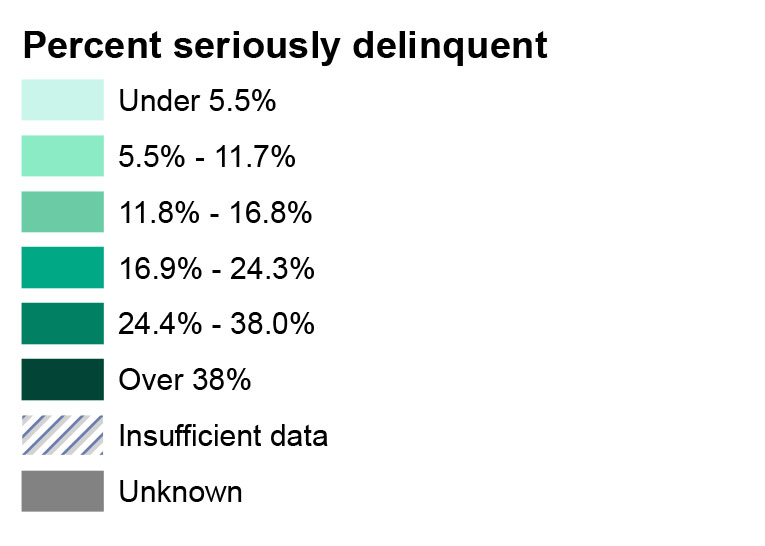

Student Loan Performance Varies Among Texas Counties

In Texas counties, the student loan delinquency rates vary widely. As shown in Chart 4, the serious delinquency rates based on borrower are much higher than those based on balance.

Chart 4

Seriously Delinquent Student Loans in Texas

SOURCE: Authors’ calculations based on Federal Reserve Bank of New York Consumer Credit Panel/Equifax

Student loans are a financial tool that enables many individuals to pursue a higher education. However, the financial burden of paying back student loan debt, if formidable, can impact not only borrowers, but also the broader economy. In the upcoming articles in this series, we will explore factors that contribute to student debt accumulation and loan performance in Texas, comparing it with other states. We will also examine the impact of student loan borrowing and loan performance on families and the economy. Finally, we will discuss implications for state and national policies and practices.

Notes

- Mortgage is still the largest category, accounting for about 70 percent of U.S. total consumer debt.

- The Consumer Price Index rose about 2 percent over that period.

- Loans that are 90 days late, 120 days late or severely derogatory are considered seriously delinquent. Severely derogatory loans are defined as loans that are in any stage of delinquency combined with loans assigned to government or charged off to bad debt and reports of consumer deceased or in consumer counseling.

- In fiscal year 2013, undergraduate borrowing was capped at $54,500 ($23,000 subsidized), while graduate students could borrow as much as $204,000 ($65,500 subsidized).

- In second quarter 2014, the median minimum monthly payment for Texas student loan borrowers in repayment was $109, while the average was $663. For 25 percent of borrowers, the minimum required payment was less than $49. Another 25 percent had a minimum payment of more than $238 per month, and about 5 percent had over $852. Payments can significantly limit discretionary income for some of these borrowers.

About the Authors

Wenhua Di is a senior economist in Community Development at the Federal Reserve Bank of Dallas.

Emily Ryder Perlmeter is a community development analyst at the Federal Reserve Bank of Dallas.